Q3 2025

Plan Universe Allocation & Return Analysis

AI enthusiasm and Federal Reserve rate cut drive markets Q3 2025

November 11, 2025

by:

Executive Summary

The Q3 2025 Confluence Plan Universe Report – the highly granular analytics tool for plan sponsors with data sourced directly from over 4,000 institutions – reported another strong quarter for defined benefit plans with a median return of 4.43%. Year-to-date, the median defined benefit plan return of 10.72% is 40 basis points ahead of Q3 2024 and represents the strongest year-to-date performance in Q3 since 2019.

Equity markets posted strong performance in Q3 2025, led by continued excitement around AI (Artificial Intelligence) and a 25-basis-point rate cut by the U.S. Federal Reserve. U.S. equities were driven by growth stocks, with the Russell 1000 Growth Index returning 10.50%. A weakening U.S. dollar, combined with monetary easing, also boosted emerging markets, with the MSCI Emerging Markets Index returning 10.95% for the quarter. As of September, the MSCI Emerging Markets benchmark has outperformed the Russell 1000 by 13.6% year-to-date. Within fixed income, the U.S. Bloomberg Aggregate Index returned 2.03% for the quarter, while the Bloomberg U.S. Long Treasury Index returned 2.49%.

Highlights

- All defined benefit plans posted a median return of 4.43% for the quarter, underperforming a traditional 60/40 benchmark return of 5.43%. (60% MSCI ACWI Index/ 40% Bloomberg Barclays U.S. Aggregate Index).

- For the year to date, all defined benefit plans posted a median return of 10.72%, the highest Q3 year-to-date performance since 2019.

- Corporate defined benefit plans, driven by their fixed income allocation and exposure to long bonds, were the weakest performers by plan type during the quarter, returning 4.04% at a median level.

- Public plans, driven by their comparatively high equity and low fixed income allocations, were the highest performers by plan type for the quarter, returning 4.78% at a median level.

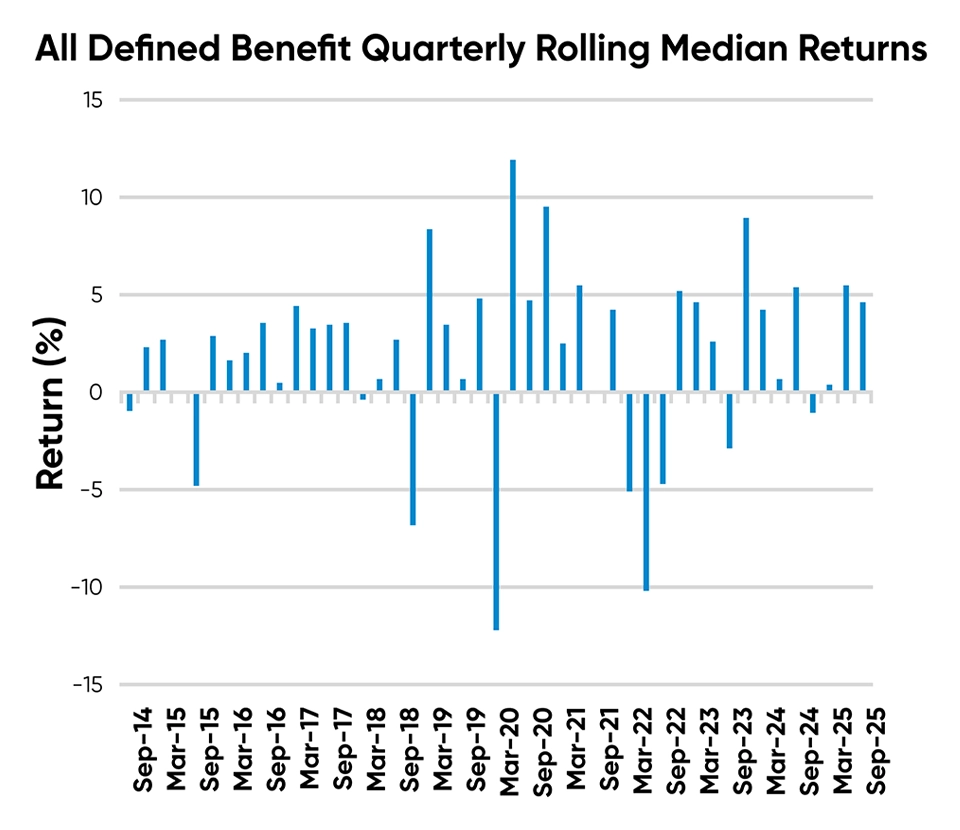

Plan Performance Over Time

For the quarter, the Confluence All Defined Benefit Plan Sponsor Universe posted a median return of 4.43%. Despite all major asset classes delivering positive returns, the median underperformed a traditional 60/40 benchmark return of 5.43%. (60% MSCI ACWI Index/ 40% Bloomberg Barclays U.S. Aggregate Index).

