Report

Cyclicals vs. Defensives in Rising Interest Rates

by:

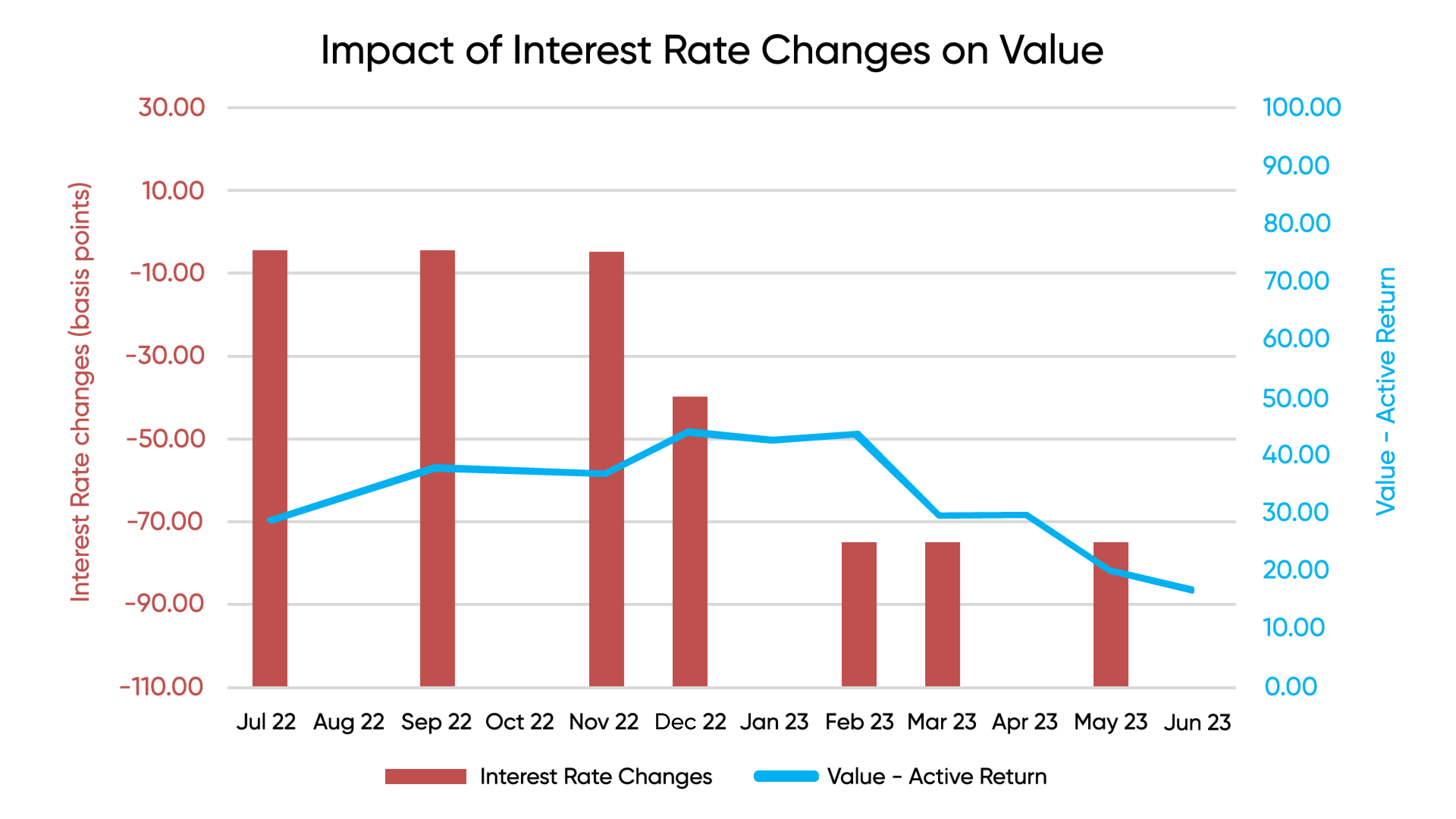

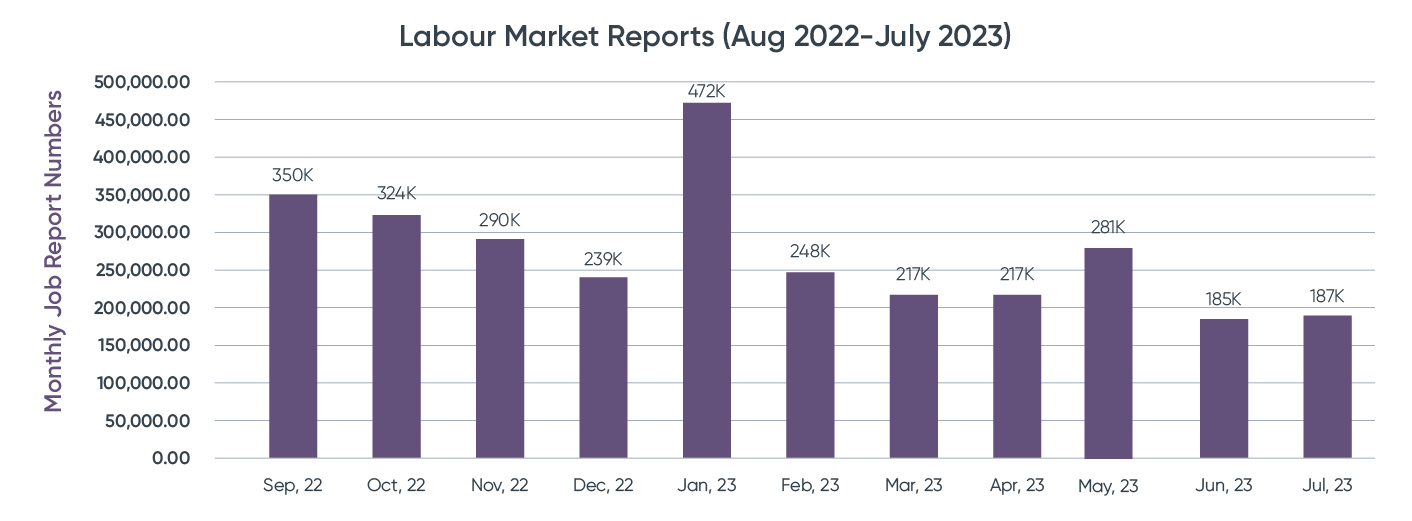

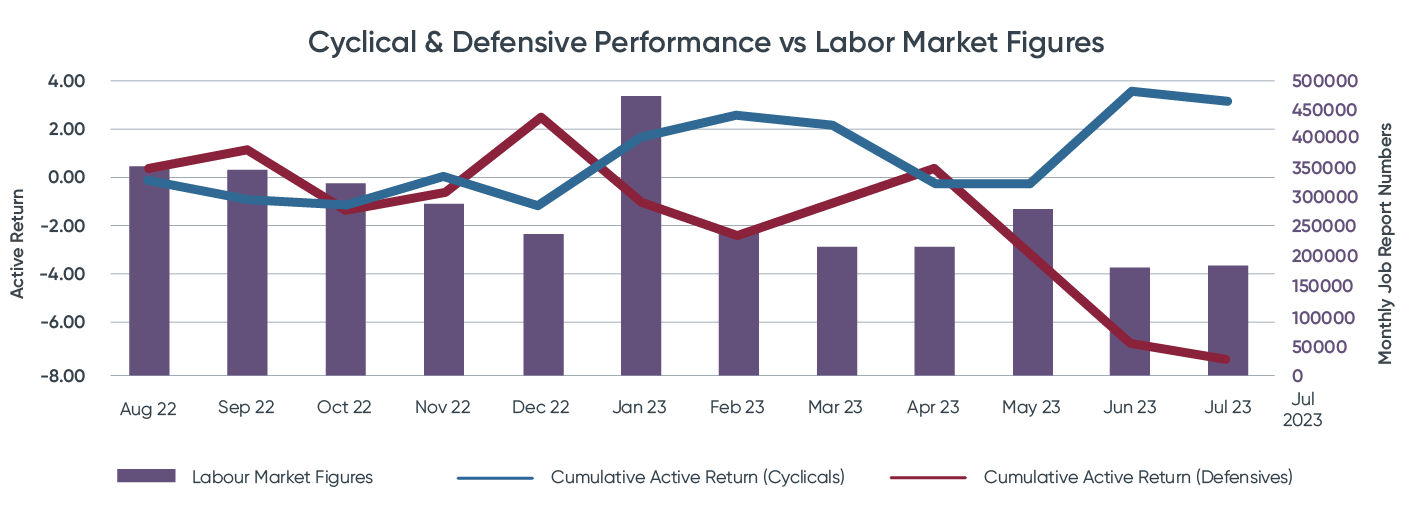

Job reports are one of the crucial indicators impacting interest rates. Job reports, often referred to as labor market reports, are critical in shaping the overall economic landscape of a country. Released by the Bureau of Labor Statistics, nonfarm payroll reports are closely watched by investors and economists. Positive job reports frequently contribute to higher interest rates in anticipation of positive economic expansion, international cashflows, and inflationary pressure.

