From Challenge to Advantage:

Rethinking Fund Positioning for Institutional Investors

Author:

Institutional investors are reshaping how they evaluate and choose funds — demanding greater transparency, evidence-based differentiation, and deeper insights into factor and ESG exposures. However, fund distribution and sales teams still encounter strategic and technical hurdles when positioning their products in this landscape. Identifying genuinely comparable funds, understanding how investors create shortlists, and demonstrating a fund’s unique value have become increasingly difficult tasks.

To tackle these issues, Style Analytics has created a factor-driven, customisable peer-analysis toolkit that goes beyond fixed style boxes and opaque risk metrics. By making factor exposures — including ESG, quality, and liquidity — transparent, and offering flexible cross-category peer discovery, the solution replaces static classification with dynamic, data-driven insight.

Benchmarking and differentiating a fund against its peers may seem simple, but traditional methods often obscure as much as they reveal. Long-established peer grouping tools and category systems can distort comparisons — a challenge that is becoming increasingly critical as institutions adopt more granular, factor-based approaches to selection.

The Challenges

Over-simplified fund categories

- Two funds in the same category can have significantly different mandates. For instance, a “Global Equity” fund might allocate 60% to U.S. equities, whereas another only invests 10% — yet both could be classified under the same fund category.

- Peer groups that do not accurately reflect a fund’s true investment universe can skew relative performance assessments. A strong fund may appear weak or vice versa, depending on the chosen comparison set.

- Defensive equity funds designed to minimise drawdowns are often benchmarked against high-beta peers that maximise equity exposure. Risk-adjusted metrics, such as the Sharpe or Sortino ratios, do not capture this mismatch, resulting in defensive strategies being ranked poorly despite meeting their stated objectives.

- Unique strategies are frequently “shoehorned” into inappropriate categories, leaving them as outliers, which undermines distribution opportunities and confuses investors.

- Oversimplification also obscures significant exposure differences, masking concentration risks or duplications across strategies.

Insufficient strategy detail

- Institutional allocators are increasingly demanding insight into deeper characteristics — such as ESG tilts, factor exposures, active share, and style biases. Common fund database solutions do not always capture or analyse these dimensions effectively. Their reliance on opaque risk models and crude style classifications often obscures the true nature of a strategy. Reported measures of volatility, beta, or VaR are typically derived from black-box methodologies that offer little transparency into whether risk stems from market beta, factor tilts, sector concentrations, or derivative exposures, leaving sales teams struggling to reconcile database snapshots with their own risk analysis.

- At the same time, the simplicity of style boxes diminishes the nuance of modern portfolio construction, grouping defensive, ESG-integrated, factor-driven, or low-volatility strategies with aggressive peers in ways that distort peer comparisons. Databases also tend to underrepresent increasingly important differentiators such as ESG characteristics, active share, portfolio concentration, liquidity risk, and factor exposures — precisely the dimensions institutional allocators are most eager to evaluate. The result is that nuanced strategies often appear “plain vanilla” in screening tools, forcing distribution teams to dedicate significant effort to correcting misconceptions and articulating a fund’s true value proposition.

Lack of transparency in the selection criteria

- Even when fund databases provide broad coverage, sales teams often face a deeper challenge: understanding the actual — and often opaque — selection filters used by institutional investors and consultants. Screening models vary widely among allocators, with some employing hidden parameters such as clean share classes, specific volatility bands, minimum track records, or ESG exclusions. As a result, a fund may seem qualified in one consultant’s analysis but remain invisible in another’s. Without visibility into these differing filters, distribution teams risk targeting the wrong peer groups or misjudging competitive positioning. The disconnect between how institutions screen funds and how managers present them creates inefficiency and missed opportunities. To engage meaningfully, sales professionals need tools that make these implicit criteria explicit — enabling them to mirror institutional selection logic and tailor fund narratives to the parameters that actually drive shortlisting.

