Identifying complementary funds through style differentiation

Fund of Funds construction using Style Analytics®

Author:

Client challenge

Fund of Funds managers and multi-manager investors are under pressure to deliver diversified portfolios that maintain performance consistency while reducing unintended style concentration and risk. Traditional peer group analysis often focuses solely on returns, making it challenging to identify managers who complement, rather than duplicate, existing exposures.

To improve diversification outcomes, investors need a way to look beyond performance and understand how style, factor, and risk profiles interact at both the manager and portfolio level.

Objective

The goal of this analysis was to identify an international equity fund that complements the Artisan International Value Fund (ARTKX) by delivering comparable long‑term performance with a distinctly different style profile, thereby enhancing diversification in a Fund of Funds portfolio.

Approach

Using Confluence® Style Analytics, the analysis followed a structured, multi-phase workflow aligned to the portfolio management lifecycle, leveraging four integrated modules:

1. Peer Insights – Identify key differentiating style exposures

2. Similyzer™ – Quantify similarity and dissimilarity across peers

3. Fund of Funds Studio – Construct and test portfolio combinations

4. Analytics Studio – Compare diversification and risk outcomes across scenarios

Portfolio management lifecycle phase: Manager search & select

Identifying style differentiators

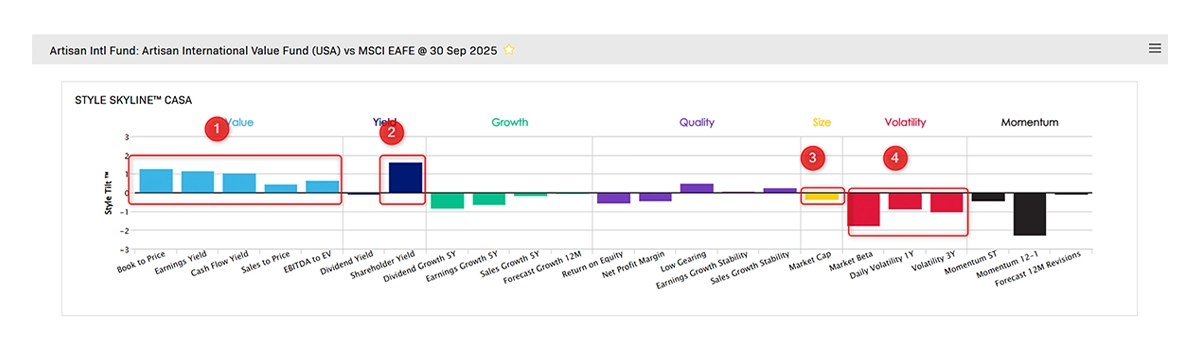

Using Peer Insights, ARTKX was analyzed within the Foreign Large Cap Blend peer group. Relative to the MSCI EAFE benchmark, the fund exhibited pronounced exposures to:

- High Value

- High Shareholder Yield

- Lower Market Capitalization

- Lower Volatility

These factor tilts defined the style footprint used to search for complementary funds.

Finding complementary managers

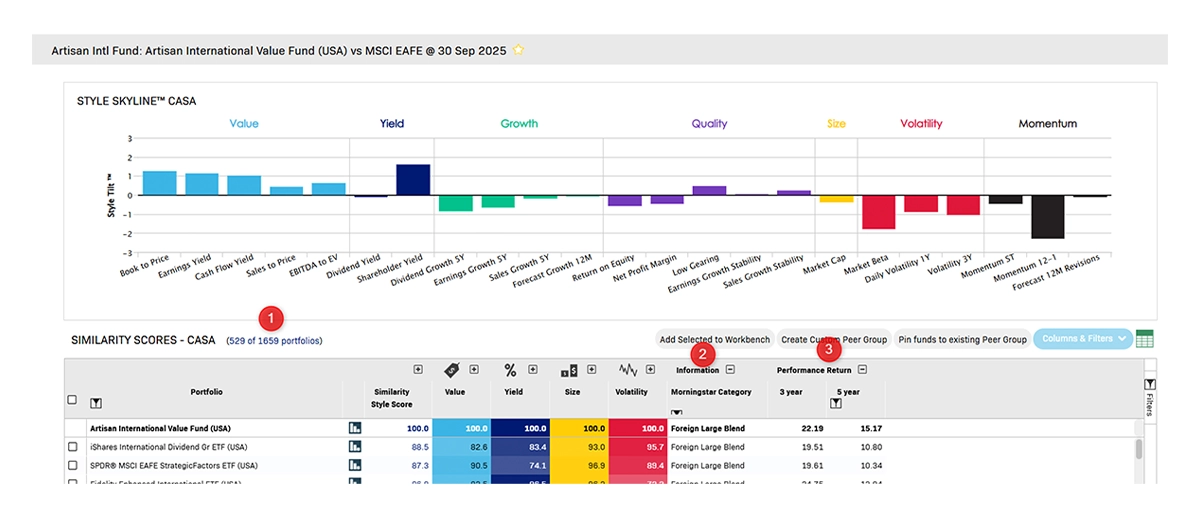

The Similyzer™ module repurposed these differentiating factors to evaluate similarity across the peer universe. Filters were applied to:

- Exclude Artisan-managed funds

- Include only funds with a full 5-year performance history

- Restrict results to the same Morningstar category

Value Factors

Shareholder Yield

Market Cap

Volatility Factors

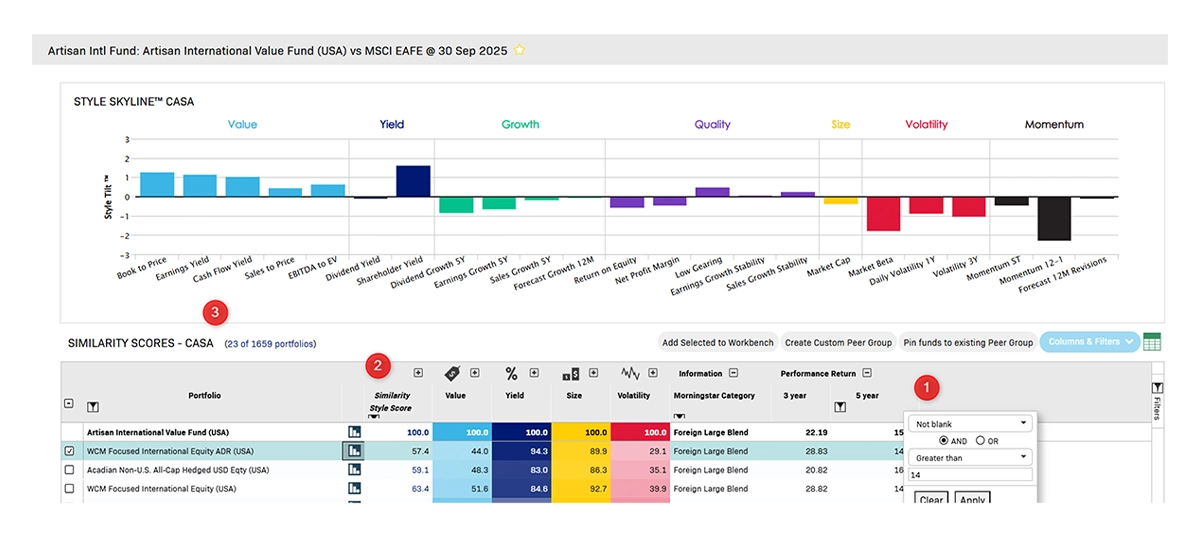

From an initial universe of 529 eligible portfolios , results were sorted by Similarity Style Score and filtered by Morningstar Category , surfacing funds with the most distinct style profiles but comparable performance. This refinement produced 23 candidate funds, with three emerging as the most stylistically dissimilar to ARTKX while maintaining similar five-year returns .

The funds were sorted in ascending order based on their Similarity Style Score to show the most dissimilar funds first , and filtered for funds with a similar 5-year performance value , resulting in 23 portfolios .

The three most dissimilar funds from ARTKX within the peer group exhibit very different style footprints, yet they still share similar 5-year performance.

Portfolio management lifecycle phase:

Multi-manager analysis

Constructing fund combinations

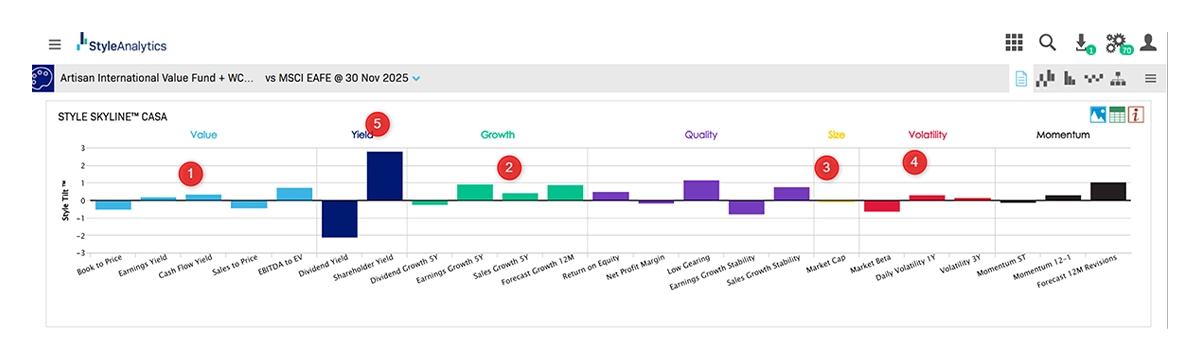

The WCM Focused International Equity Fund, combined with ARTKX in the Fund of Funds Studio, demonstrates how a 50/50 combination of these two funds would impact the Style Skyline™.

- Dissimilar Value exposures neutralized their combined Value exposure

- Superior Growth exposures

- Neutral Market Cap tilt

- Neutral Volatility

- Similar Yield exposures amplified their combined Yield exposures

One of the most dissimilar candidates, the WCM Focused International Equity Fund, was paired 50/50 with ARTKX in Fund of Funds Studio.

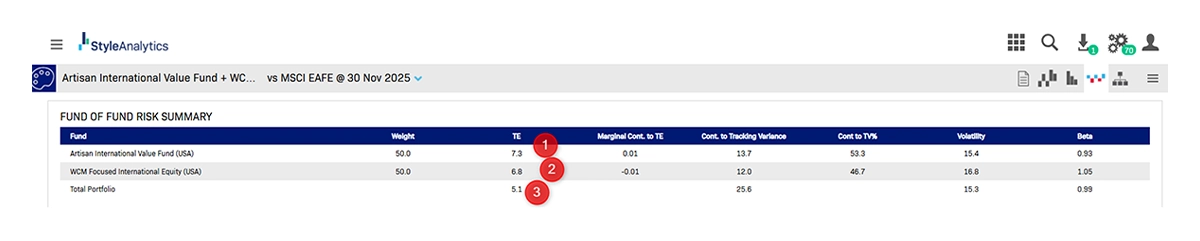

Individually, each fund ( ) has a tracking error of approximately 7, while combining them reduces the new portfolio’s tracking error to about 5 (). This demonstrates that combining the funds meaningfully reduces overall tracking error through diversification, highlighting the diversification benefit of pairing managers with differentiated style drivers.

The combined portfolio demonstrates:

- Neutralization of extreme Value exposures

- Amplification of complementary Yield characteristics

- Balanced Growth exposure

- Neutral Market Cap and Volatility profiles

Combining stylistically distinct managers can reshape the overall portfolio’s Style footprint without sacrificing performance objectives.

Portfolio management lifecycle phase:

Scenario comparison

Evaluating alternative pairings

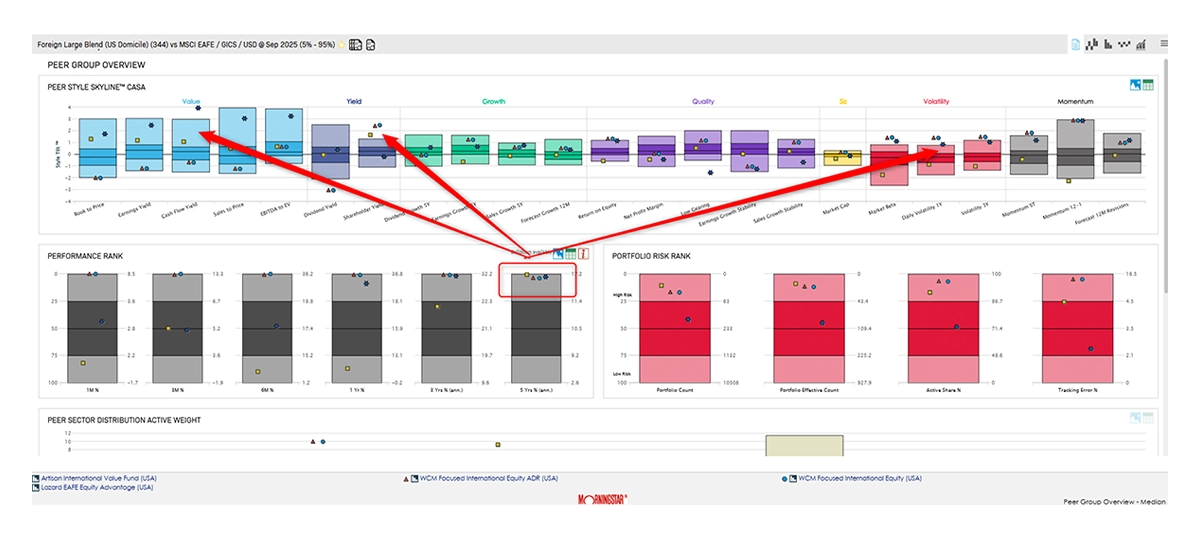

Using Analytics Studio, the ARTKX/WCM combination was compared against an alternative pairing scenario involving a Lazard-managed fund . The first scenario is represented by the shaded bars, while the second scenario is shown by the darker bars.

The Lazard pairing exhibits higher Value exposure , lower Growth exposure and lower Volatility exposure .

This side-by-side scenario analysis enabled a clear, data-driven comparison of trade-offs, helping decision-makers assess which combination best aligned with their portfolio objectives.

Outcome

This use case demonstrates how Style Analytics enables investors to:

- Move beyond performance-only manager selection

- Identify true diversification opportunities using factor-level insights

- Construct Fund of Funds portfolios with improved balance and risk efficiency

- Transparently compare portfolio scenarios before implementation

By integrating Peer Insights, Similyzer™, Fund of Funds Studio, and Analytics Studio, investors gain a repeatable, scalable framework for building diversified multi-manager portfolios with confidence.

Style Analytics

The industry-leading, visually compelling portfolio insights for the asset management industry.

Analyze factor exposures with confidence.

Disclaimer

The content provided by Confluence Technologies, Inc. is for general informational purposes only and does not constitute legal, regulatory, financial, investment, or other professional advice. It should not be relied upon as a substitute for specific advice tailored to particular circumstances. Recipients should seek guidance from appropriately qualified professionals before making any decisions based on this content.

Unless otherwise stated, Confluence Technologies, Inc. (or the relevant group entity) owns the copyright and all related intellectual property rights in this material, including but not limited to database rights, trademarks, registered trademarks, service marks, and logos.

No part of this content may be adapted, modified, reproduced, republished, uploaded, posted, broadcast, or transmitted to third parties for commercial purposes without prior written consent.

About Confluence® Technologies

Confluence is a global leader in enterprise data and software solutions for regulatory, analytics, and investor communications. Our best-of-breed solutions make it easy and fast to create, share, and operationalize mission-critical reporting and actionable insights essential to the investment management industry. Trusted for over 30 years by the largest asset service providers, asset managers, asset owners, and investment consultants worldwide, our global team of regulatory and analytics experts delivers forward-looking innovations and market-leading solutions, adding efficiency, speed, and accuracy to everything we do. Headquartered in Pittsburgh, PA, with 700+ employees across North America, the United Kingdom, Europe, South Africa, and Australia, Confluence services over 1,000 clients in more than 40 countries.

For more information, visit confluence.com

You may also like: