The coronavirus pandemic is a trigger event ushering in not only a global financial crisis, but also the inevitable regulations that will follow. After the 2008-2009 financial crisis, the financial services and technology industries saw a significant response from regulators. The first focus was on systemic risk monitoring to ensure that individual actors and their financial transactions and holdings didn’t create a risk large enough to impact the entire system.

New regulations were particularly heavy in the alternatives space, which was a substantial holder of the mortgage-related securities at the heart of the crisis. New regulatory reporting requirements were issued both in Europe and the US, including ESMA’s AIFMD Annex IV quarterly reporting and the similar Securities and Exchange Commission (SEC) Form PF for private funds and Commodity Futures Trading Commission (CFTC) Form CPO-PQR for commodity pools.

New regulations were particularly heavy in the alternatives space, which was a substantial holder of the mortgage-related securities at the heart of the crisis. New regulatory reporting requirements were issued both in Europe and the US, including ESMA’s AIFMD Annex IV quarterly reporting and the similar Securities and Exchange Commission (SEC) Form PF for private funds and Commodity Futures Trading Commission (CFTC) Form CPO-PQR for commodity pools.

Still, the reporting trend was not limited to alternatives. In the US, the SEC created reporting requirements for money market funds, which incredulously had also “broken the buck” during the crisis. The new monthly Form N-MFP required holdings-level disclosure and liquidity statistics. Then, the new holdings and liquidity reporting in Form N-PORT and N-LIQUID applied to SEC 40-Act Funds came in 2018. ESMA followed recently with Money Market Fund Reporting, which added even more focus on liquidity disclosure. Last but not least, ESMA Liquidity Stress Testing was issued in 2019 and is due September 2020 for all UCITS and AIFs.

Complying with all of these new regulations has become a steady and significant burden for asset managers and the administrators who serve them.

The Role of Data Management

The concept of data management is not new; it is only recently that the term has come to emphasize information management and big data. Mastering data has the objective of defining and managing all critical data through a single point of reference, by also collecting, aggregating, quality-assuring and distributing data throughout the organization to ensure consistency, accuracy and control in their ongoing application.

With the increasing compliance pressure and ever-growing number of regulations globally, it becomes essential that financial services firms develop a robust framework which covers all aspects – from data integration to data quality and from data governance to data analytics.

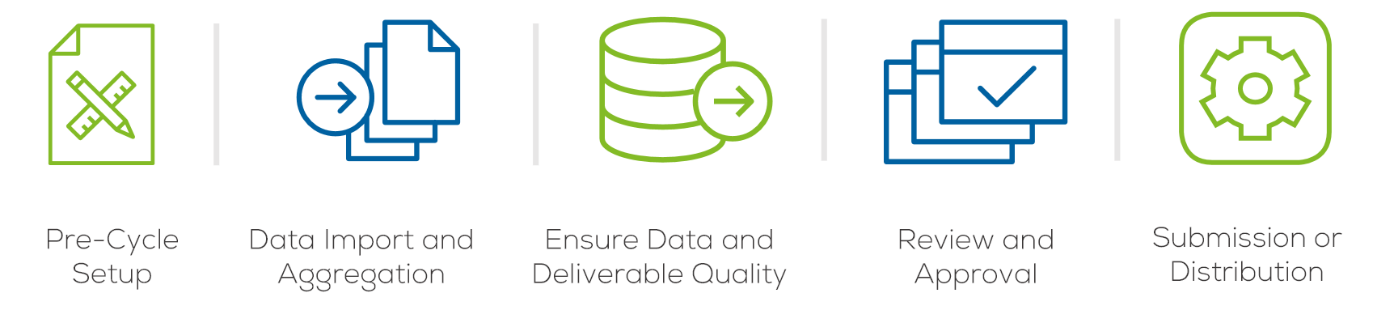

Below is a standard process workflow illustrating the different steps both asset managers and fund administrators typically follow when preparing regulatory filing submissions:

This deceptively simple workflow hides complexity and opportunity—a fact that is driving financial services technology acquisitions strategically focused on creating value in this process. In particular, by complementing risk management software solutions with leading investment data management automation, there is significant room to improve this process for regulatory, financial and investor reporting.