Operational constraints

- Compounding these challenges are operational realities within asset management firms. Even when relevant insights are available, sales teams often lack the time, analytical resources, or integrated systems to turn data into persuasive stories. Manual peer analysis and spreadsheet comparisons consume valuable hours yet still fail to provide the clarity consultants require. Collaboration between product, data, and distribution teams can be inconsistent, leading to fragmented narratives and duplicated efforts. This operational strain means that differentiation is not just about having better data — it’s about efficiency and effective communication. Without a streamlined process to produce credible peer insights and visually engaging materials, even strong products can struggle to cut through consultant scrutiny and secure institutional mandates.

The Evolving Demands on Fund Positioning

Institutional sales teams now face unprecedented pressures. Increasing regulatory scrutiny, ESG integration requirements, and fee compression mean investors want more than just broad category comparisons — they seek clear, evidence-backed distinctions that demonstrate how a fund adds value to their portfolio. Traditional peer analysis frameworks, which rely on static categories and past performance metrics, no longer satisfy these expectations.

In reality, sales teams usually begin by outlining a fund’s basic features — style, category, AUM, fees, and track record — before benchmarking risk and performance against a selected peer group. However, this method often reinforces outdated classifications rather than uncovering actual competitive advantages. A label like "Global Equity" or a three-year return ranking tells little about why a strategy performs as it does or how its exposures fit into an institutional portfolio.

The real challenge, therefore, lies not in accessing data but in converting it into a compelling narrative. Institutional investors are bombarded with presentations; what truly resonates are stories that simplify complexity. Visuals that translate factor exposures, ESG tilts, or concentration levels into straightforward, investor-relevant insights enable sales teams to communicate confidently and credibly. Moving from raw data to strategic storytelling is what now separates effective fund positioning from mere functionality.

From Style Boxes to Factor Stories:

The Style Analytics Edge

Style Analytics, a specialist in equity factor research, has developed a factor similarity module called Similyzer that reduces hours of peer research into minutes.

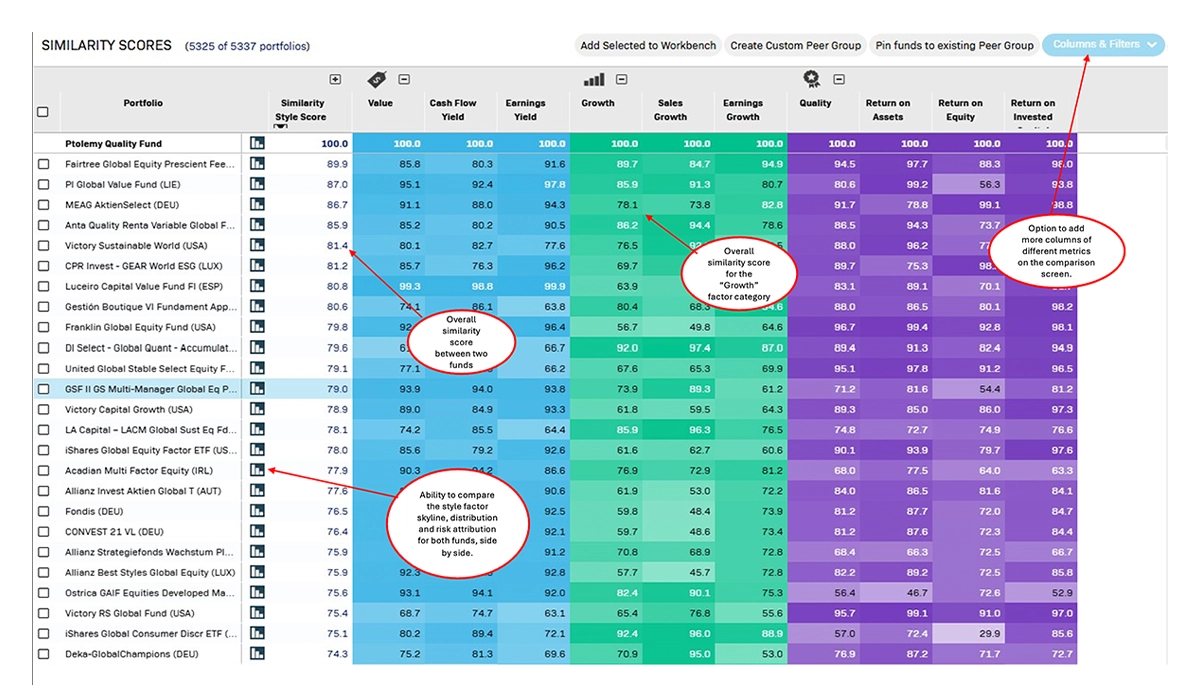

The key advantage of the module is the ability to perform similarity analysis across user-selected factors, not just within pre-defined fund categories. Instead of relying on classification systems that may be outdated or arbitrary, users can define their own factors to drive comparisons across the entire Morningstar oneVestment databases.

