Asset managers are facing increasing levels of regulation such as UCITS IV and AIFMD, and this is putting pressure on operating costs and levels of efficiency.

The industry needs to ensure it has the right tools for the job in order to realize the opportunities that the right regulations can bring about. Portfolio analysis and compliance tools need to provide the high level overview of the portfolio estate, and have the power and speed to act on potential breaches and limit thresholds.

But is it possible to address this need without heavy investment of time and money in large software projects?

Over the years, the asset management industry hasn’t been the most efficient in its use of technology. It certainly hasn’t been alone in this, but also hasn’t been the most forward looking and dynamic either. Maintaining the status quo was always a safe option when inflows were strong, the markets were safe and the CTO ruled. Nowadays things are slightly different. The industry is recovering, but markets are uncertain and the CFO is now back in charge and looking at costs. The new wave of regulations aimed at improving risk oversight and increasing transparency to end investors, present a new wave of possible solutions, but which path should the industry take? Is this an opportunity to implement flexible technology that can bring real business benefits in not only managing new regulations, but distributing and sharing the output?

Taking the UCITS regulation as an example, being able to distribute your fund on a worldwide basis is attractive to many managers and certification will help with this. The promise of a European passport without the need for further authorization, once certified in one member country, certainly has its benefits and the UCITS brand is now powerful and well established. At the beginning of 2012 there were over 36,000 UCITS funds out there managing over €6 trillion in assets according to the European Fund and Asset Management Association (EFAMA). Many other regions around the world also recognize the robustness of the UCITS standard and also see it as a way of distributing their funds into Europe (China for example). The benefits for certain funds are clear, so how can asset management firms demonstrate the required risk management capabilities and communicate this effectively to all stakeholders?

The traditional technology path is well trodden. Build an expensive project team and implement a large local software solution over a period of months. Get behind schedule and over budget, then realize you can’t integrate the output with any other systems and the information is locked within the software silo you’ve created. Wait six more months before you get an update then spend another two months implementing the upgrade while you scratch your head wondering why the system is now slower than before.

The modern approach now being adopted by forward thinking asset managers out there is a lot more flexible. Software as a Service (SaaS) is the buzzword you have heard of but what does it actually mean in reality? Let me give you a real example. StatPro develops software and delivers it as a service. We design the user interface for that software and at the start of that design process, we draw out ideas with buttons and charts and menus. We used to use a piece of software that we installed on our laptops. This allowed us to create these design sketches so the developers could see what we wanted to build. This was great for a while, but sharing the output was difficult and maintaining the sketch versions was very difficult. You had to have the software installed to see the sketches which was expensive and needed IT support, and we used email to communicate about our ideas. With lots of people as part of this process, this quickly turned into a nightmare. Then we discovered the SaaS version of this little sketch tool and we tried it out. I created a ‘project’ online and invited people to be part of it. The sketches got created, people collaborated online all using the same version of the sketch so each update stayed in the same place. I could invite anyone to view or edit the sketch and they didn’t need to install or manage any software to do this. Instead of paying for each bit of software I used to install, I now paid a monthly fee based on the number of projects I was working on, not the number of people. This made the whole project cheaper, easier to manage and much more productive. Instead of using software, we were now using software as a service. It was easy to get started, flexible and cheaper than local software.

SaaS is a proven method of software delivery and is bringing much needed flexibility to the asset management industry. Not all your funds need managing to certain standards, so why implement a software solution that sits across all of them? The solution doesn’t need to be that arduous; it needs to be flexible so it can grow with your requirements. Having a granular solution is more cost effective, you only pay for what you need rather than paying for a whole system. It needs to be at the portfolio level so you can implement the controls you need on a fund by fund basis.

Flexible systems can be very powerful, but be careful they don’t lead to an explosion of services to manage. Implementing multiple systems can lead to problems with integration, workflow and data control. Having separate systems for each type of portfolio analysis and compliance can quickly result in higher management costs than the old fashioned behemoth software system you’re trying to move away from. Ensure your SaaS solutions play nicely with each other, and with local systems, that won’t be replaced any time soon. Look for APIs within the solution (programmable interfaces) so you can retrieve data easily and maintain harmony across your application estate.

SaaS can provide the flexibility and cost effectiveness needed in today’s market place, but what do we need from a solution in order to provide daily, quality and distributable limit monitoring management for regulations such as UCITS?

StatPro has a rich portfolio risk analysis history. We have been providing risk solutions to global clients since 2003 and we ensured that these in-depth capabilities were part of our StatPro Revolution SaaS platform from day one back in 2011. Expanding this to cover global exposure and liquidity monitoring for UCITS was a natural step, and this additional module is now available within the multi-asset class analysis platform.