In July, the U.S. nonfarm payrolls rose to 187,000, impacting the unemployment rate to drop from 3.6% to 3.5%, while the annual wage inflation held steady at 4.4%. Following the release of the May employment data, the Fed decided to hold the interest rates steady in June to assess the economy’s progress. After the release of the July data, a 25-basis point increase was announced.

Labor Market Reports and Fed Rate Hikes (2022 – 2023)

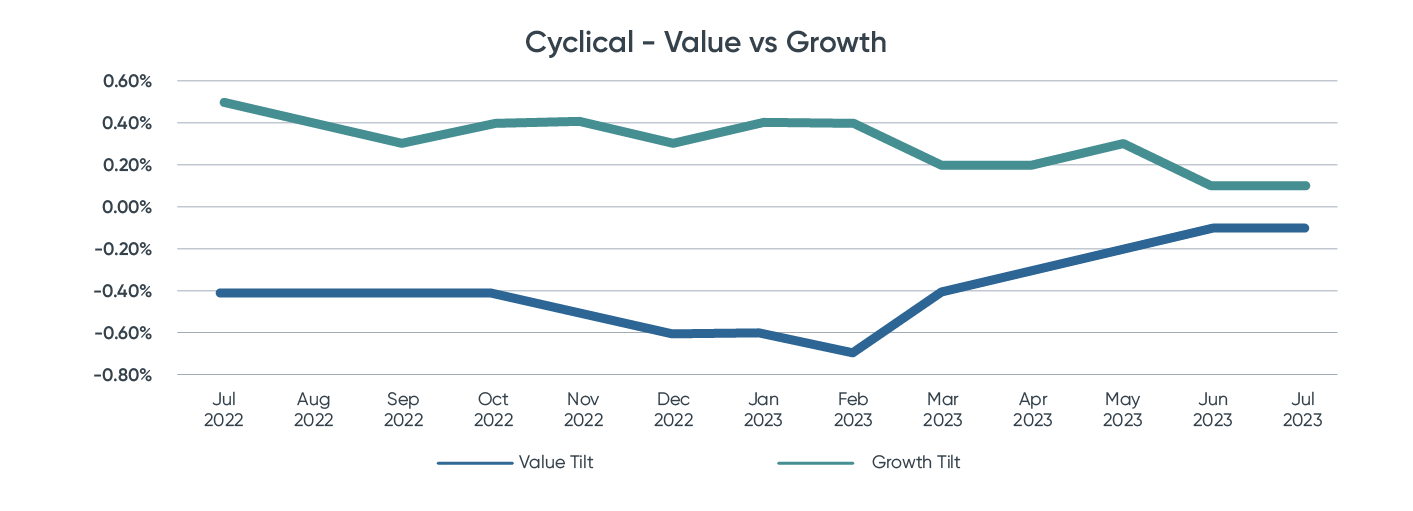

Cyclical sectors, which include consumer discretionary, industrials, and materials, are more sensitive to economic conditions than defensives. As high-interest rates indicate increased borrowing costs for businesses, this results in a slowdown in demand in the cyclical sectors. Consequently, this leads to decreased earnings and stock performance.

