Q4 2025

Plan Universe Allocation & Return Analysis

Equity allocations drive defined benefit plan performance to post best annual performance since 2020.

February 13, 2026

by:

Executive Summary

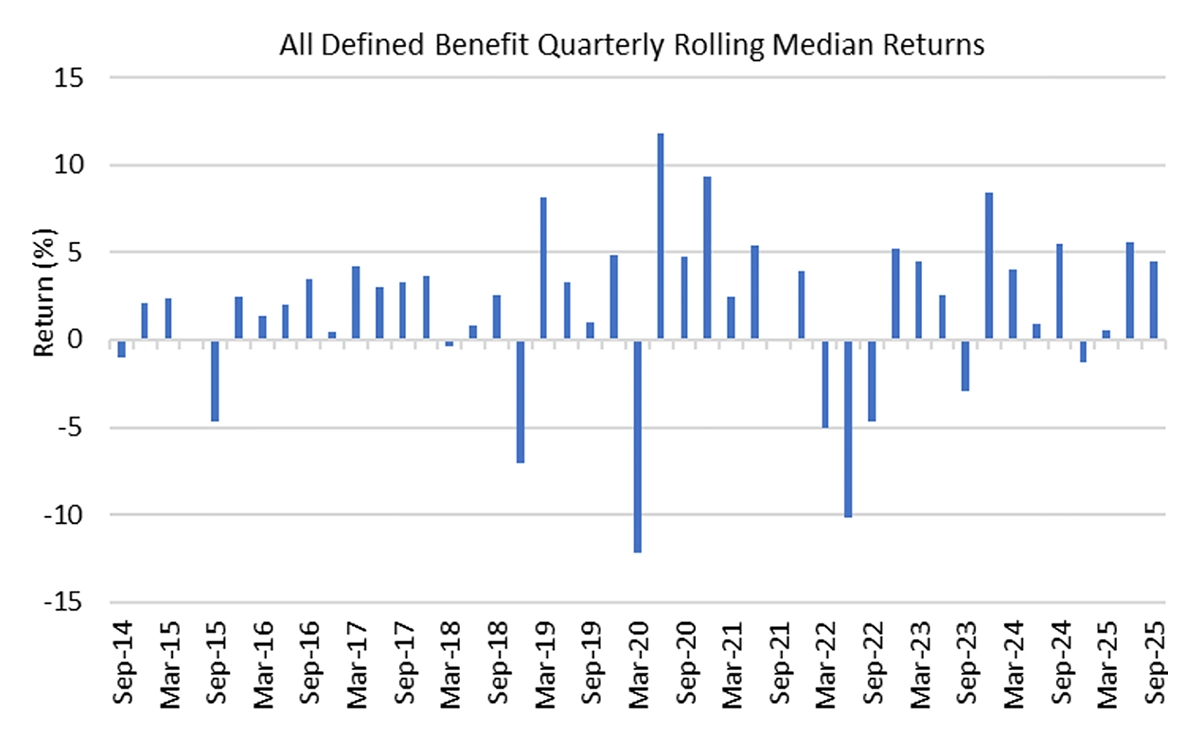

The Q4 2025 Confluence® Plan Universe Report – the industry’s most granular analytics tool for plan sponsors with data sourced directly from over 4,000 institutions – reported another positive quarter for defined benefit plans with a median return of 1.74%. The median defined benefit plan returned 12.79% for the year, the strongest calendar year performance since 2020.

Global equity markets posted a third consecutive quarter of positive performance in Q4 2025. A weakening U.S. dollar, attractive valuations, and monetary easing boosted international markets, with the MSCI EAFE Index returning 4.91% for the quarter. U.S. equities trailed non-U.S. equities for the quarter, with the Russell 1000 Index returning 2.41%. Within fixed income, the U.S. Bloomberg Aggregate Index returned 1.10% for the quarter, while the Bloomberg U.S. Long Treasury Index returned -.05%.

Highlights

- All defined benefit plans posted a median return of 1.74% for the quarter, underperforming a traditional 60/40 benchmark return of 2.46%. (60% MSCI ACWI Index/ 40% Bloomberg Barclays U.S. Aggregate Index).

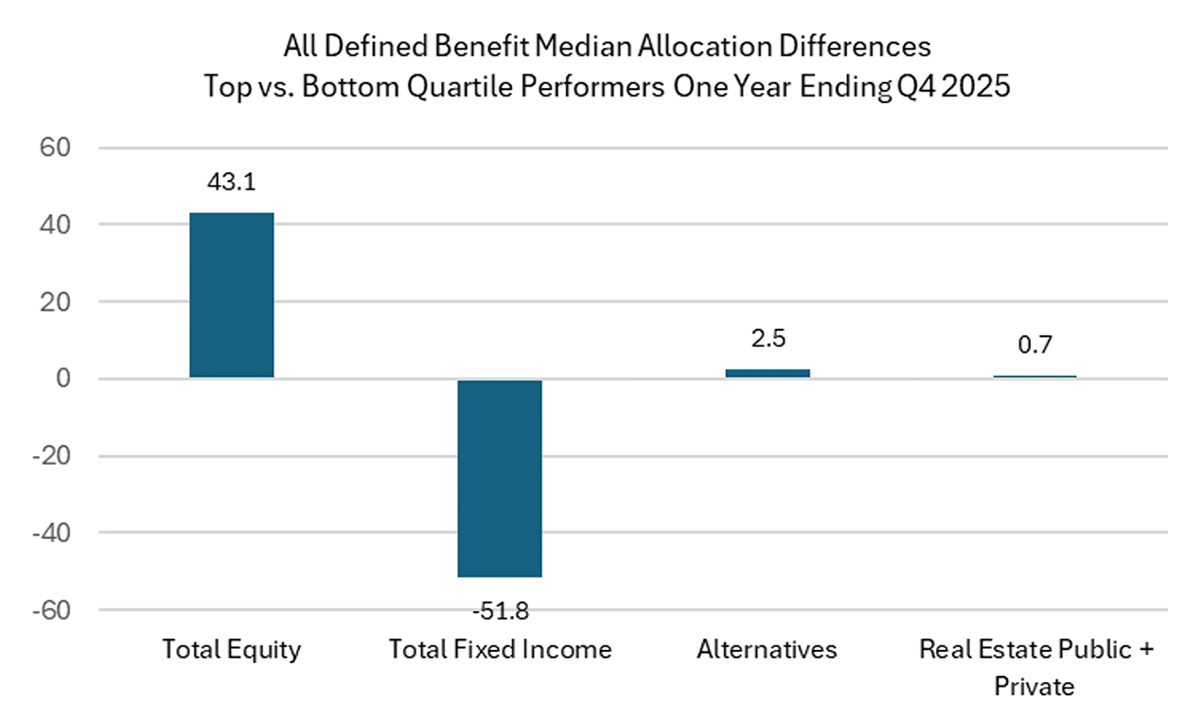

- For the year, the median allocation to equity for top quartile performing plans was 59%, compared to 16% for the bottom quartile performers.

- For the fourth quarter and calendar year, Endowments & Foundations delivered the strongest performance, driven by their high allocation to top-performing equity markets.

- Corporate plans, driven by their comparatively high fixed income allocations, were the weakest performers by plan type for the quarter and the year.

Plan Performance Over Time

For the quarter, the Confluence All Defined Benefit Plan Sponsor Universe posted a median return of 1.74%. Despite all major asset classes delivering positive returns, the median underperformed a traditional 60/40 benchmark by 2.46%. (60% MSCI ACWI Index/ 40% Bloomberg Barclays U.S. Aggregate Index).

Source: Confluence

For the year, plans with a return greater than 14.49% were top quartile performers while plans returning less than 10.32% fell in the bottom quartile. The median allocation to equity for top-quartile-performing plans was 59%, compared to 16% for bottom-quartile plans. Conversely, the bottom quartile-performing plans had a median allocation of 78.6% to fixed income, 51.8% higher than the top quartile's allocation of 26.8%.