Source: Confluence

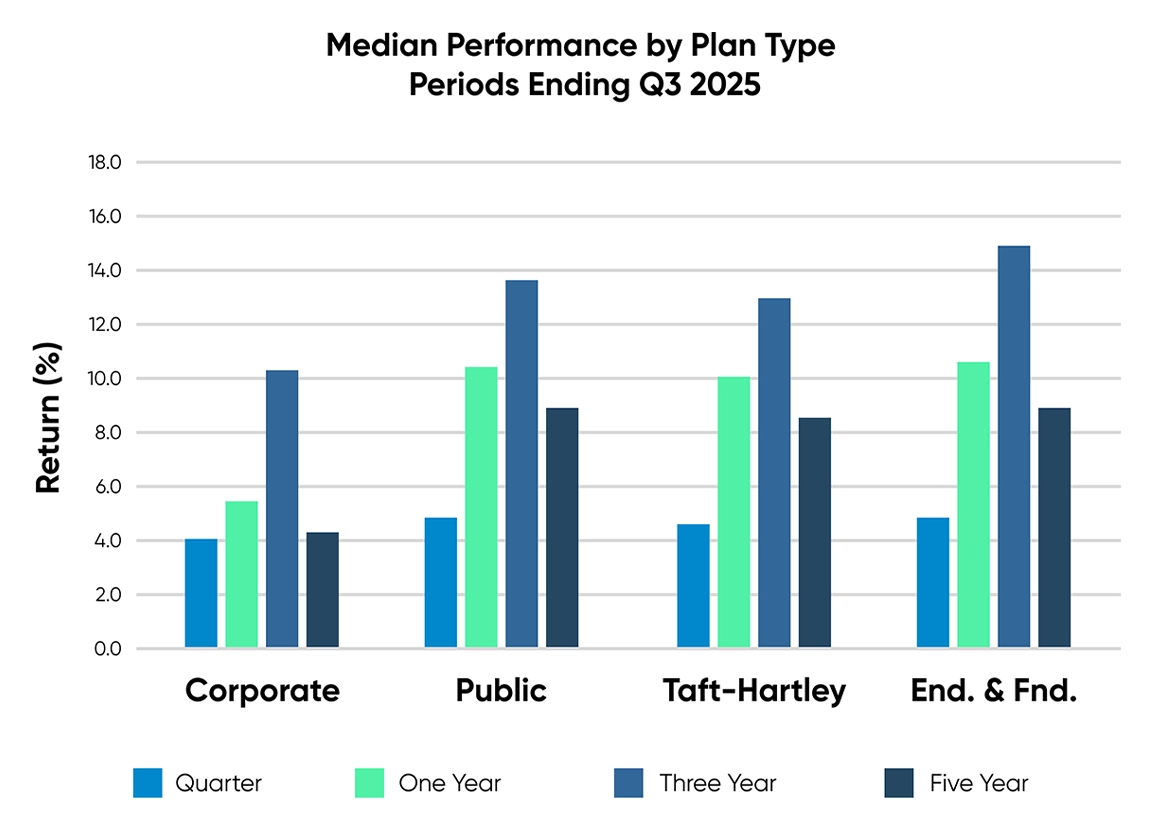

Historical Plan Comparison

Public plans delivered the strongest performance for the quarter, with a median return of 4.78%. As Figure 2 highlights, corporate plans, which have significantly higher exposures to fixed income compared to other plan types, delivered the weakest performance for the quarter with a median return of 4.04%.