For example, a fund with favourable tilts to Value, Growth, and Quality factors may be labelled “Large Cap Blend” by Morningstar. By running a peer group analysis within this category, users, by default, accept the factors used by Morningstar’s classification model. With Style’s Similyzer tool, users can instead construct a peer analysis based on factors such as those used in our example, including Earnings Yield, Cash Flow Yield, Sales Growth, Earnings Growth, Return on Equity, Return on Invested Capital, and Return on Assets.

Figure 1: Style Analytics Similyzer Peer Analysis

This analysis avoids outdated definitions of “Value” or “Growth.” Drawing on a library of 136 distinct equity factors, users can define their own benchmarks, timeframes, and metrics, with similarity scores (0–100) displayed across individual factors, factor groups, and overall fund profiles. The factor library is continuously updated to reflect market changes, incorporating new academic research, practitioner insights, and emerging ESG frameworks. This ensures that sales teams stay aligned with modern investment styles and regulatory developments, equipped with a dynamic, future-proof toolkit for accurate and adaptable peer comparison.

From Data to Dialogue: Transforming Peer Analysis into Strategic Storytelling

What distinguishes factor-based peer analysis is not just its analytical precision but also its ability to reshape conversations with institutional investors. Instead of reacting to predefined fund categories, sales teams can proactively frame how their strategy contributes to an investor’s broader objectives—such as factor diversification, risk control, or ESG alignment.

By uncovering peers that share similar factor signatures, even across different Morningstar or eVestment categories, distribution professionals can anticipate investor comparisons and position their fund within the proper strategic context. Analysis that once took hours can now be generated in minutes, allowing teams to focus more on engagement and narrative refinement.

The actual breakthrough lies in communication. Complex data becomes clear, defensible storytelling—grounded in transparent metrics, visualised through intuitive similarity grids and skyline charts, and aligned with the language institutions actually use. This shift in fund positioning from descriptive (“what we are”) to consultative (“how we fit your portfolio”) enhances credibility and increases the likelihood of mandate success.

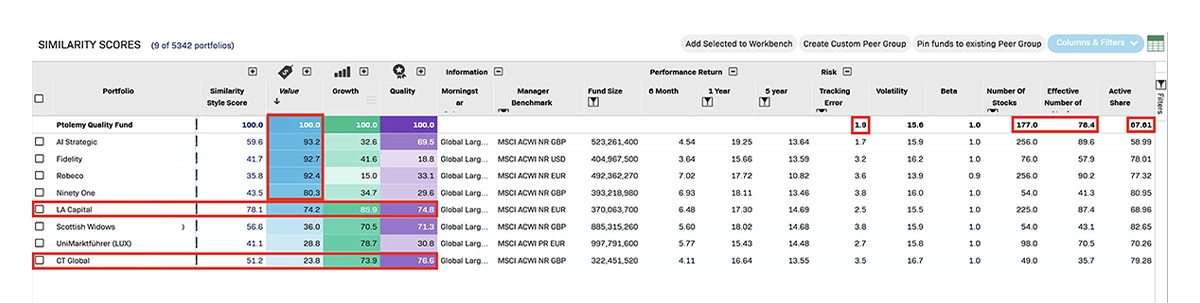

For instance, in our example, we applied the following filters:

- Fund size $300m–$1bn

- One-year return > 15%

- Five-year return > 10%

- Tracking error < 5%

- Fewer than 500 holdings

From over 5,000 funds, the process quickly narrowed to a shortlist of eight:

Figure 2: Style Analytics Similyzer Peer Analysis Filtered

Based on the above analysis, we can highlight insights such as:

- The top four similarity peers for Value were not similar on Growth or Quality factors.

- Some of the most similar funds belong to a different Morningstar category.