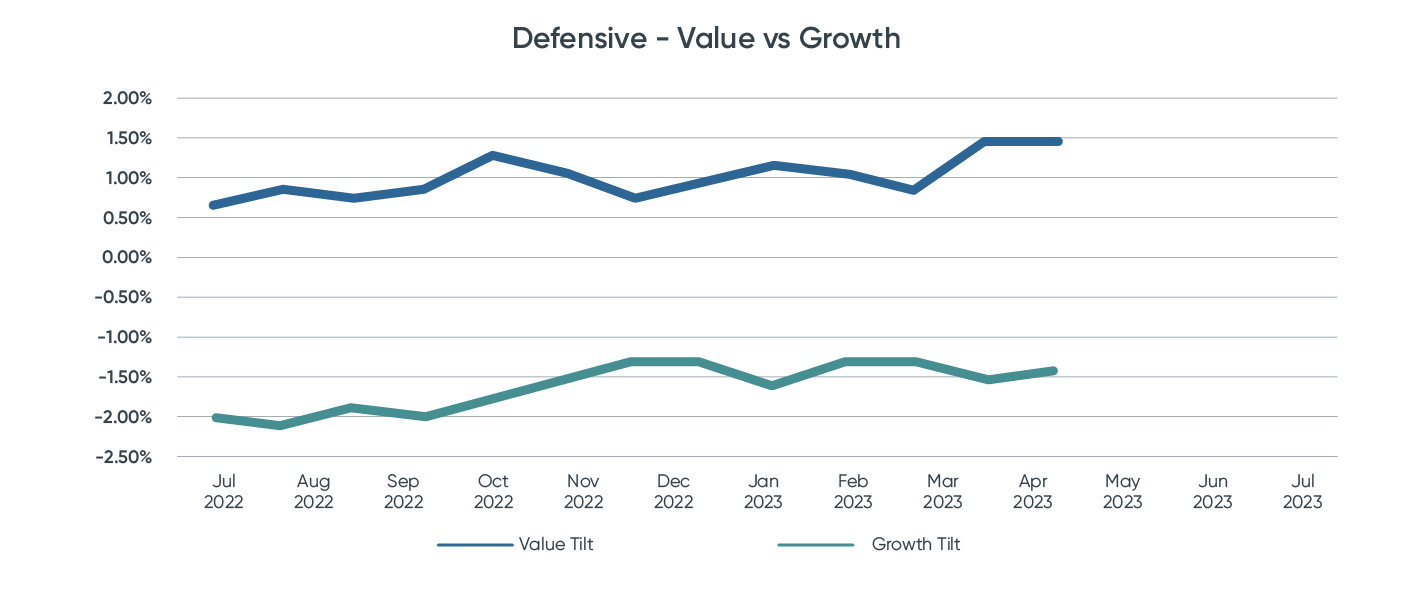

On the other hand, defensive sectors such as utilities, consumer staples, healthcare, and communication rely on stable earnings and dividends to attract investors. Defensive sectors, known for their bond proxy characteristics, tend to attract investors seeking stability. However, as the yield of fixed-income investments rises, investor preference eventually shifts from defensive stocks to Fixed Income investments, causing downward pressure on prices.

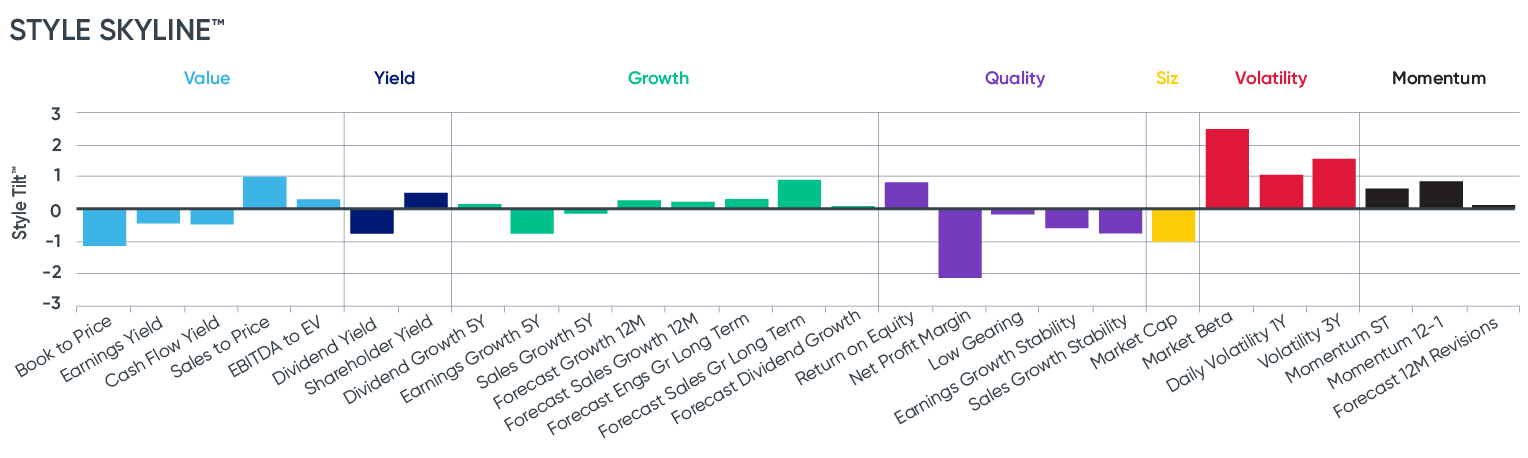

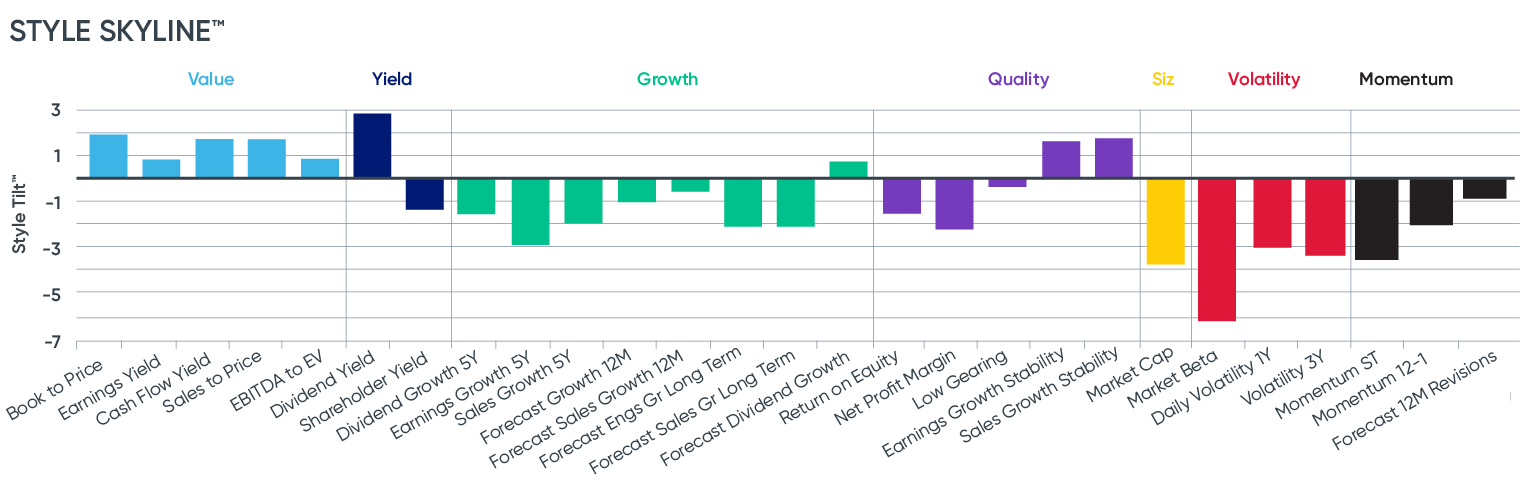

Using Style Analytics Portfolio Analyzer tool to generate a proxy portfolio for Cyclical / Defensive sectors, these proxies were analyzed against the S&P 500 to determine a factor exposure across time, the factors were then bucketed under Value and Growth labels to track modified Z-Scores over time.

The chart below indicates that cyclical sectors’ exposure to Value and Growth are much more sensitive to labor market reports than their defensive counterparts.

Cyclical sectors experienced pronounced fluctuations in both January and May, driven by the robust job report figures.

As the tilt Style Analytics skyline in the exhibits below indicate, the growth bias of Cyclical sectors and the value of defensives, the drop in performance of these sectors in the rising interest rate environment.

Or as illustrated by the tilt in the Style Analytics skyline presented below, the growth bias of Cyclical sectors juxtaposed with the value orientation of defensive sectors accentuates the decline in performance observed within these segments amid the backdrop of rising interest rates.

Or as shown in the tilt of the Style Analytics skyline below, the fact that Cyclical sectors focus more on growth and defensive sectors emphasize value highlights how these sectors have experienced a drop in performance interest rates went up.

Factor Tilt Skyline for Cyclical Sectors

Factor Tilt Skyline for Defensive Sectors

About the Style Analytics Portfolio Analyzer

The use of tools like Style Analytics Portfolio Analyzer has enabled a nuanced analysis of factor exposures, demonstrating the dynamics between Value and Growth within these sectors. As the financial landscape continues to evolve, platforms like Style Analytics are pivotal to navigating the complexity of changing interest rate environments and their multifaceted impacts on diverse market segments.