Among such recent acquisitions, Confluence Technologies purchased StatPro in October 2019, aiming to provide asset managers and fund administrators an even greater range of services and analytics, especially in the regulatory space. With regards to data management, the approach is to be data vendor agnostic; integrating multiple sources of underlying risk driver data provided by leading firms globally. Confluence is not affiliated with any financial institution (nor was StatPro before its acquisition), and it is not actively involved in the business of investment managements or securities trading.

One key to data management success is to empower skilled experts with proven technologies. Confluence uses QuantLib, an open-source software library, as the building block for its proprietary financial pricing and risk measurement tools. These tools—together with the complex methodologies and proven in-house modelling techniques—are ultimately mastered by a team of Quantitative and Data Management experts. Their depth and breadth of experience enable them to fully understand and analyze a wide range of complex instruments within the financial marketplace.

The additional consistency of all terms and conditions used to feed the risk engine is a key element, as sound data is absolutely necessary to properly compute and monitor holdings, leverage, market risk, stress testing, liquidity risk or any other figure for regulatory reporting.

How Technology Can Help

The evolving market conditions around COVID-19 have further highlighted the need for sound checks to anticipate as much as possible the drifts in figures produced downstream and ultimately part of any regulatory filing and investor communication reporting. Data accuracy, quality and reporting has never been so important, with heavy scrutiny now on the financial industry more than ever.

Technology can absolutely help in this sense by increasing both data quality and levels of efficiency. The key is to offer the data management function a simplified means of visualizing and collaborating on the massive amounts of data generated by technology systems and to connect to any data source, query and visualize data, also creating an alerting system.

Automation, scalability and warehousing are the key elements of any regulatory risk cloud solution. In fact, the multidimensional modelling technique for data storage plays an important role when trying to retrieve all data quickly. The accuracy in creating such modelling determines the success of any data warehouse implementation since different schemata may apply to the different why-when-where-who-what of any business process.

There are many ways to organize data for reporting, each with its advantages and disadvantages with respect to workflow and process.

A flexible data management system can handle any type of incoming data architecture. The data management effort never fully disappears, but it can be automated if skillfully implemented. It is not only a matter of minimizing the data management effort, but also that firms want to prepare and review filings faster and smarter, gain process visibility, reduce costs and risks and elevate their service levels to internal and external stakeholders. From aggregating data from multiple systems, to running the analytics, monitoring and validating the results, and producing internal or external regulatory reports, there is a lot of work involved.

Beyond calculations for reporting, asset managers and risk managers must customize various outputs for their audiences, whether for regulator-mandated templates or internal reports, or both. Also, some regulations like the SEC’s N-LIQUID require reports to be triggered based on liquidity events. Hence the users need to monitor and report very quickly.

Regulatory requirements are constantly changing, so monitoring and ultimately complying with them is difficult. Without dedicated technology solutions that apply these changes, risk and performance teams would experience significant amounts of extra work. Instead of solving individual ad-hoc regulatory reporting, the challenge is identifying platform providers and solutions that will evolve with the global regulatory mandates.

Conclusion

We can only speculate about how regulators will respond to the current coronavirus pandemic – especially because it is still in progress from a public health perspective, and the financial market impacts will be long lasting.

Putting together a cohesive strategy which comprises robust data management techniques as well as flexible risk and compliance reporting will likely yield benefits beyond any individual regulation. Regulators globally are starting to apply extra scrutiny to existing reports to ensure data is correct and timely. More reporting requirements may be issued in the near future. Having data organized and monitoring regimes in place will make it much easier to modify, reconfigure or add new calculations to respond to any future regulatory requirements.

Confluence’s current focus is to continue investing in platform and market expansion, technology and innovation to deliver the best solutions to the market, enabling growth and providing greater flexibility for global regulations.

{{cta(‘583a5bd7-2728-49c9-96d2-7b1889365294’)}}