- Our example fund had the second-lowest tracking error and second-lowest active share, while showing the lowest concentration ratio among funds with 100+ holdings.

- Results can be exported into Style’s Peer Group module for deeper skyline analysis and into striking visual formats for reports, presentations, and client pitches.

Redefining Peer Analysis as a Strategic Advantage

As institutional investors demand deeper transparency and alignment with portfolio objectives, traditional fund categories and risk metrics have reached their limits. Fixed-style boxes obscure nuance, while legacy peer definitions fail to capture the complexity of modern, multifactor strategies.

Factor-based peer analysis represents the next evolution — one that empowers sales teams to view their products through the lens of investors. By moving beyond rigid classifications and embracing flexible, transparent factor definitions, managers can surface hidden peers, anticipate investor questions, and demonstrate differentiation with precision and confidence.

The result is not merely faster analysis, but a strategic shift in how funds are positioned and understood. In a landscape where institutional selection depends increasingly on data clarity and portfolio relevance, the ability to tell a compelling, factor-grounded story has become a competitive advantage in its own right.

Fund Sales Challenges vs. Style Analytics Similyzer Solutions

| Sales Team Challenge | How Style Analytics Helps |

|---|---|

| Over-simplified categories from fund data aggregators: funds with very different mandates get lumped together, obscuring differentiation and creating misleading peer groups. | Custom factor-based similarity analysis: users select from 136 factors (Value, Growth, Quality, ESG, etc.) to define their own peer groups across the entire Morningstar or eVestment database. |

| Insufficient strategy detail: traditional databases often miss deeper insights (ESG tilts, factor exposures, concentration, active share). | Granular factor and ESG analysis: Style’s Similyzer captures subtle portfolio tilts and style biases, enabling precise comparisons beyond what categories alone reveal. |

| Opaque institutional selection criteria: investors and consultants apply proprietary, often hidden filters (track record, share class, volatility bands, clean fees). | Customisable and transparent screening filters: users can apply institution-like criteria (AUM, track record, share class type, risk metrics) to identify the most relevant competitor set. |

| Competitive intelligence gaps: limited visibility into which peer funds and institutions are shortlisting; difficult to anticipate competition outside categories. | Cross-category peer discovery: identify similar funds that might sit in other Morningstar categories but are real competitors in factor space. |

| Operational constraints: sales teams lack time, resources, and integrated tools to produce compelling, data-driven materials. | Automation + presentation-ready visuals: analysis that once took hours now takes minutes, with exportable, striking graphics for pitchbooks and consultant-facing decks. |

| Difficulty communicating differentiation: complex data doesn’t translate easily into marketing or client conversations. | Intuitive UX & clear outputs: results presented as similarity scores and skyline charts, ready to demonstrate competitive strengths in a compelling narrative. |

Disclaimer

The content provided by Confluence Technologies, Inc. is for general informational purposes only and does not constitute legal, regulatory, financial, investment, or other professional advice. It should not be relied upon as a substitute for specific advice tailored to particular circumstances. Recipients should seek guidance from appropriately qualified professionals before making any decisions based on this content.

Unless otherwise stated, Confluence Technologies, Inc. (or the relevant group entity) owns the copyright and all related intellectual property rights in this material, including but not limited to database rights, trademarks, registered trademarks, service marks, and logos.

No part of this content may be adapted, modified, reproduced, republished, uploaded, posted, broadcast, or transmitted to third parties for commercial purposes without prior written consent.

About Confluence

Confluence is a global leader in enterprise data and software solutions for regulatory, analytics, and investor communications. Our best-of-breed solutions make it easy and fast to create, share, and operationalize mission-critical reporting and actionable insights essential to the investment management industry. Trusted for over 30 years by the largest asset service providers, asset managers, asset owners, and investment consultants worldwide, our global team of regulatory and analytics experts delivers forward-looking innovations and market-leading solutions, adding efficiency, speed, and accuracy to everything we do. Headquartered in Pittsburgh, PA, with 700+ employees across North America, the United Kingdom, Europe, South Africa, and Australia, Confluence services over 1,000 clients in more than 40 countries.

For more information, visit confluence.com

You may also like: