Q3 2025

Preliminary Plan

Universe Performance

Global equity markets posted strong performance in Q3 2025,

led by continued excitement around AI.

October 21, 2025

by:

Plan Performance

Global equity markets posted strong performance in Q3 2025, led by continued excitement around AI (Artificial Intelligence) and a 25-basis point rate cut by the U.S. Federal Reserve. U.S. equities were led by growth stocks, with the Russell 1000 Growth Index returning 10.50%. A weakening U.S. dollar combined with the monetary easing also boosted emerging markets, with the MSCI Emerging Markets Index returning 10.95% for the quarter. Within fixed income, the U.S. Bloomberg Aggregate Index returned 2.03% for the quarter, while the Bloomberg U.S. Long Treasury Index returned 2.49%.

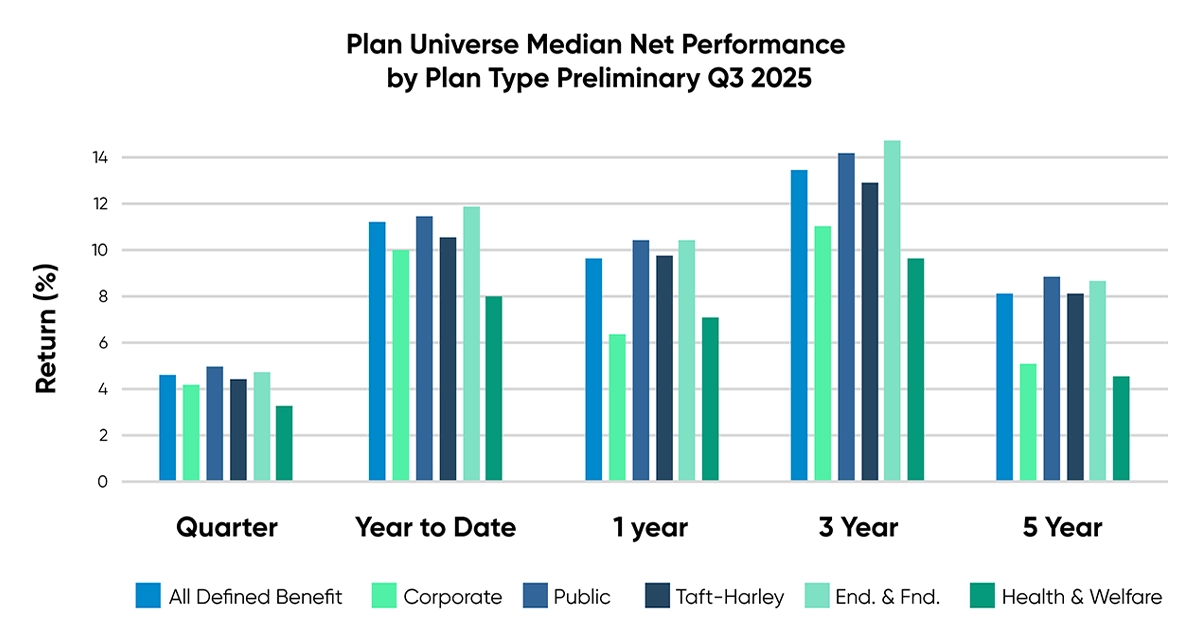

The Confluence All Defined Benefit Plan Sponsor Universe posted a median net return of 4.59% for the quarter. All plan types underperformed a traditional 60/40 benchmark return of 5.43%. (60% MSCI ACWI Index/ 40% Bloomberg Barclays U.S. Aggregate Index).

All Defined Benefit: 570, Corporate: 110, Public: 276, Taft-Hartley: 130, End. & Fnd: 783, Health & Welfare: 129

Figure 1: Preliminary median performance by plan type, Q3 2025.