Read: New Insights for Asset Managers: How Technology Can Drive the Most Effective Middle Offices

Developing additional modules for a SaaS platform is much easier for a software vendor than releasing new versions of stand-alone software and it brings the flexibility required to our global client base. There is no software to install or manage; it is simply a case of enabling the new module for the portfolios that need to be monitored.

Once enabled, new levels of risk analysis are available within the platform that is aligned with the UCITS IV regulation. This daily service monitors each asset within the portfolio against set limits and features a traffic light approach used to identify early warnings and breaches.

Just like the interface design sketch example I gave earlier, everyone is looking at the same data and it’s not restricted to silos of local software. The service is based on the portfolios and not the number of people needing to interact with or view this information so it’s cost effective to be rolled out to anyone who needs it. Managing large numbers of portfolios needs a new way of looking at data. Some systems are too quick to chew through data without thinking about how it will be interpreted or used. Looking for potential breaches and alerts needs a helicopter view with the ability to drill down to the detail so actions can be taken. Our little online interface sketch SaaS solution helped us think about this and come up with something that can handle large amounts of data but present it in a visual and usable way.

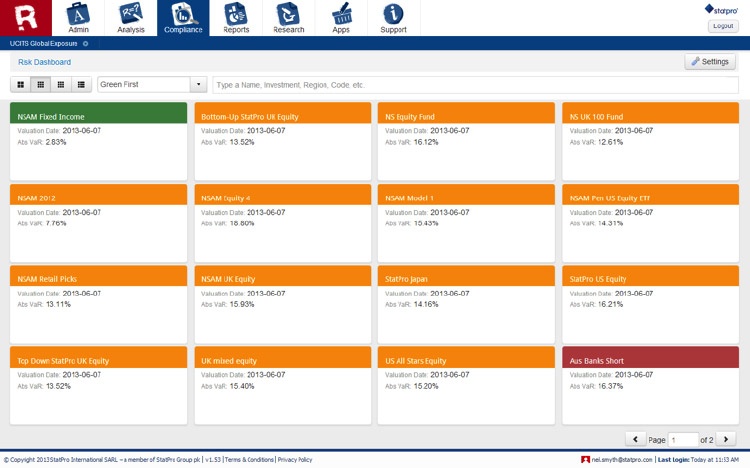

StatPro Revolution Risk Limits Monitoring Module: risk dashboard

StatPro Revolution Risk Limits Monitoring Module: risk dashboard

A high level ‘estate’ view is the right starting point, but adhering to regulations requires action and any management system needs to show the right level of detail so comments and actions can be taken. StatPro Revolution presents this information using three dashboards (VaR, stress testing and back testing). Each starting point shows the high level overview of the portfolios with the user able to click through to detailed levels of analysis.

StatPro Revolution Risk Limits Monitoring Module: Portfolio risk detail

StatPro Revolution Risk Limits Monitoring Module: Portfolio risk detail

Having visual analysis at the portfolio level allows a manger to take action based on the limits that are in warning or in breach. Being able to follow this high level through to a detailed approach for all aspects of the monitoring process allows for each portfolio to be validated and any warnings or breaches to be flagged. The module keeps a validation history of the risk manager’s actions and comments for auditing purposes. Just like the SaaS interface design system I mentioned earlier, anyone I invite to view this portfolio can see the same data I can along with the comments. This makes collaboration and sign off so much easier and more productive because we’re working on the same data.

Many compliance systems stop at the point of distribution. Maybe a simple static report is produced but you need separate systems to distribute that (good old email!). In order to share interactive analysis you need to deploy the software to your colleagues’ or partners’ machines. What if they use two machines and a tablet? That’s a lot of software license to pay for and a headache. SaaS solutions are deployed by default. All you need to manage is the access control. When you want to share the analysis with someone, you simply grant them a logon to the platform. They can access the information from any machine in any location. The ability to easily share information is the great win of SaaS solutions over their local software counterparts. This huge benefit is amplified when dealing with tasks such as compliance and risk reporting. The speed in which information can be shared and acted upon totally outstrips traditional software systems. The fact they are tied down to a machine is their ultimate downfall.

All managers are dealing with compliance and regulatory issues, for most this is not a choice, but the tool used to manage the process can be. Therefore the key question to ask is, are you using a flexible, cost effective, and powerful toolset to manage regulations or not?

Visit our AIFMD resource page for more articles and information.