Source: Confluence

Plan Allocation Analysis

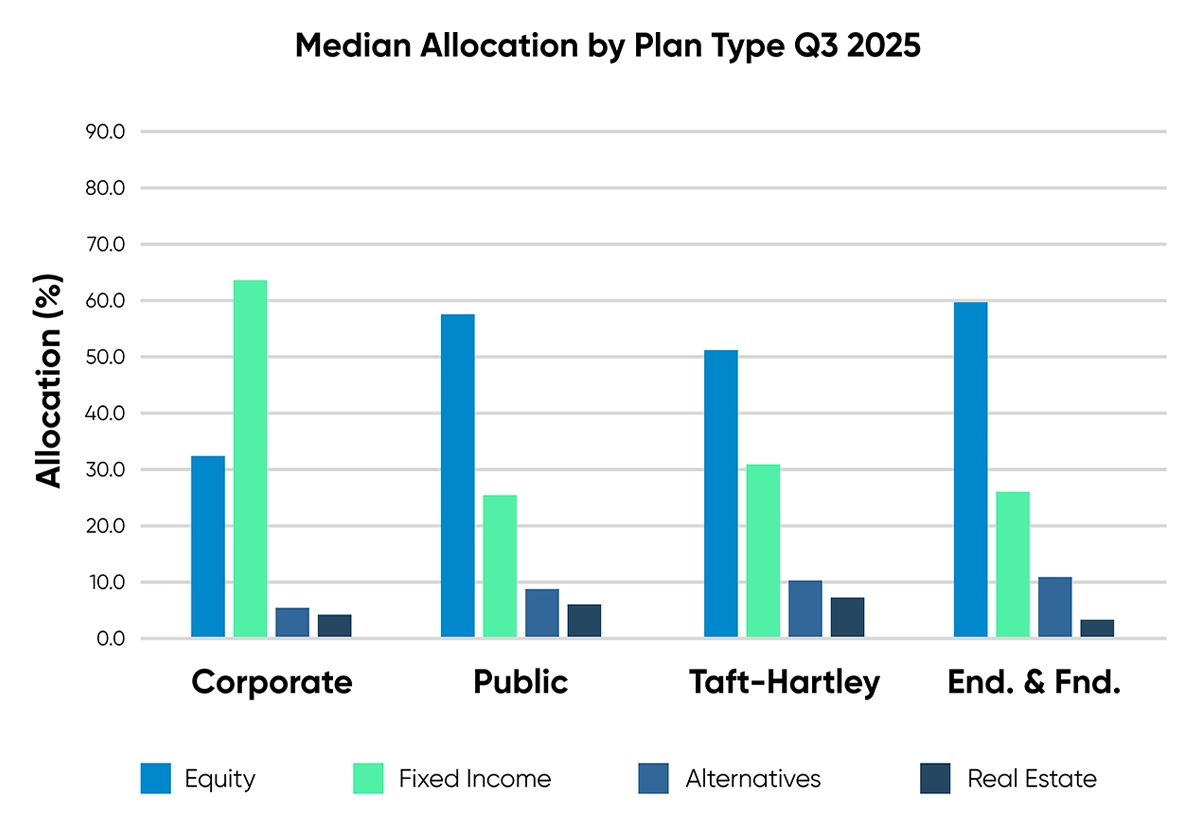

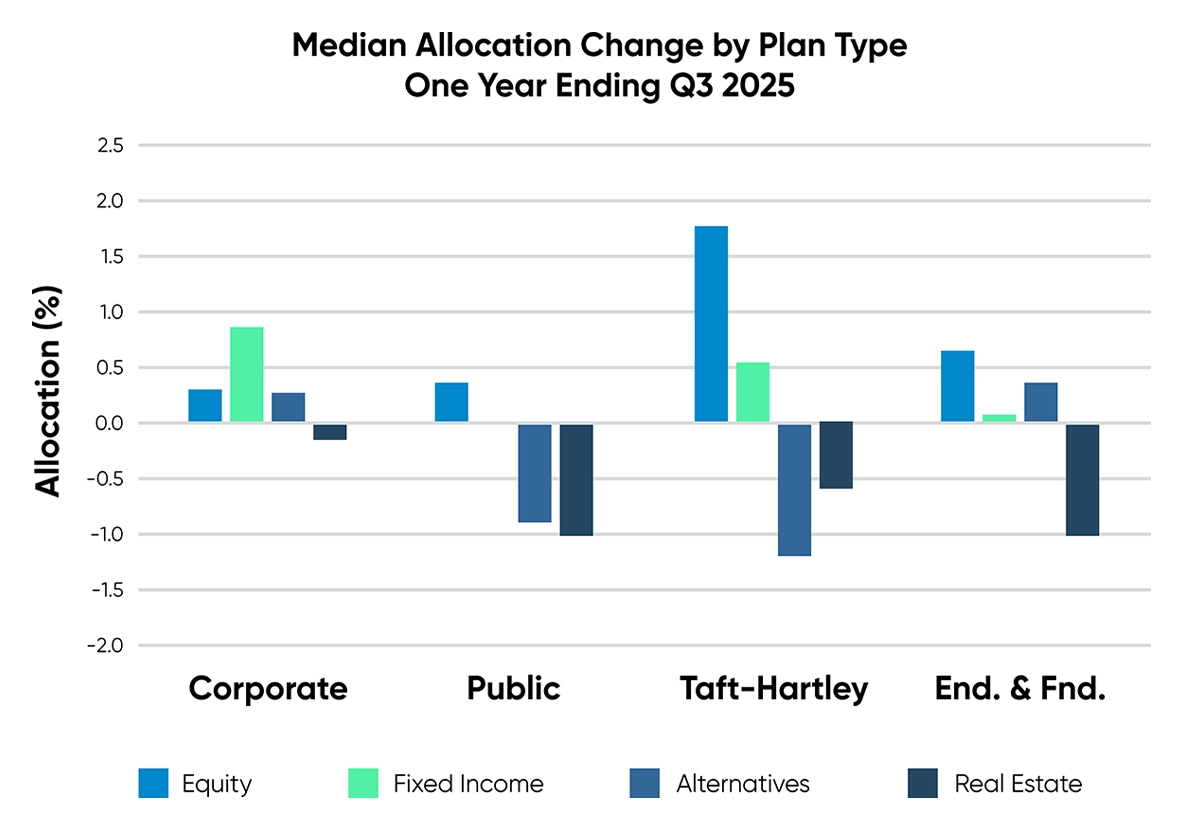

Corporate plans, which underperformed all other plan types for the quarter, continue to hold the largest allocation to fixed income. The median allocations to equity, the highest performing asset class, increased for all plan types over the last year. Allocations to Real Estate, the worst-performing asset class over the previous year with a median return of 2.94%, were down across all plan types by an average of .68%.