Source: Confluence

Historical Plan Comparison

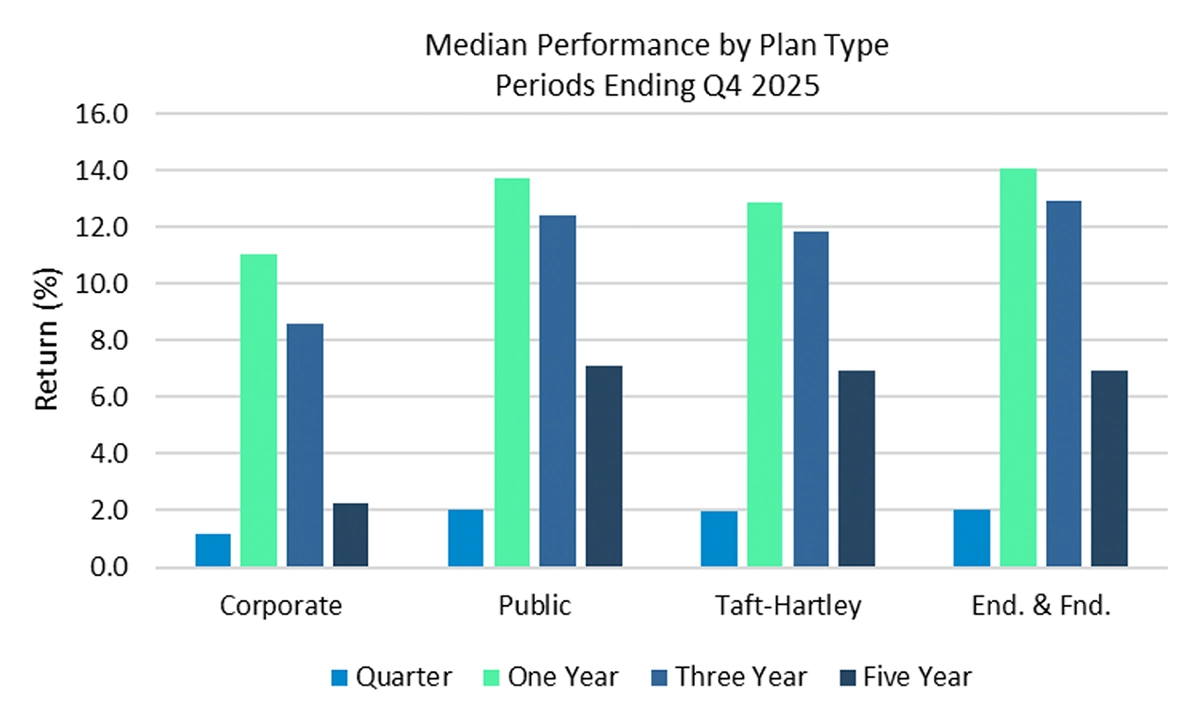

Endowments & Foundations delivered the strongest performance for the quarter and the year, with median returns of 2.05% and 14.10%. As Figure 3 highlights, corporate plans, which have significantly higher exposure to fixed income than other plan types, delivered the weakest performance for the quarter and the calendar year, with median returns of 1.15% and 11.05%, respectively.

Source: Confluence

Plan Allocation Analysis

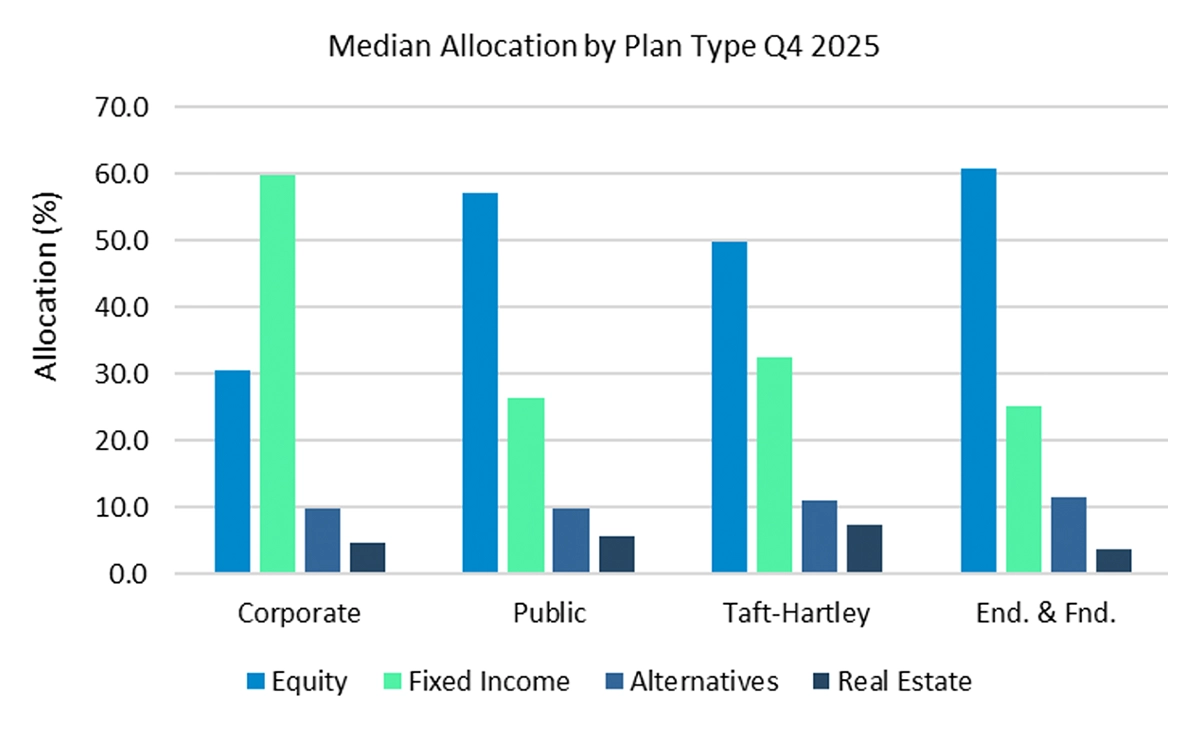

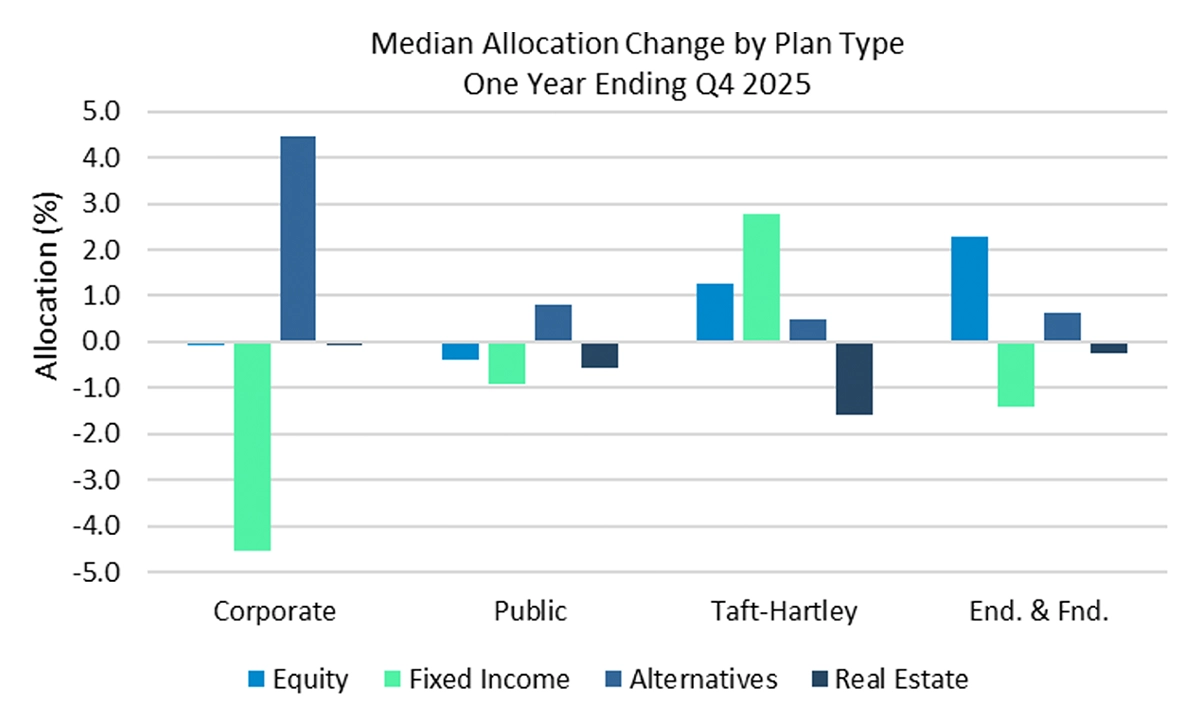

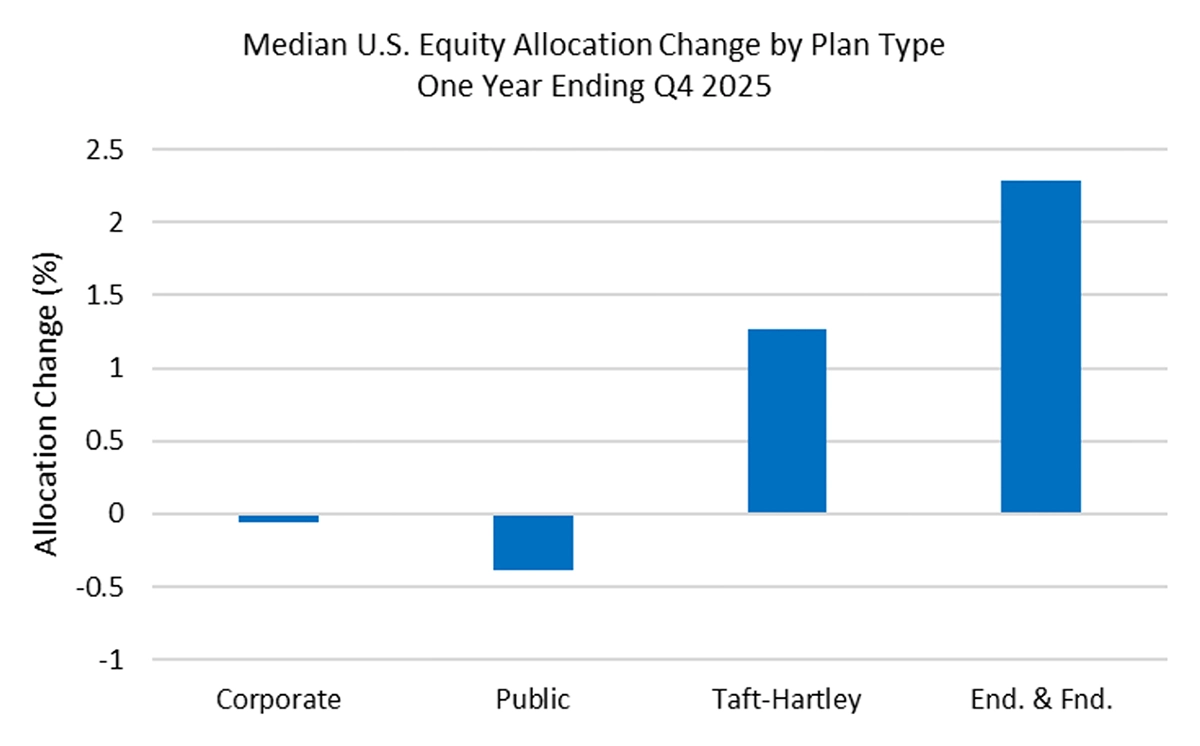

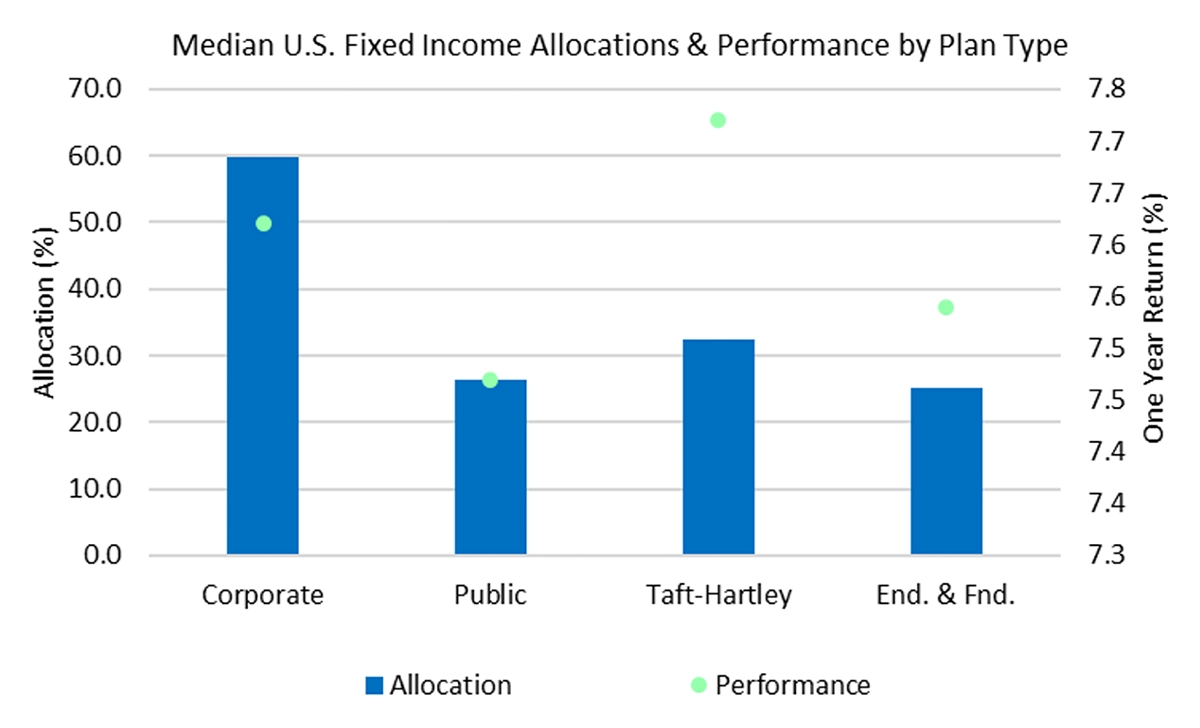

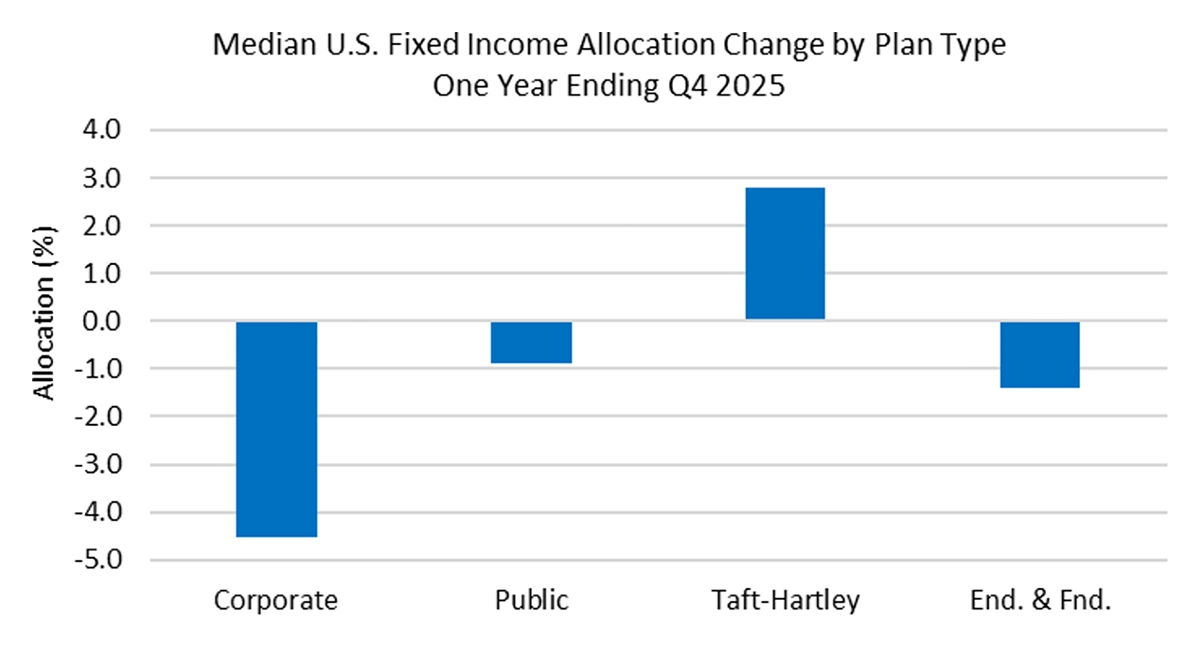

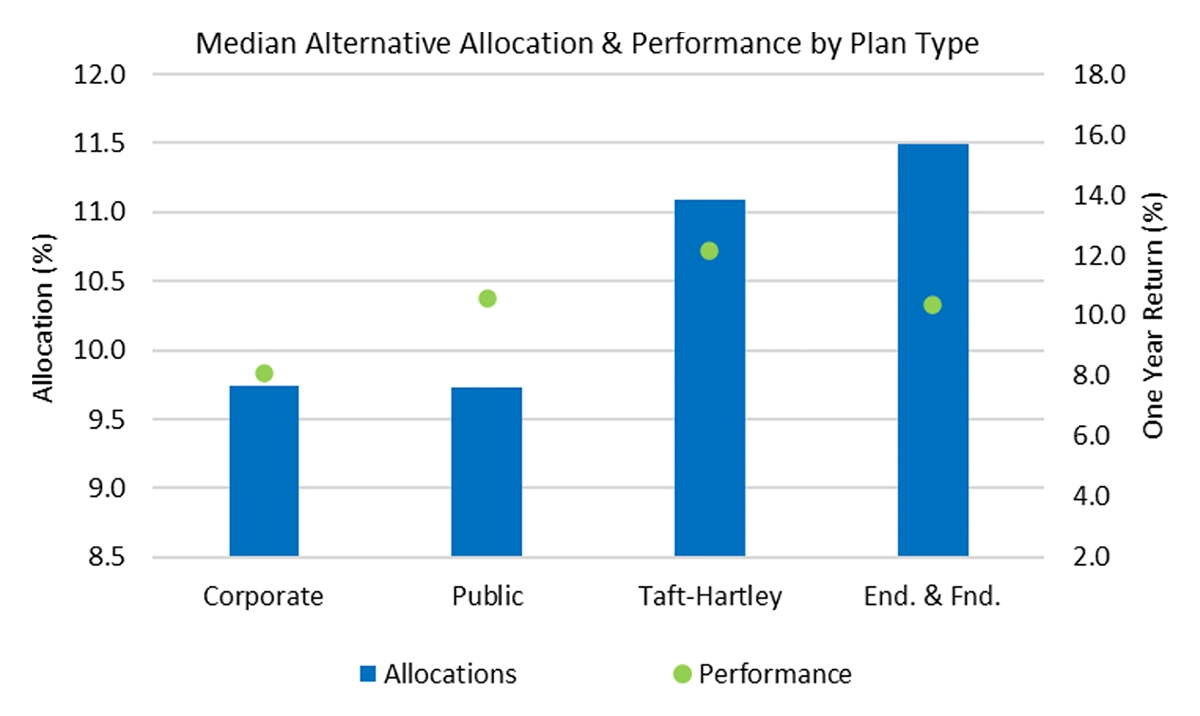

Corporate plans, which underperformed all other plan types for the quarter and year, continue to hold the largest allocation to fixed income at 59.9%. The median allocations to equity, the best-performing asset class, increased for Taft-Hartley and Endowment & Foundation plans over the last year. Allocations to Real Estate, the worst-performing asset class over the last year with a median return of 3.62%, were down across all plan types by an average of .63%.

Source: Confluence

Source: Confluence

U.S. Equity Performance

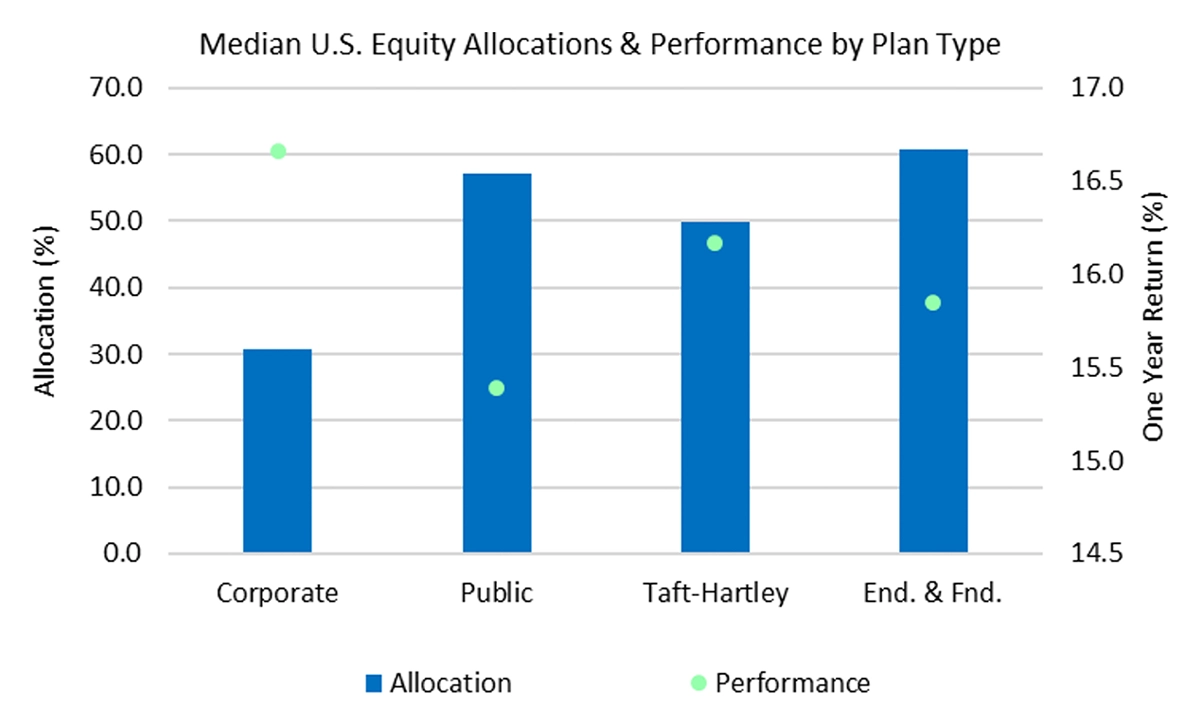

U.S. public equity markets delivered another positive quarter with the Russell 1000 Index returning 2.41%. Compared with the median U.S. equity return for all defined benefit plans, the median U.S. equity return for all defined benefit plans was 2.39%. Corporate plans continue to be underweight U.S. equity, with a median allocation of 30.6%, nearly half that of other plan types.

Source: Confluence

Source: Confluence

U.S. Fixed Income Performance

Other than Taft-Hartley, all plan types decreased their allocation to U.S. Fixed income over the last year. Corporate plans, which have the highest allocation to the asset class at 59.9%, decreased their allocation by 4.5% over the last year.

Source: Confluence

Source: Confluence

Alternatives Performance

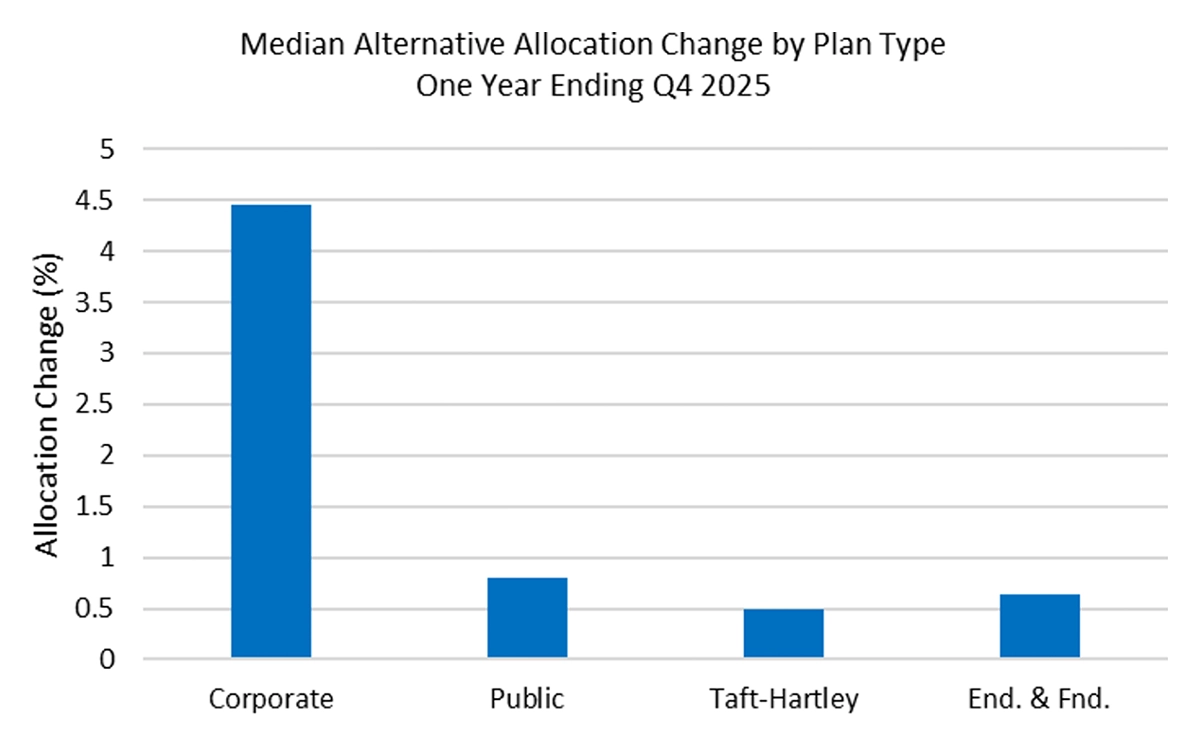

Corporate plans' median allocation to alternatives increased by 4.4% in the last year, despite the increase, they comparatively remain underweight. Endowments & Foundations continue to have the highest median allocation to alternatives at 11.49%.

Source: Confluence

Source: Confluence

Confluence Plan Universe

Confluence Plan Universe is the industry’s most granular analytics tool for plan sponsors including standard and custom peer group comparisons of performance, risk, and asset allocations by plan type and size. The data is sourced directly from over 4,000 institutions using our reporting and analytics solutions, including investment consultants, advisors, and asset owners. Plan Universe is updated quarterly and typically available on or near the following schedule: preliminary data available on the 14th business day after quarter end, a second cut on the 21st business day, and final cut on the 29th business day. The data includes 20+ years’ history on:

- Trust Funds, Corporates, Public Plans, Taft-Hartley, Endowments & Foundations, High Net Worth, Health & Welfare, and custom groups.

- Asset Allocations broken into equity (US, global, global ex-US), fixed income (US, global, and global ex-US), alternatives, real estate (public and private), multi-asset and cash. Emerging Markets allocations are available for equities and debt securities.

- Net and gross performances displayed by quartile with full percentiles via download.

- With all information aggregated by Plan Size.

Confluence PARis now partnering with Canoe Intelligence, to bring AI-powered alternative data automation into existing PARis environments. If you'd like to schedule a brief overview, please reach out to your consultant by emailing [email protected]

Disclaimer

The content of this blog post is for general information purposes only and does not constitute legal, regulatory, financial, investment, or other professional advice. The information should not be relied upon as a substitute for specific advice tailored to particular circumstances. Readers should seek advice from appropriately qualified professionals before taking or refraining from any action based on the content of this blog. This blog post is not intended to market or sell any financial instrument and should not be interpreted as an invitation or inducement to engage in investment activities.Unless otherwise stated, Confluence Technologies, Inc. (or the relevant group entity) owns the copyright and all related intellectual property rights in the content of this blog post, including but not limited to database rights, trademarks, registered trademarks, service marks, and logos.

No part of this content may be adapted, modified, reproduced, republished, uploaded, posted, broadcast, or transmitted to third parties for commercial purposes without prior written consent.