August 2025

Factor Performance Analysis

Global Equity Markets Post Broad-Based Gains

September 16, 2025

Prepared by:

Market Background

Global equity markets posted broad-based gains in August 2025, as both developed and emerging markets advanced on the back of optimism surrounding monetary policy, solid corporate earnings, and easing geopolitical tensions.

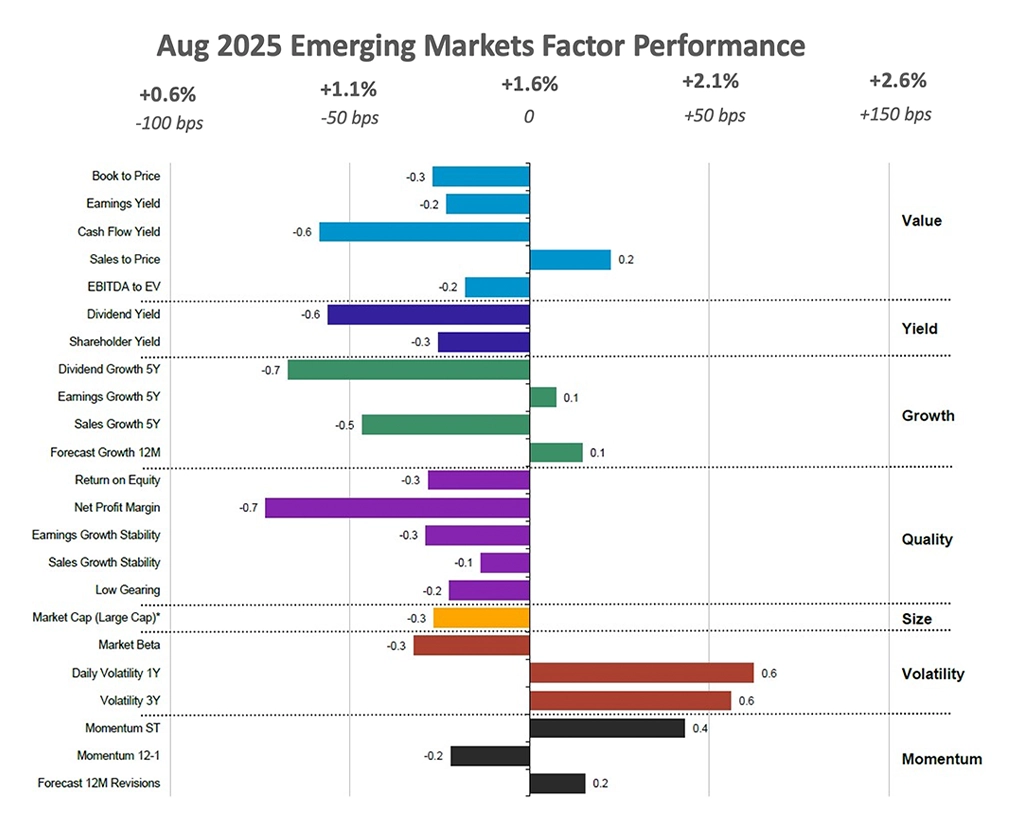

Positive equity returns across major economies were driven by growing optimism around monetary policy, strong corporate earnings, and easing trade tensions compared to the previous month. Additionally, the decline of the U.S. dollar enhanced the relative attractiveness of Emerging Markets and the Eurozone. Compared to the previous month, equity mutual funds saw a decline in inflows across all regions in August, with overall flows turning negative.

Crude oil prices dropped to $64.42 per barrel. down from $70 from previous month-end. Gold prices climbed at the end of August to $3,501/ troy ounce at month-end from $3,294/ troy ounce in July