Source: Confluence

Source: Confluence

U.S. Equity Performance

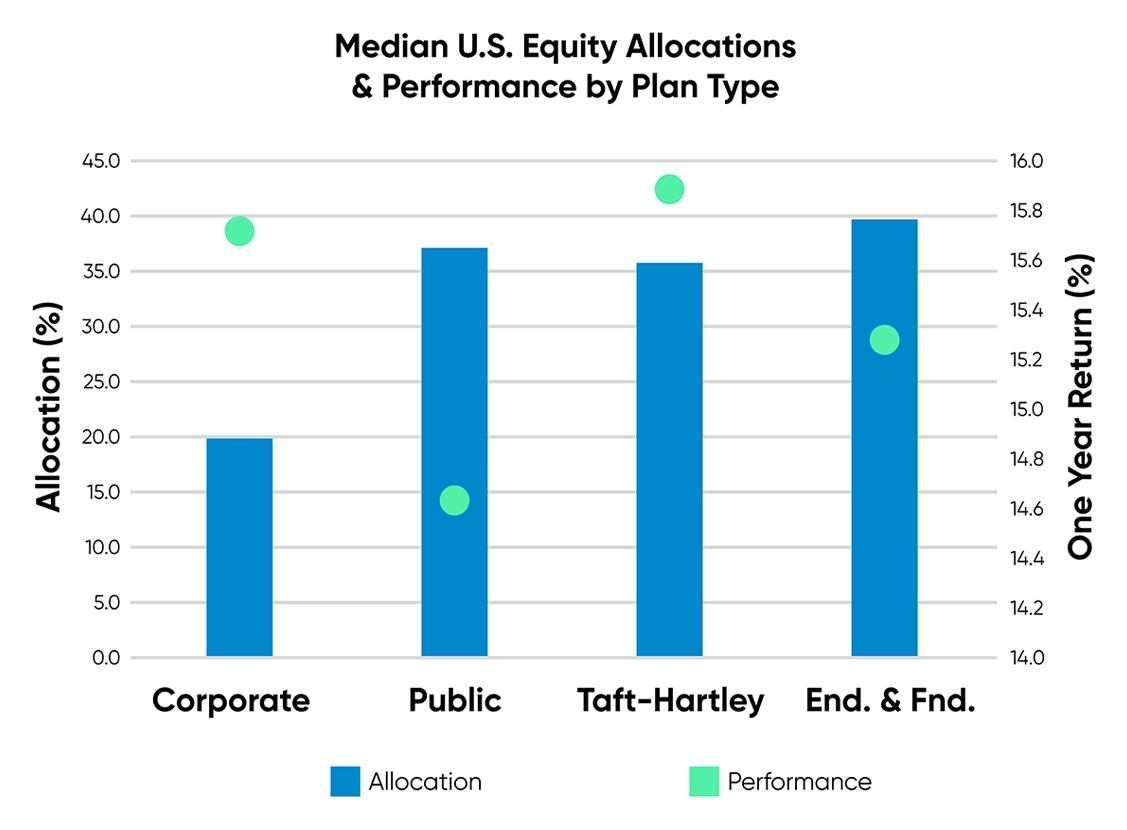

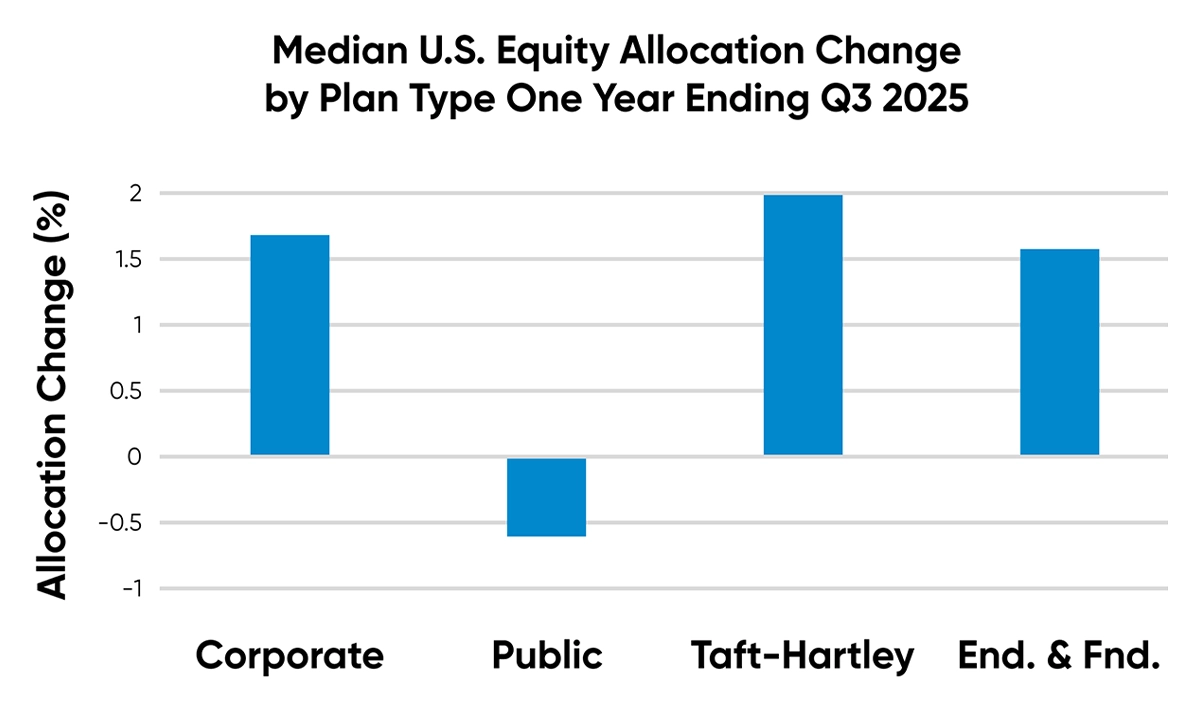

U.S. public equity markets delivered another strong quarter with the Russell 1000 Index returning 7.99%. Compared to the median U.S. equity return for all defined benefit plans, which was 7.71%, corporate plans continue to be underweight U.S. equity with a median allocation of 19.96%, nearly half of the allocation compared to other plan types. For the year ending June, all plan types, except public plans, have increased their allocation to U.S. equity.