Source: Confluence Plan Universe

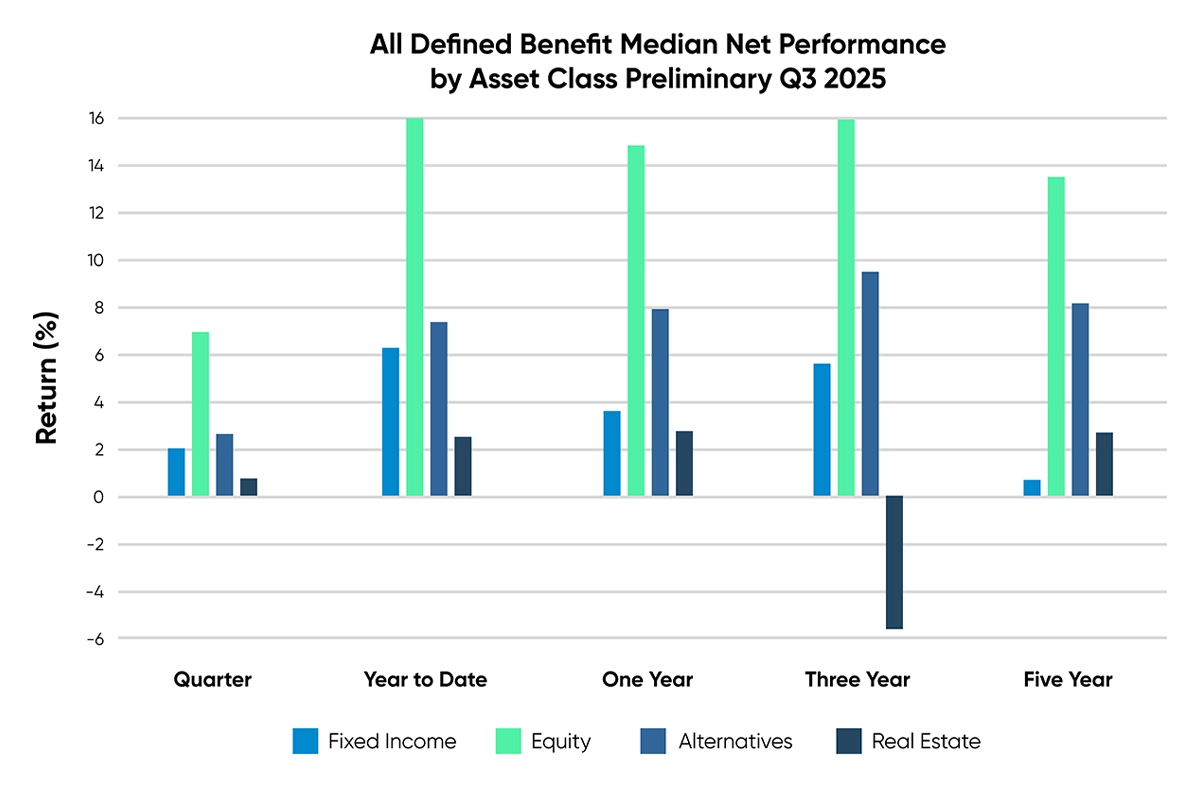

Public Plans and Endowment & Foundations had the best performance for the quarter and year to date, driven by their higher exposures to equity, which was the best performing asset class. As Figure 2 highlights, the median equity return across all defined benefit plans for the quarter was 7.05%, outperforming all other asset classes by at least 4%. Corporate and Health & Welfare plans posted the weakest returns for quarter. As previously noted, Corporate and Health & Welfare plans have significantly higher exposures to fixed income.

Figure 2: Preliminary median performance by asset class, Q3 2025.

Source: Confluence Plan Universe

Confluence Plan Universe

Confluence Plan Universe is the industry’s most granular analytics tool for plan sponsors including standard and custom peer group comparisons of performance, risk, and asset allocations by plan type and size. The data is sourced directly from over 4,000 institutions using our reporting and analytics solutions, including investment consultants, advisors, and asset owners. Plan Universe is updated quarterly and typically available on or near the following schedule: preliminary data available on the 14th business day after quarter end, a second cut on the 21st business day, and final cut on the 29th business day. The data includes 20+ years’ history on:

- Trust Funds, Corporates, Public Plans, Taft-Hartley, Endowments & Foundations, High Net Worth, Health & Welfare, and custom groups.

- Asset Allocations broken into equity (US, global, global ex-US), fixed income (US, global, and global ex-US), alternatives, real estate (public and private), multi-asset and cash. Emerging Markets allocations are available for equities and debt securities.

- Net and gross performances displayed by quartile with full percentiles via download.

- With all information aggregated by Plan Size.

Disclaimer

The content provided by Confluence Technologies, Inc. is for general informational purposes only and does not constitute legal, regulatory, financial, investment, or other professional advice. It should not be relied upon as a substitute for specific advice tailored to particular circumstances. Recipients should seek guidance from appropriately qualified professionals before making any decisions based on this content.

Unless otherwise stated, Confluence Technologies, Inc. (or the relevant group entity) owns the copyright and all related intellectual property rights in this material, including but not limited to database rights, trademarks, registered trademarks, service marks, and logos.

No part of this content may be adapted, modified, reproduced, republished, uploaded, posted, broadcast, or transmitted to third parties for commercial purposes without prior written consent.

In this article: