April 2025

Factor Performance Analysis

Equity Response to Tariffs

May 14, 2025

Prepared by:

Market Background

Market volatility spiked to post-pandemic highs in early April, but a partial recovery followed the announcement of a 90-day pause on tariff hikes. Despite this, the U.S. market underperformed for the month, weighed down by uncertainty surrounding global trade policy, which dampened consumer and investor confidence. Among developed markets, the U.S. lagged behind peers like the UK and Europe.

U.S. dollar weakness primarily supported returns in the Euro Area and Emerging Markets. European markets demonstrated resilience in April, bolstered by positive economic data and the softer dollar.

Crude oil prices dropped to $58 per barrel towards the end of April before rising to $62/ barrel in the first week of May.

In April 2025, gold prices experienced significant fluctuations, peaking at $3,436.70 per ounce on April 22. The month closed with gold at $3,317 per ounce. Price volatility has continued through May, as observed in the most recent data. Following the volatility in March, Bitcoin index prices resumed an upward trajectory throughout April, ending the month at $94,207.

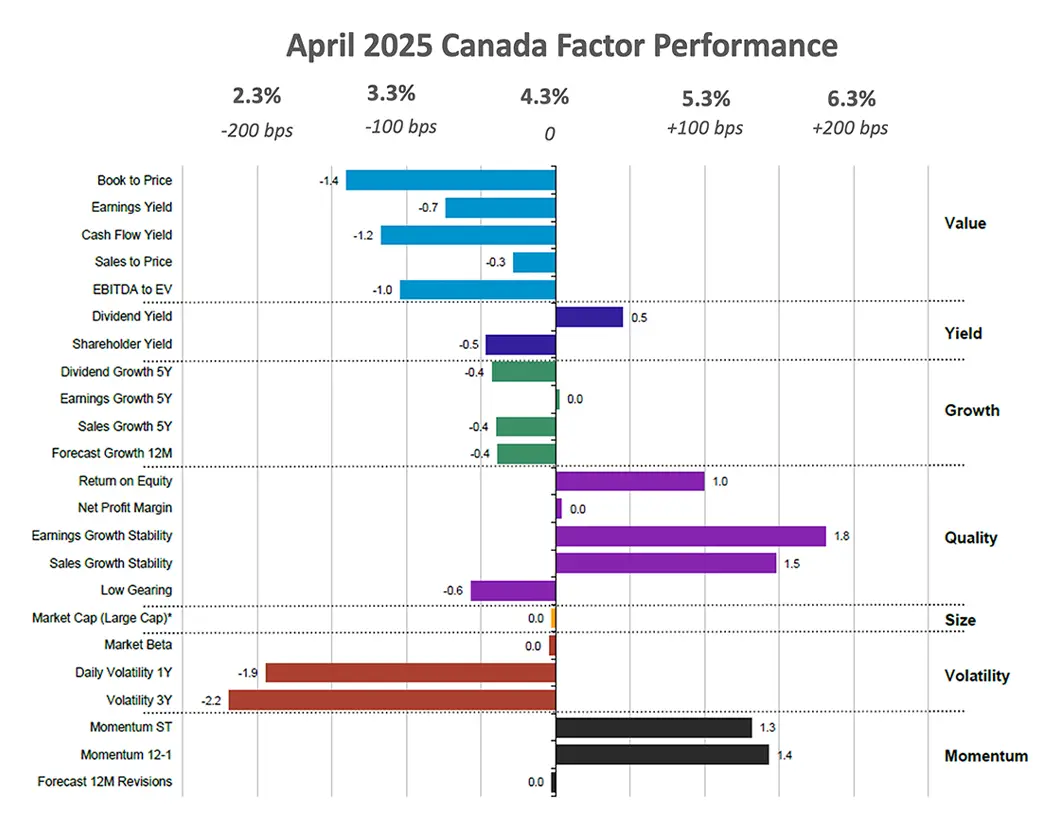

Factor Summary

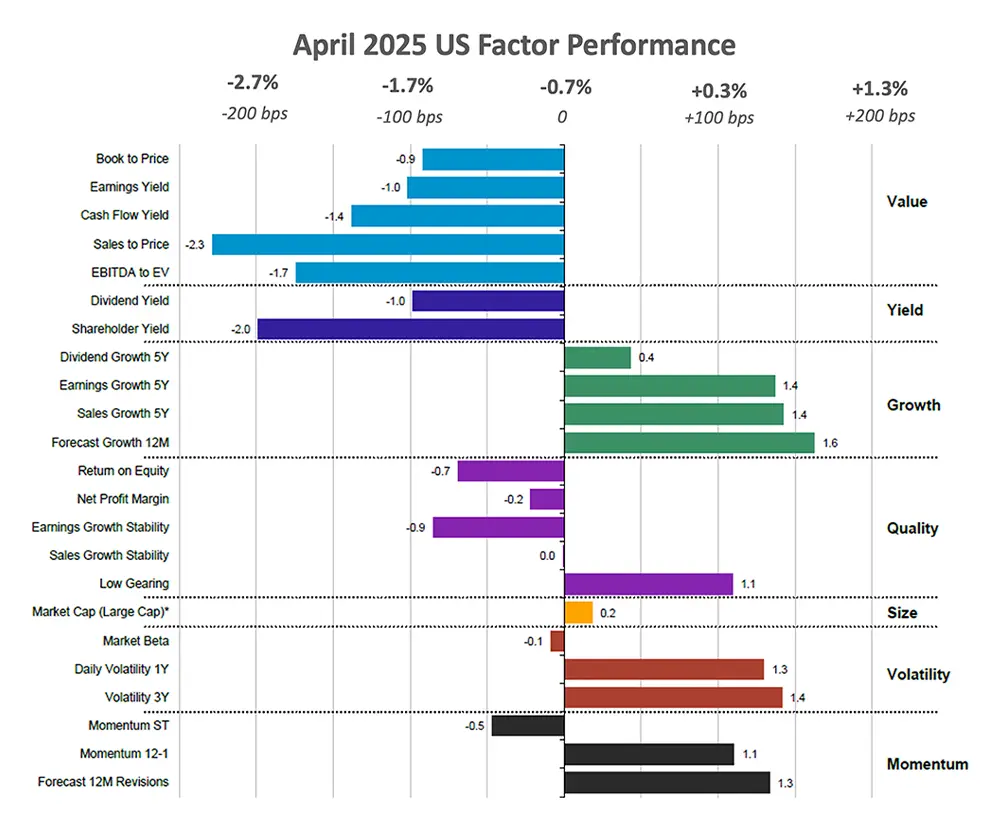

- US Equities: Growth and Volatility outperformed.

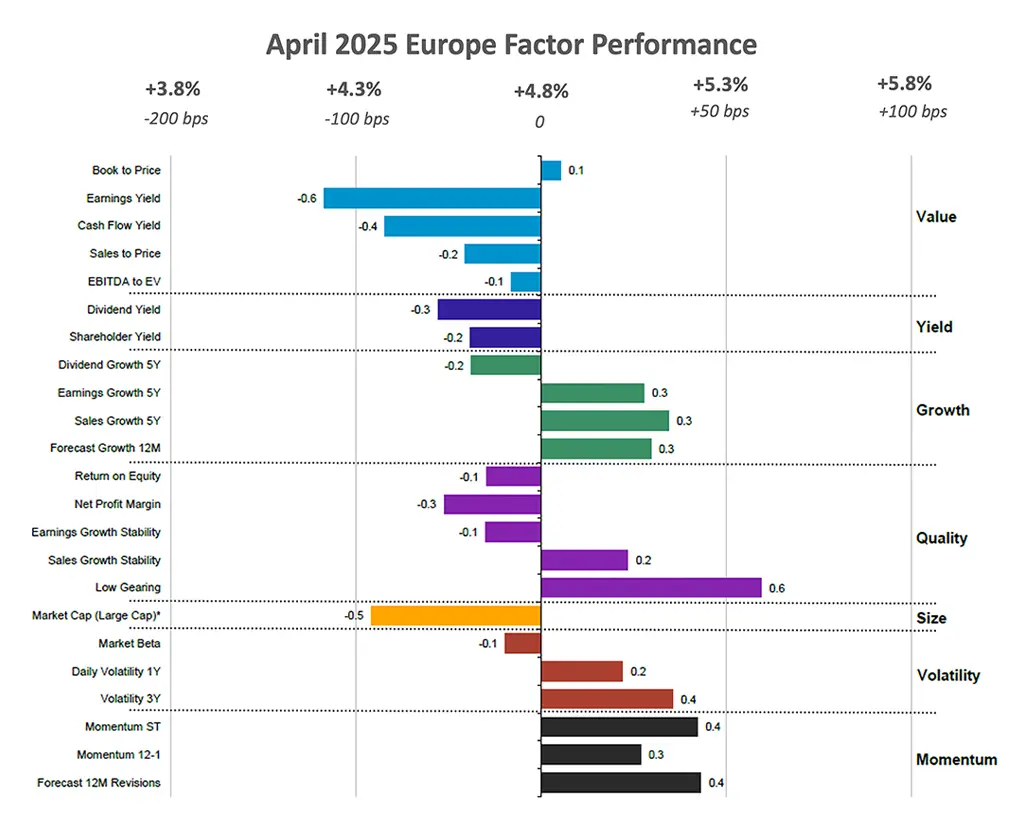

- European Equities: Growth and Momentum outperformed.

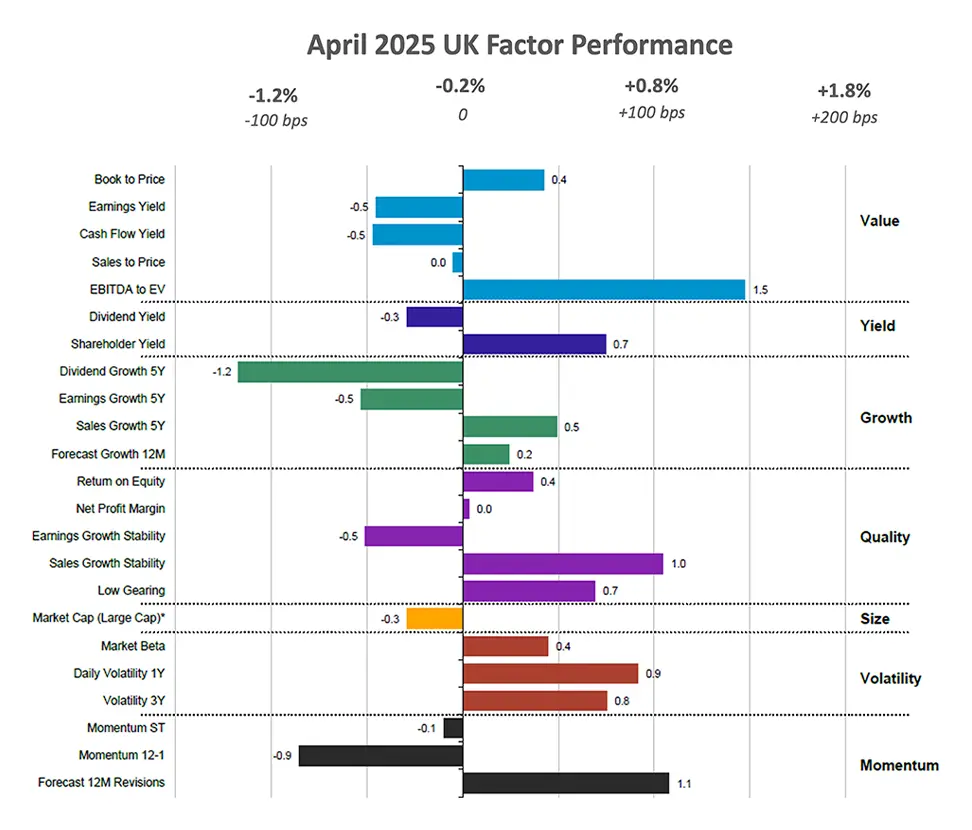

- UK Equities: Quality and Volatility outperformed.

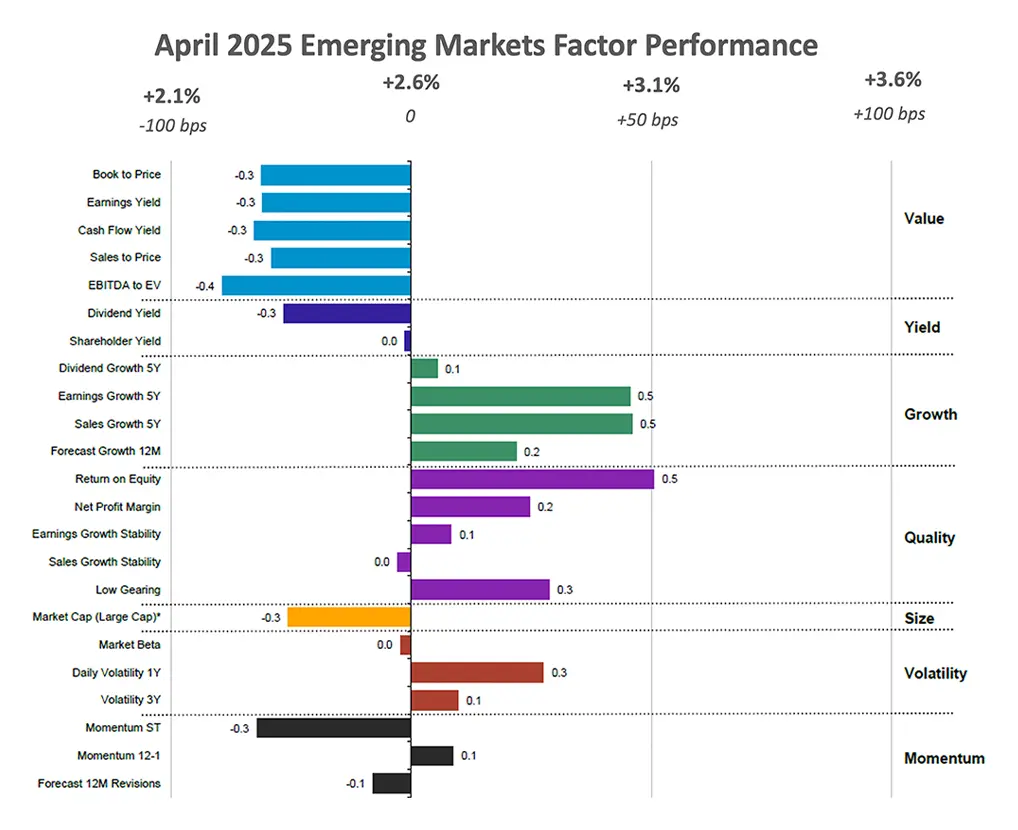

- Emerging Markets Equities: Growth and Quality outperformed.

- Canadian Equities: Quality and Momentum outperformed.

Figure 1: Regional relative factor performance (country and sector adjusted)

Source: Confluence Style AnalyticsUS Equities

U.S. equities experienced an anticipated underperformance amid rising trade tensions at the start of April but recovered nearly all initial losses by month-end. On April 2, President Trump announced his long-promised 'reciprocal' tariffs, including a 10% baseline tax on imports from all countries, a 34% tariff on Chinese goods, a 25% tariff on all car imports, and a 20% tariff on EU goods. This triggered the worst two-day market performance. In response, China imposed a 34% tariff on U.S. goods, and the EU introduced its countermeasures. However, on April 9, the President announced a 90-day pause on the higher-level reciprocal tariffs to allow for negotiations, prompting the US region to record its strongest single-day gain since 2008.

The region experienced a reversal in factor trends compared to the previous month, with high-growth, high-volatility companies leading performance. In contrast, companies with attractive valuations and high yields weighed on overall returns.

The annual inflation rate in the U.S. is expected to remain unchanged at 2.4% in April 2025, consistent with the March reading. The unemployment rate also held steady at 4.2% in April, matching both the previous month and market expectations.

Stocks with high sales growth 5Y, which contributed to the performance of U.S. equities in April, include health care company Eli Lilly and Co (9% in April), consumer discretionary company Tesla Inc (9% in April), and info tech company Broadcom Inc (15% in April). Additionally, companies with strong forecast 12M revisions include communication services company Netflix (+21% in April), and info tech company Microsoft Corp (5% in April), contributing to the outperformance.

Figure 2: April 2025 US Factor Performance (sector adjusted)

Source: Confluence Style AnalyticsEuropean Equities

European equity markets delivered a positive return of 480bps relative to the broader market. Although those Large-cap companies with attractive valuations largely underperformed, weighing on the region’s overall performance, the strong returns were driven by the outperformance of the Growth, Volatility, and Momentum subfactors.

Europe experienced a complete reversal in factor trends compared to the previous month, driven by heightened uncertainty following the U.S.'s tariff announcements. Amid escalating trade tensions, investors gravitated toward high-momentum stocks with elevated volatility, while high-Value companies struggled due to rising recession fears and concerns over tariffs.

Consumer price inflation in the Euro Area held steady at 2.2% in April 2025, slightly above market expectations of 2.1%. Meanwhile, the unemployment rate also remained unchanged at 6.2% in March.

Key European stocks with strong short-term momentum that outperformed in April include French consumer staples company L’oreal (+19% in April), French financials company Axa SA (+11% in April), Spanish financials company Banco Santander SA (7% in April) and French consumer discretionary company Hermes International SCA (5% in April).

Figure 3: April 2025 Europe Factor Performance (country and sector adjusted)

Source: Confluence Style AnalyticsUK Equities

Similar to the U.S. performance in April, UK equities slightly underperformed the broader market by 20bps. The UK market delivered mixed results, while the Volatility factor clearly outperformed by 70bps, other factors showed mixed performance. The UK was subject to baseline tariffs of 10%, lower than those imposed on the EU. After an initial dip driven by geo-economic uncertainty following tariff announcements earlier in the month, the UK equity market stabilized, ultimately ending the month with a modest underperformance.

The Value subfactor EBITDA to EV outperformed the market notably by 150 basis points, primarily driven by companies with stable valuations. Following the initial downturn in global markets at the start of April, the remainder of the month saw a recovery, with high-volatility companies leading the region's outperformance.

The UK's annual inflation rate eased to 2.6% in March 2025, down from 2.8% in February. Meanwhile, the unemployment rate remained steady at 4.4% from December through February 2025, marking the fourth consecutive period of no change.

British stocks with strong EBITDA to EV that outperformed this month include healthcare company GSK Plc (+5% in April), and London Stock Exchange Group Plc (+6% in April), industrials company Bae Systems Plc (16% in April).

Stocks with steady forecast 12-month revisions outperforming the UK market include utilities company National Grid Plc (11% in April), industrials company Relx Plc (9% in April), and consumer staples company Unilever Plc (7% in April).

Figure 4: April 2025 UK Factor Performance (sector adjusted)

Source: Confluence Style AnalyticsEmerging Market Equities

The factor trend in Emerging Markets favored Growth and Quality, outperforming the market by 33bps and 22bps, respectively. The region continued and strengthened its outperformance from the previous month, exceeding the market by 2.6% in April.

The strong outperformance of Emerging Markets relative to the U.S. amid ongoing trade tensions reflects a shift in investor sentiment toward hedging. Historically, Emerging Markets’ equities have outperformed global equities during periods of weakness in the U.S. dollar. Additionally, the greater policy flexibility available to Emerging Markets’ governments, compared to the more constrained options in developed markets, has further supported Emerging Markets’ equity performance.

India's annual inflation rate eased to 3.34% in March 2025, down from 3.61% in the previous month, while the unemployment rate declined to 7.90% in February from 8.20% in January. Mexico's annual inflation rate increased to 3.93% in April 2025, up from 3.8% the previous month, while the unemployment rate declined to 2.2% in March 2025. Brazil's annual inflation rate edged up to 5.53% in April 2025 from 5.48% in the previous month, while the unemployment rate rose to 7% in March.

Emerging Markets equities that outperformed in the month of April, captured by the ROE subfactor, include a Taiwanese info tech company Taiwan Semiconductor Manufacturing Company (+4% in April); Chinese utilities company China Yangtze power Co Ltd (+6 % in April). Companies with high earnings growth stability include Chinese financials company Industrial and Commercial Bank of China (+2% in April), and Chinese financials company Agricultural Bank of China Ltd (5% in April).

Figure 5: April 2025 Emerging Factor Performance (country and sector adjusted)

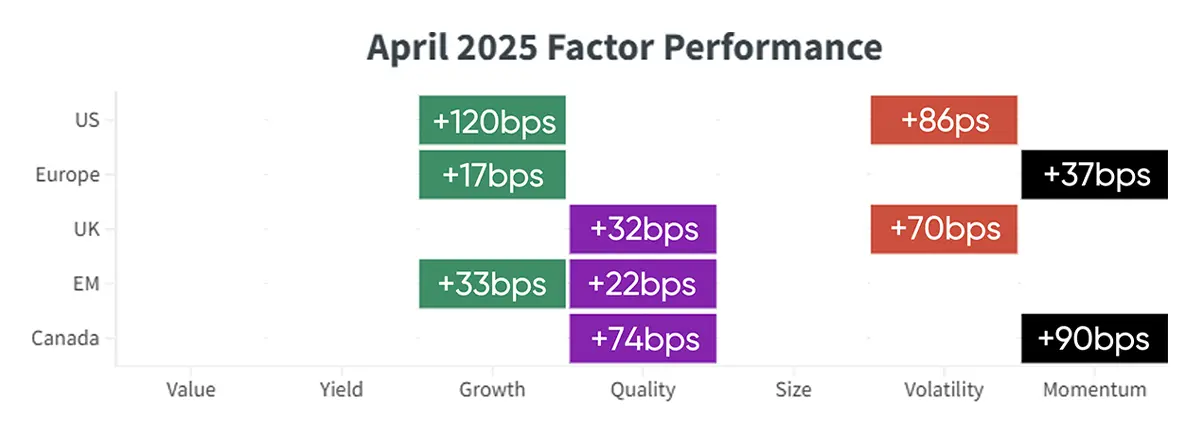

Source: Confluence Style AnalyticsCanadian Equities

In April, factor performance trends in Canada favored the Quality and Momentum subfactors. Compared to the previous month, Value and Growth subfactors showed a reversal in performance, underperforming by 92bps and 30bps, respectively. Volatility subfactors primarily contributed to the region’s overall performance drag during the month.

Equity markets in the region rebounded in April, rising to 4.3% after a decline in March triggered by concerns over the potential impact of U.S. tariffs. As the initial shock from the tariffs eased, investor sentiment improved, driving the market’s recovery.

Volatility continued to underperform relative to the previous quarter, as investors favored stability, risk mitigation, and long-term value, driving outperformance in Quality stocks with strong fundamentals.

Canada's annual inflation rate reached to 2.3% in March from 2.6% high in the previous month. Canada's unemployment rate rose to 6.9% in the latest month, up from 6.7% previously.

Stocks with a strong earnings growth stability, in the region, include info tech company Constellation Software (+13 % in April), energy company Enbridge Inc (+6% in April), and financials company Royal Bank of Canada (+7% in April). 12-1 Momentum equities that led to the outperformance of the region include financials companies Brookfield Asset Management (15% in April), and info tech company Shopify (4% in April).

Figure 6: April 2025 Canada Factor Performance (sector adjusted)

Source: Confluence Style AnalyticsStyle Analytics

Style Analytics provides industry-leading, visually compelling portfolio insights, empowering asset managers to analyze factor exposures with confidence. With advanced tools like the Style SkylineTM, users can visually compare their fund’s factor exposures against benchmarks, enhancing portfolio strategy with faster, data-driven decisions. Access to 28,000+ funds with pre-calculated factor exposures enables efficient comparison and identification of similar or competing funds. The platform ensures transparency by validating style consistency and alpha generation through an independent factor lens, while offering 130+ factors for effective investor communication. Style Analytics allows users to track and understand factor shifts and simulate rebalancing decisions, optimizing risk management and portfolio differentiation.

Appendix: How to read the charts

For example, for the book-to-price factor, we determine the period’s performance of the basket of stocks with the highest book-to-price values relative to the total market. Each factor is analyzed independently, market and fundamental data are adjusted to enable sector-average (within each country) relative data to be used, and the performance measurement isolates the factor’s contribution to return.

Disclaimer

The content of this blog post is for general information purposes only and does not constitute legal, regulatory, financial, investment, or other professional advice. The information should not be relied upon as a substitute for specific advice tailored to particular circumstances. Readers should seek advice from appropriately qualified professionals before taking or refraining from any action based on the content of this blog. This blog post is not intended to market or sell any financial instrument and should not be interpreted as an invitation or inducement to engage in investment activities.

Unless otherwise stated, Confluence Technologies, Inc. (or the relevant group entity) owns the copyright and all related intellectual property rights in the content of this blog post, including but not limited to database rights, trademarks, registered trademarks, service marks, and logos.

No part of this content may be adapted, modified, reproduced, republished, uploaded, posted, broadcast, or transmitted to third parties for commercial purposes without prior written consent.

About Confluence

For more information, visit confluence.com