Source: Confluence

Source: Confluence

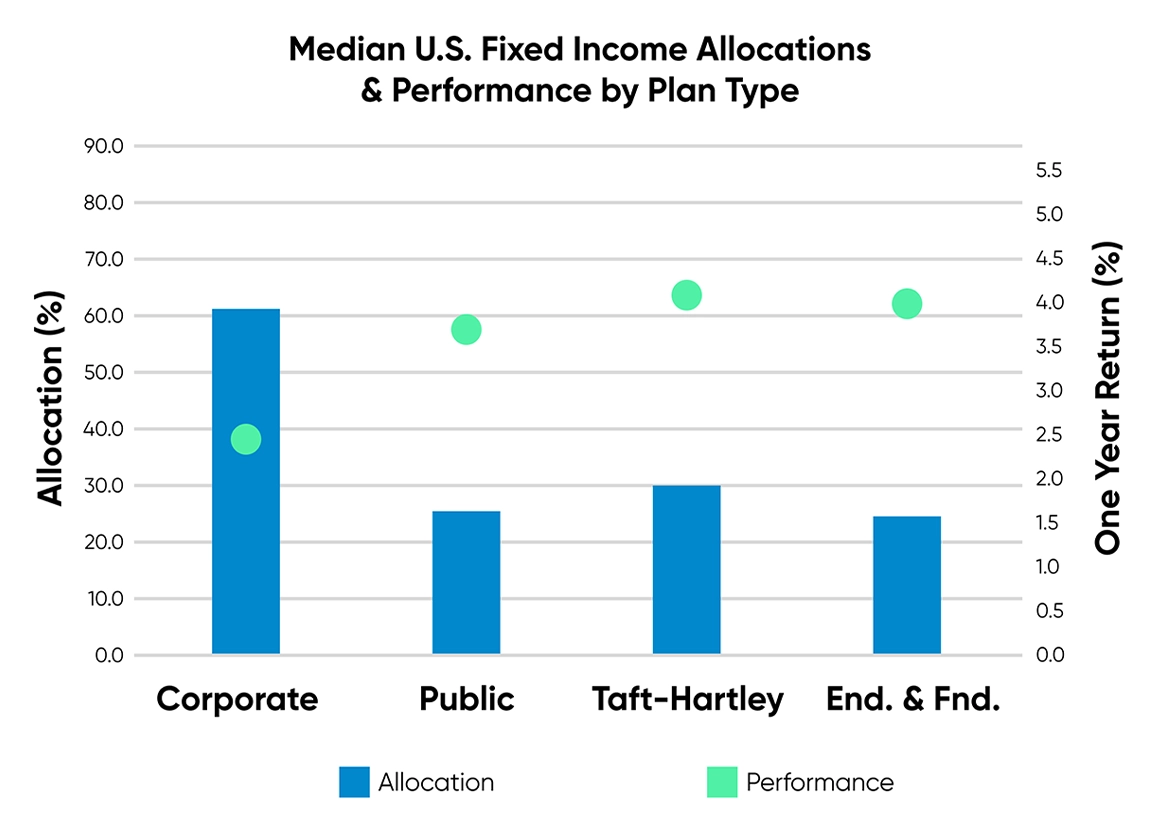

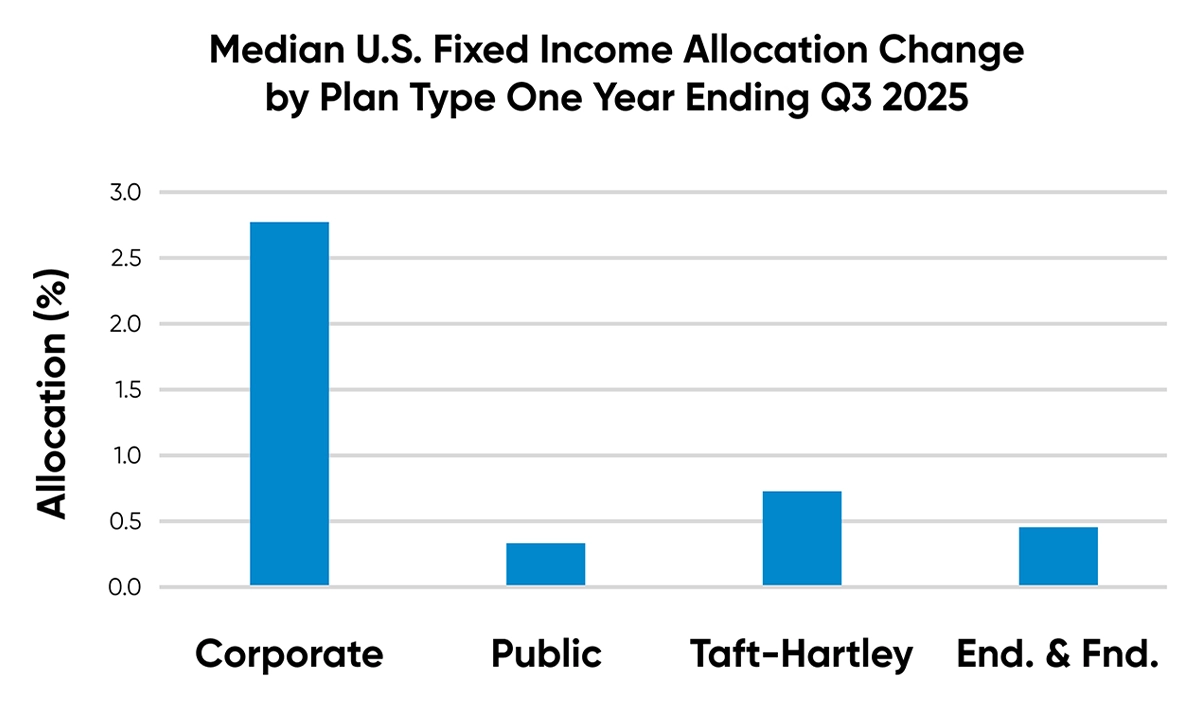

U.S. Fixed Income Performance

All plan types have increased their allocation to U.S. fixed income over the last year. Corporate plans, which have the highest allocation to the asset class at 61.5%, increased their allocation by 2.78% over the previous year.

Source: Confluence

Source: Confluence

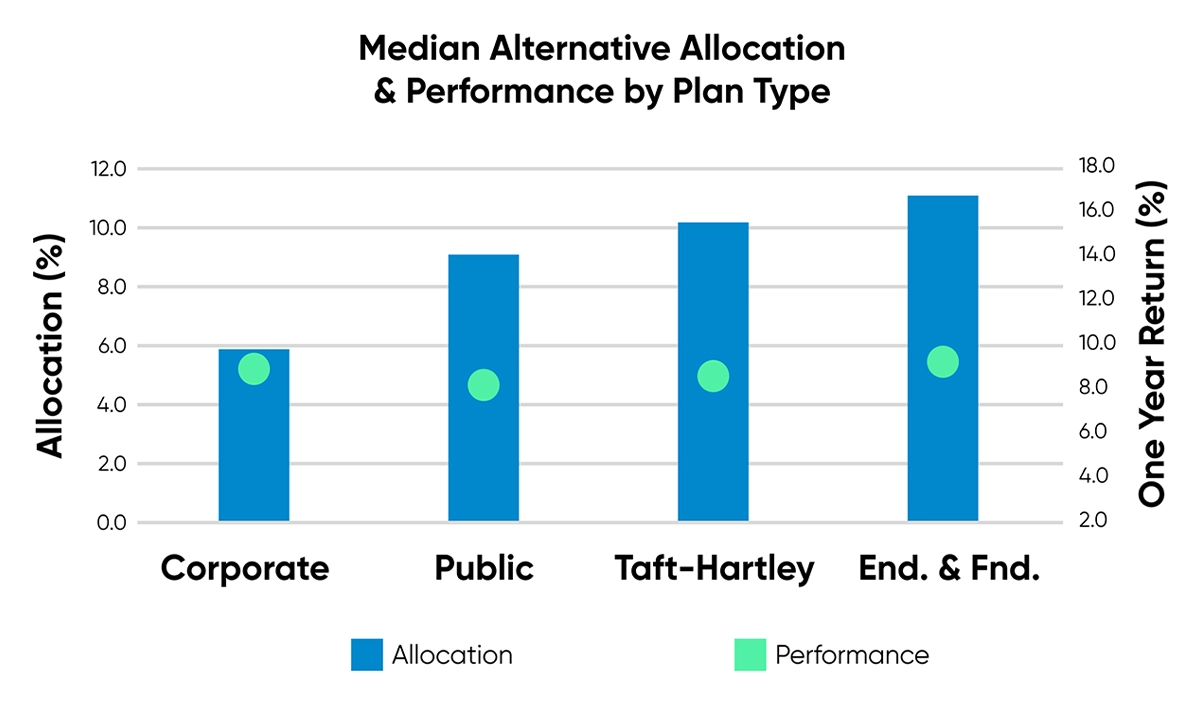

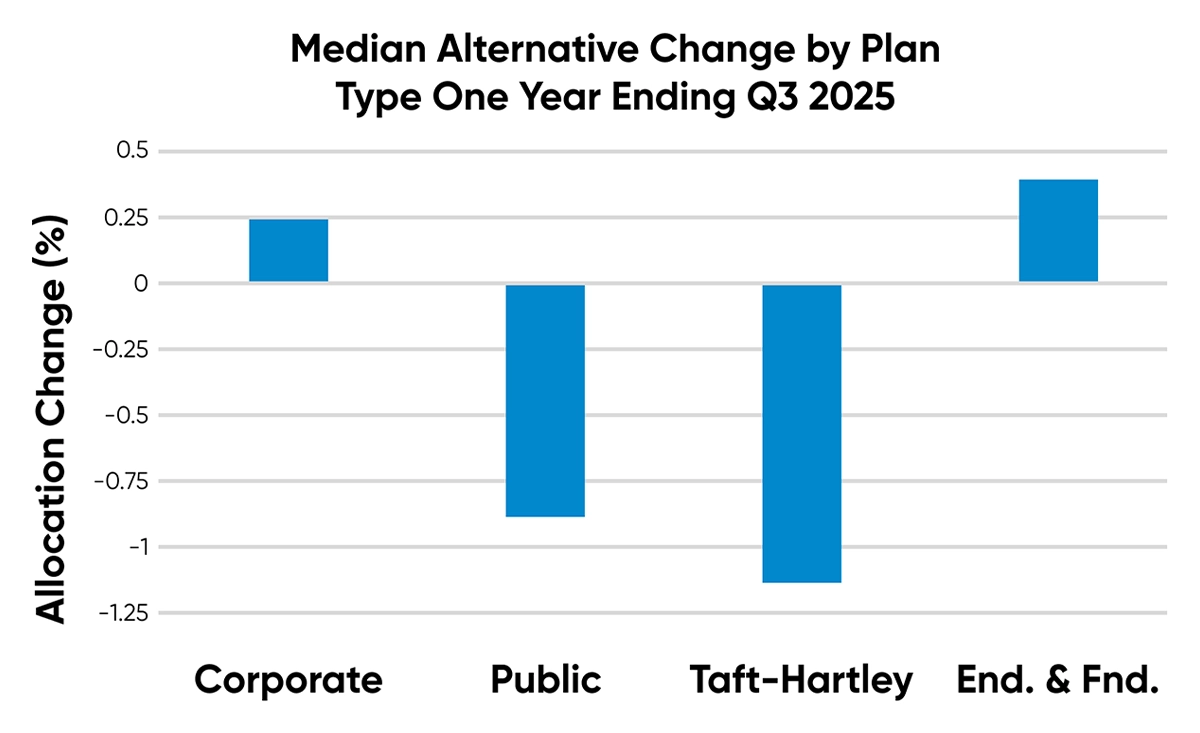

Alternatives Performance

Endowments & Foundations, which have the highest allocation to alternatives at 10.9%, had the highest performance and most significant increase in their exposure over the last year. Though corporate plans have increased their allocation to alternatives, they remain underweight comparatively.

Source: Confluence

Source: Confluence

Confluence Plan Universe

Confluence Plan Universe is the industry’s most granular analytics tool for plan sponsors, including standard and custom peer group comparisons of performance, risk, and asset allocations by plan type and size. The data is sourced directly from over 4,000 institutions using our reporting and analytics solutions, including investment consultants, advisors, and asset owners. Plan Universe is updated quarterly and typically available on or near the following schedule: preliminary data are available on the 14th business day after quarter-end, a second cut on the 21st business day, and a final cut on the 29th business day. The data includes 20+ years’ history on:

- Trust Funds, Corporates, Public Plans, Taft-Hartley, Endowments & Foundations, High Net Worth, Health & Welfare, and custom groups.

- Asset Allocations broken into equity (US, global, global ex-US), fixed income (US, global, and global ex-US), alternatives, real estate (public and private), multi-asset and cash. Emerging Markets allocations are available for equities and debt securities.

- Net and gross performances displayed by quartile with full percentiles via download.

- With all information aggregated by Plan Size.

Disclaimer

The content of this blog post is for general information purposes only and does not constitute legal, regulatory, financial, investment, or other professional advice. The information should not be relied upon as a substitute for specific advice tailored to particular circumstances. Readers should seek advice from appropriately qualified professionals before taking or refraining from any action based on the content of this blog. This blog post is not intended to market or sell any financial instrument and should not be interpreted as an invitation or inducement to engage in investment activities.Unless otherwise stated, Confluence Technologies, Inc. (or the relevant group entity) owns the copyright and all related intellectual property rights in the content of this blog post, including but not limited to database rights, trademarks, registered trademarks, service marks, and logos.

No part of this content may be adapted, modified, reproduced, republished, uploaded, posted, broadcast, or transmitted to third parties for commercial purposes without prior written consent.