Figure 1: August 2025 Mutual Fund Flows data

Source: Confluence Style AnalyticsFactor Summary

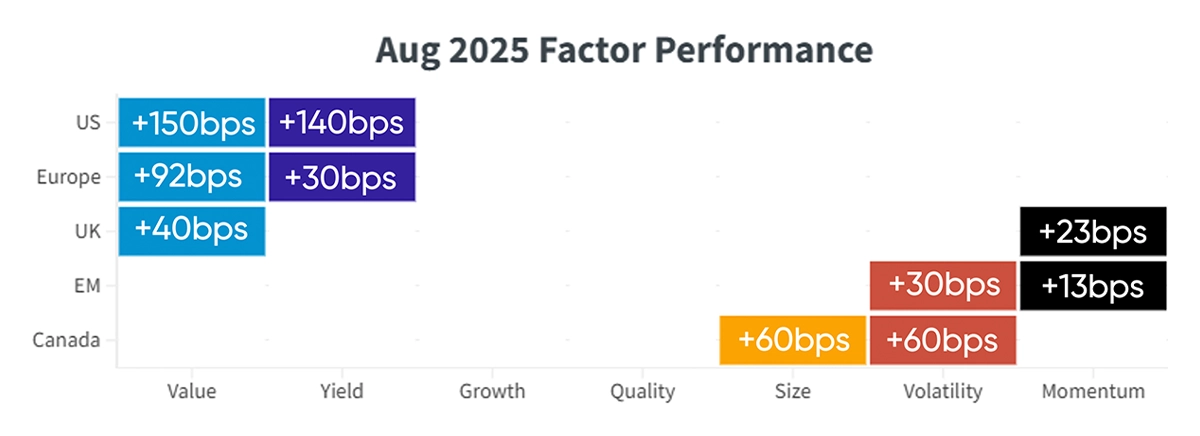

- US Equities: Value and Yield outperformed.

- European Equities: Value and Yield outperformed.

- UK Equities: Value and Momentum outperformed.

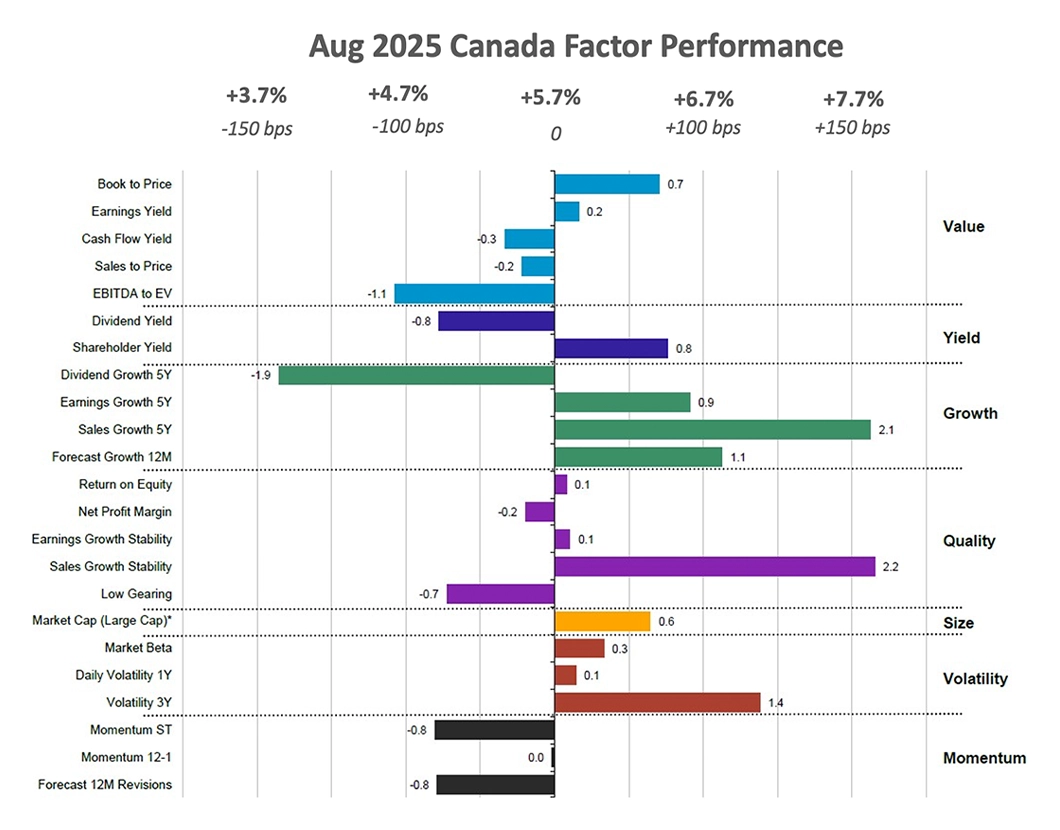

- Emerging Markets Equities: Volatility and Momentum outperformed.

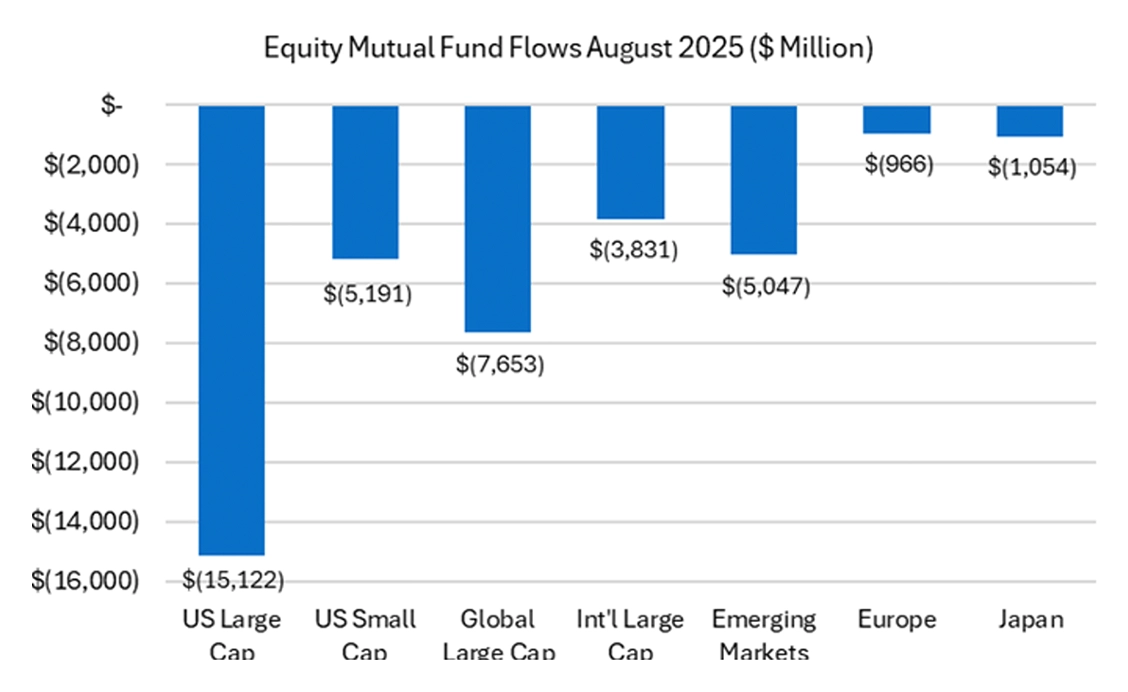

- Canadian Equities: Size and Volatility outperformed.

Figure 2: Regional relative factor performance (county and sector adjusted) August 2025

US Equities

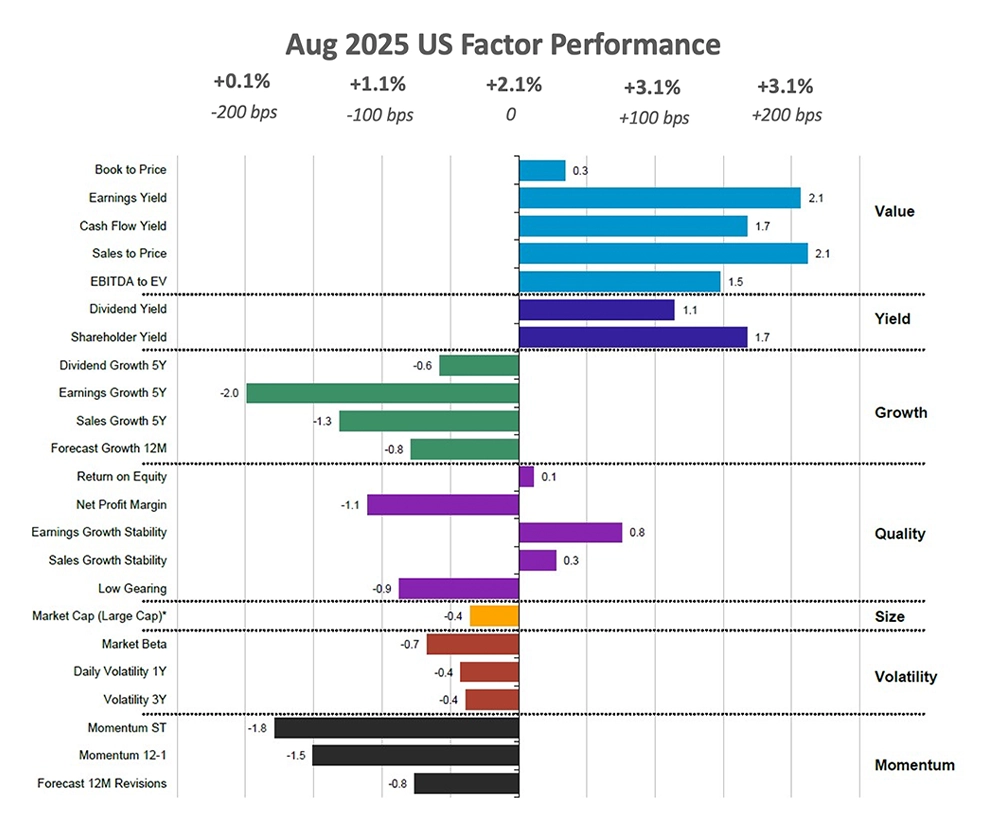

U.S. Equities delivered strong performance in August 2025, maintaining momentum in line with the previous month. Unlike the previous period where Volatility and Growth factors led, this month’s outperformance was driven by Value and Yield strategies.

The Volatility factor underperformed in August 2025 after strong gains in July, as equity markets stabilized, risk appetite improved, and robust corporate earnings helped ease investor concerns. This is in contrast to the previous month when market uncertainty - driven by mixed economic data and labour market worries - boosted Volatility. August saw a decline in investor anxiety, supported by solid earnings reports and positive signals from the Fed, which led to Value and Yield factors outperformance in U.S. equities, as investors rotated toward undervalued companies with strong and consistent dividend payouts, seeking safety and dependable returns amid ongoing market volatility and uncertainty around monetary policy.

The U.S. annual inflation rate accelerated to 2.9% in August 2025. Meanwhile, the unemployment rate edged up to 4.3%, compared to 4.2% in the previous month.

Stocks with high earnings yield which contributed to the performance of U.S. Equities in August include info tech company Apple Inc (12% in August), and communication services company Alphabet Inc (11% in August). Additionally, companies with high dividend yield include financials company Mastercard Inc (+5 % in August), and consumer discretionary company Home Depot (11% in August) who also contributed to the outperformance.

Figure 3: August 2025 US Factor Performance (sector adjusted)

