Most rules have an exception, and the rule that there is no such thing as a free lunch is no exception to this.

Investment portfolios seek to benefit from the free lunch that is diversification, one of the benefits of collective investment vehicles for end investors.

Investment portfolios seek to benefit from the free lunch that is diversification, one of the benefits of collective investment vehicles for end investors.

Understanding & Control

Whilst books and courses on portfolio theory tend to concentrate on equities, diversification is just as important in fixed income and multi-asset investing. Portfolio managers and risk controllers must understand and control the level of diversification (or concentration) of exposures to issuers as well as to sectors and regions. This requires knowledge and modeling of how credit spreads move at the issuer level, which in turn requires granular issuer level spread curves for calibration. Without these, any estimate of diversification is guesswork, and a concentrated portfolio is indistinguishable from a diversified one.

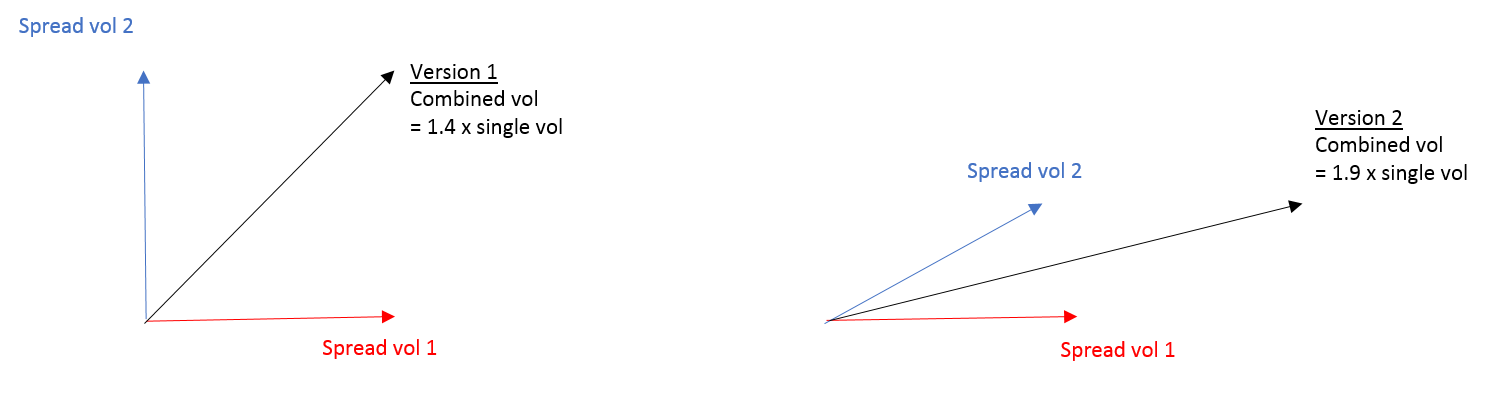

This is illustrated with the correlation triangles below. We represent the volatility of returns on bond 1 (issued by ABC Corp) from spread moves with the red arrow, and the spread volatility of bond 2 (issued by DEF Inc) with the blue arrow. The angle between the 2 lines is representative of the correlation between these two sources of volatility – the more correlated they are, the smaller the angle. (Technically the cosine of the angle is equal to the correlation).

In version 1, the spread moves of the 2 issuers have zero correlation and the resulting portfolio spread volatility is lower— about 70% of that for either bond alone, a significant amount of diversification with only 2 issuers.

In version 2, the spreads are highly positively correlated, and the resulting portfolio spread volatility is close to being equal to that for a single bond, a significant concentration. A similar story would be seen if we considered default correlation.

If we did not have granular spread curves and instead we treated all issuers in the same sector and currency as being mapped to the same market curve, the modeled portfolio volatilities would be identical (or at least very close) in the two versions above. The distinction between the diversified portfolio and the highly concentrated one would not come through.

Granularity is key

As well as needing granular credit spread curves to properly understand the level of diversification / concentration, there also needs to be a connection between the dynamics of the credit spread and the equity of the same issuer (where the issuer has also issued equity). To do this, the credit model must be as granular as the equity model. Additionally, a detailed issuer structure is required which connects the equity issuer and the debt issuer. The name of the equity issuer (in the equity static data) and the name of the bond issuer (in the bond static data) are rarely alphanumerically identical, even when they are the same entity. For many issuing entities, different legal entities with different names issue the equity and the debt, but there will still be a significant connection between the securities which should be reflected in the risk model, and portfolio managers and risk controllers will need to see the modeled risk coming from the same issuer.

Connecting the equity and debt issuer not only allows the risk model to function appropriately, but also makes it possible to view exposures to an issuer across the capital structure. A simple metric such as “jump-to-default” risk which measures the effect of an issuer defaulting will need to capture risk from the issuer’s debt, equity, hybrid instruments and derivatives on all the above. This can only be aggregated at the issuer level when the issuers are connected as explained above. Without these connections a concentration of exposure to one issuer may appear diversified as the securities are issued by multiple entities with different names, even though they are all part of the same company group and so are very highly correlated.

Ultimately, without detailed issuer information and cross-asset connections, and the granular credit model detailed above, investment managers and asset owners cannot tell whether their fixed income and multi-asset portfolios are enjoying the free lunch of diversification or missing out with excessive concentration.

{{cta(‘0bd8eb7e-992b-478a-9b28-3e64bfff7d77’)}}