Source: Confluence Style AnalyticsEuropean Equities

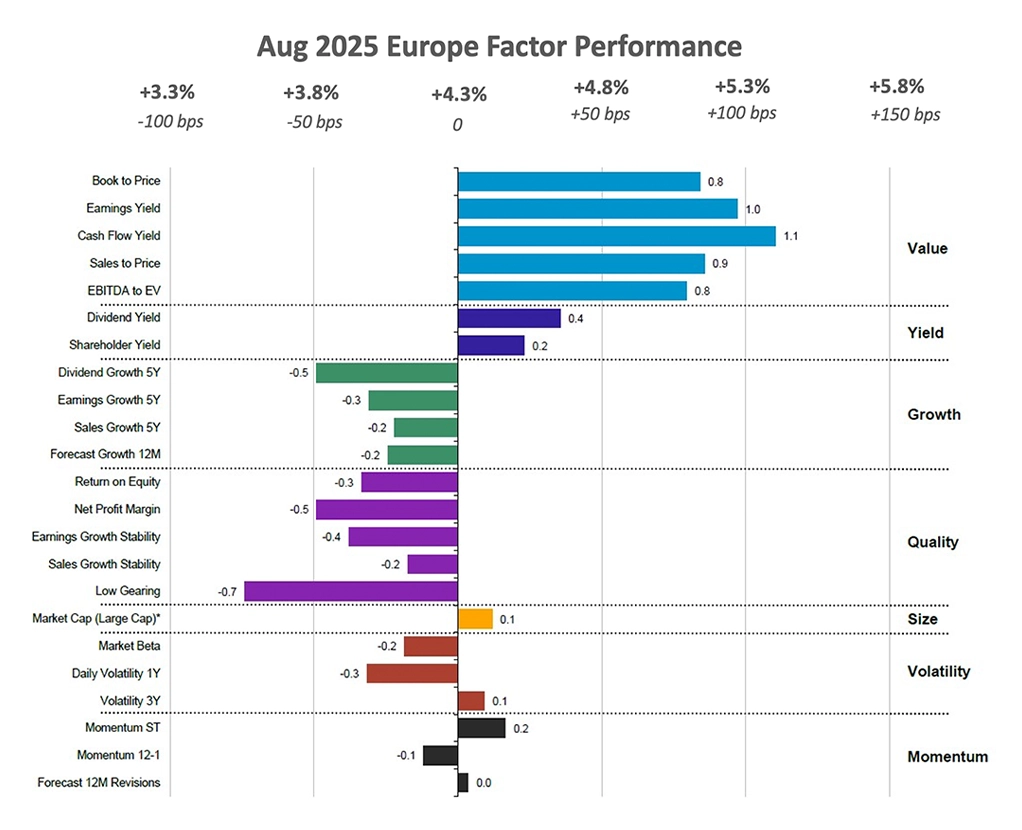

European Equities recorded modest gains in August 2025, delivering a positive return of 4.3% following a negative performance in the previous month. The region’s outperformance was primarily driven by the Value and Yield subfactors, with Value stocks outperforming the broader market by an average of approximately 92bps.

In August, dividend-paying stocks outperformed in the region, offering income stability and serving as defensive positions amid market volatility. Europe’s tradition of higher average dividend yields made these stocks particularly appealing during a month marked by mixed macroeconomic signals and ongoing political uncertainties. High cash flow yield stocks, known for their resilience in volatile environments, were viewed as safe havens as growth prospects became less certain — and potential interest rate shifts posed risks to highly leveraged or low-margin companies—contributing to the outperformance of securities with strong cash flow yields.

Consumer price inflation in the Euro Zone increased to 2.1% in August 2025. Meanwhile, the seasonally adjusted unemployment rate declined to 6.2% in July. However, manufacturing production fell by 0.2% in June 2025.

Key European stocks with strong shareholder yield that outperformed in the month of August include French consumer discretionary company LVMH Möet Hennessy Louis Vuitton (+9% in August) and Spanish financials company Banco Bilbao Vizcaya Argentaria (+8% in August). High sales growth 5Y companies in Eurozone region which contributed to the outperformance of this region include French consumer discretionary company Hermes International (10% in Aug) and German communication services company Deutche Telekom (9% in August).

Figure 4: August 2025 Europe Factor Performance (country and sector adjusted)

Source: Confluence Style AnalyticsUK Equities

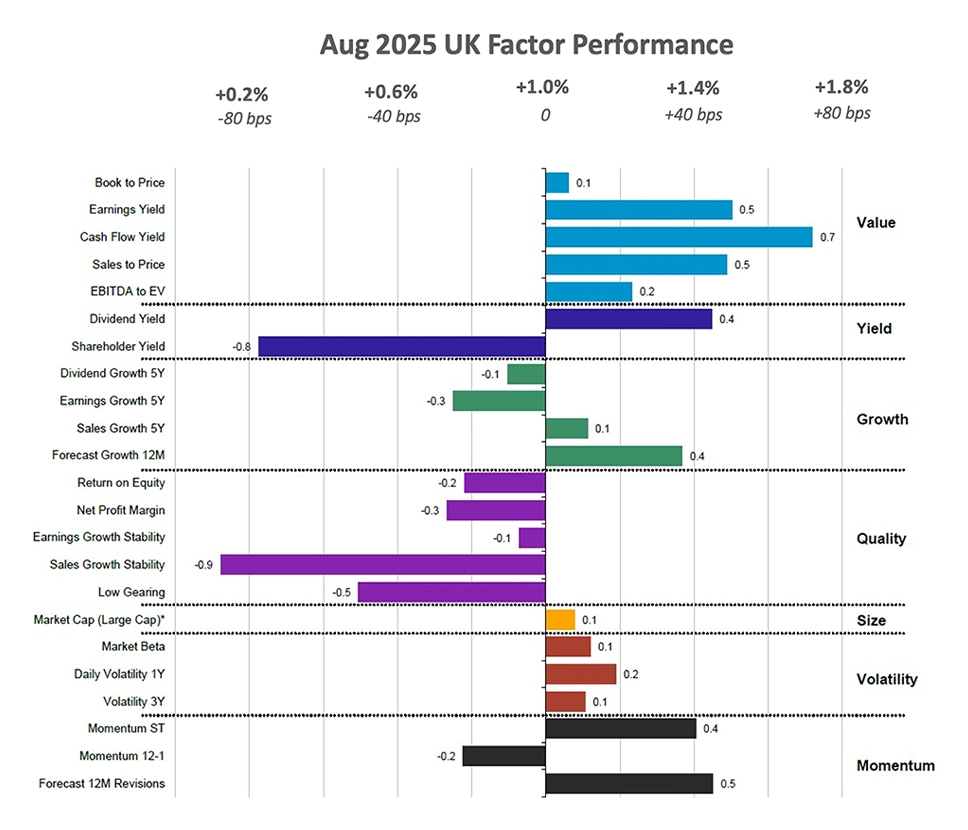

The UK market delivered modest positive returns in August 2025 but lagged behind other major regions due to ongoing domestic economic challenges and persistent inflation pressures. Similar to other developed economies, Value equities outperformed the broader market in the UK. Additionally, Momentum and Volatility factors also showed relative strength during the month.

The region’s market benefited from resilient earnings within the Value sector, as companies with stable cash flows and attractive valuations experienced renewed investor demand amid global uncertainty. The Bank of England’s rate cuts, along with signals of a more stable policy outlook, further supported flows into dividend-paying, stable securities. As investor confidence strengthened and stabilized, risk appetite remained elevated, driving equity indices to record highs, and reinforcing interest in Momentum-driven stocks and strategies.

Relative to the previous month, both Momentum and Quality underperformed compared to the broader regional market. Investor preference for more value-oriented cyclical stocks led to the underperformance of these factors in this month.

The UK’s annual inflation rate rose to 3.8% in July 2025, marking the highest level since January 2024. Meanwhile, the unemployment rate remained steady at 4.7% in June. In contrast, manufacturing production declined by 1.3% month-over-month in July, falling short of market expectations for flat growth

British stocks with strong cashflow yield that outperformed this month include consumer staples company Daigeo Plc (+13% in August) and energy company BP Plc (+11% in August). Stocks with high forecast 12M revisions in the UK market that contributed to the outperformance of the region include communication services company Zegona Communications Plc (34% in August), industrials company Rolls Royce Holdings Plc (2% in August), and financials company HSBC Holdings (6% in August).

Figure 5: August 2025 UK Factor Performance (sector adjusted)

Source: Confluence Style AnalyticsEmerging Market Equities

Emerging Markets posted a positive return of 1.6% in August, an improvement over the previous month. Compared to July, large-cap value stocks saw weaker performance, while Volatility and Momentum factors showed notable gains. Compared to the previous month, emerging markets experienced a decline in the performance of large-cap Value equities. In contrast, Volatility and Momentum strategies outperformed, likely driven by ongoing macroeconomic and monetary uncertainties.

Amidst uncertainties in developed markets, heightened Volatility in Emerging Markets created opportunities for investors to capture rebounds. Meanwhile, investor interest shifted toward trending sectors such as technology and defensive equities that demonstrated positive earnings surprises and strong liquidity in these regions, favouring Momentum-oriented securities.

India’s consumer price inflation rose to 2.07% in August 2025, while the unemployment rate declined to 5.2% in July, down from 5.6% the previous month. In China, consumer prices fell by 0.4% year-over-year in August, following a flat reading in July. Vietnam’s annual inflation rate inched up to 3.24% in August 2025, while the unemployment rate increased to 2.24% in the second quarter of the year.

Emerging Markets equities that outperformed in the month of August captured by the EBIDTA to EV subfactor, include Chinese companies like consumer discretionary company Alibaba Group Holdings (7%); communication services company China Mobile Ltd (7%) and financials company Industrial and Commerce Bank of China (4.2%). Companies with short-term momentum include Chinese industrials company Contemporary Amperex Tech Co let (+17 % in August) and Chinese info tech company Foxconn Industrial Internet Co Ltd (56% in August).

Figure 6: August 2025 Emerging Factor Performance (country and sector adjusted)

Source: Confluence Style AnalyticsCanadian Equities

In August 2025, Canadian Equities posted strong gains, delivering a +5.7% return. This positive performance was primarily driven by Growth and Volatility subfactors, as well as large-cap companies.

While most subfactors contributed positively, the overall performance of the Growth factor was dampened by the underperformance of the Dividend Growth 5Y subfactor. The weakness in dividend-paying stocks can be attributed to rising bond yields and ongoing interest rate uncertainty. As yields on short-term bonds and inflation-protected assets became more attractive, market participants switched out of income-oriented equities, with safer fixed-income options offering competitive yields.

Conversely, while most Quality subfactors underperformed this month, sales growth stability subfactor stood out with significant outperformance relative to the broader Canadian market. Despite headwinds from a softening labor market and macroeconomic uncertainty including slowing job growth and volatile trade conditions, companies with strong revenues and stable earnings saw investor interest. Notable examples that led the sales growth stability of the region include Shopify which returned 16% in Aug, and Bank of Nova Scotia, with a 12% gain.

Compared to the previous month, Growth and Quality subfactors showed improved performance in the region, while Momentum and Volatility declined. Shifting expectations around rate cuts— driven by rising global tensions — dampened the speculative flows that typically support volatility and momentum strategies. As a result, investors pulled back from chasing short-term rallies and instead favored stable growth stocks.

Canada's annual inflation rate eased to 1.7% in July 2025, down from 1.9% in June. Meanwhile, the national unemployment rate rose by 0.2 percentage points to 7.1% in August 2025, marking the highest level in four years. Additionally, manufacturing production declined by 4.4% in June 2025, signalling continued weakness in the industrial sector.

Stocks with a sales growth 5Y, in the region include financials company Royal Bank of Canada (+13 % in August), materials company Agnico Eagle Mines Ltd (+16% in August) and financials company Canadian Imperial Bank of Commerce (8% in August).

Figure 7: August 2025 Canada Factor Performance (sector adjusted)

Source: Confluence Style AnalyticsStyle Analytics

Style Analytics Fixed Income is now available globally. To learn more or request a demo, click on the link below.

Appendix: How to read the charts

For example, for the book-to-price factor, we determine the period’s performance of the basket of stocks with the highest book-to-price values relative to the total market. Each factor is analyzed independently, market and fundamental data are adjusted to enable sector-average (within each country) relative data to be used, and the performance measurement isolates the factor’s contribution to return.

Disclaimer

The content of this blog post is for general information purposes only and does not constitute legal, regulatory, financial, investment, or other professional advice. The information should not be relied upon as a substitute for specific advice tailored to particular circumstances. Readers should seek advice from appropriately qualified professionals before taking or refraining from any action based on the content of this blog. This blog post is not intended to market or sell any financial instrument and should not be interpreted as an invitation or inducement to engage in investment activities.

Unless otherwise stated, Confluence Technologies, Inc. (or the relevant group entity) owns the copyright and all related intellectual property rights in the content of this blog post, including but not limited to database rights, trademarks, registered trademarks, service marks, and logos.

No part of this content may be adapted, modified, reproduced, republished, uploaded, posted, broadcast, or transmitted to third parties for commercial purposes without prior written consent.

About Confluence

For more information, visit confluence.com