Stablecoins: Bridging volatility and stability in the digital asset space

Prepared by:

What are Stablecoins?

Stablecoins are a specialized type of cryptocurrency designed to maintain a stable value by being pegged to a less volatile reference asset, usually a flat currency like the U.S. dollar (USD), short-term treasuries, or even commodities like gold. Unlike traditional cryptocurrencies that often experience dramatic price fluctuations, stablecoins aim to maintain a consistent value, making them well-suited for everyday transactions, and as a reliable digital store of value, providing crypto benefits while minimizing the risks of price fluctuations.

Uncovering the relationship between Stablecoins and U.S. treasuries

One of the most significant external factors influencing the prices of cryptocurrencies like Stablecoins is the U.S. Dollar Index (DXY) and short-term treasuries. Stablecoins now hold hundreds of billions of dollars in Treasury bills; with the vast sums held in Treasury bills, their inflows and outflows have the power to sway short-term yields, reshape liquidity dynamics, and challenge Treasuries’ role as a financial haven.

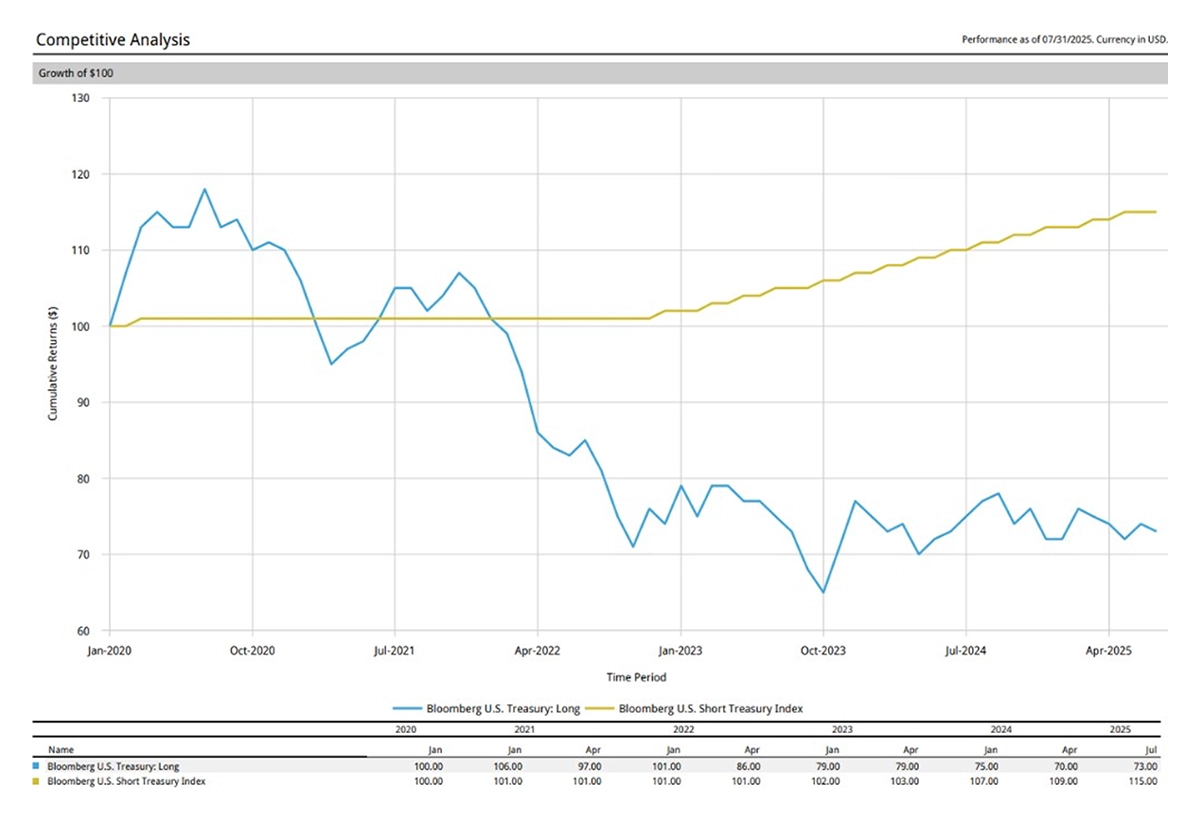

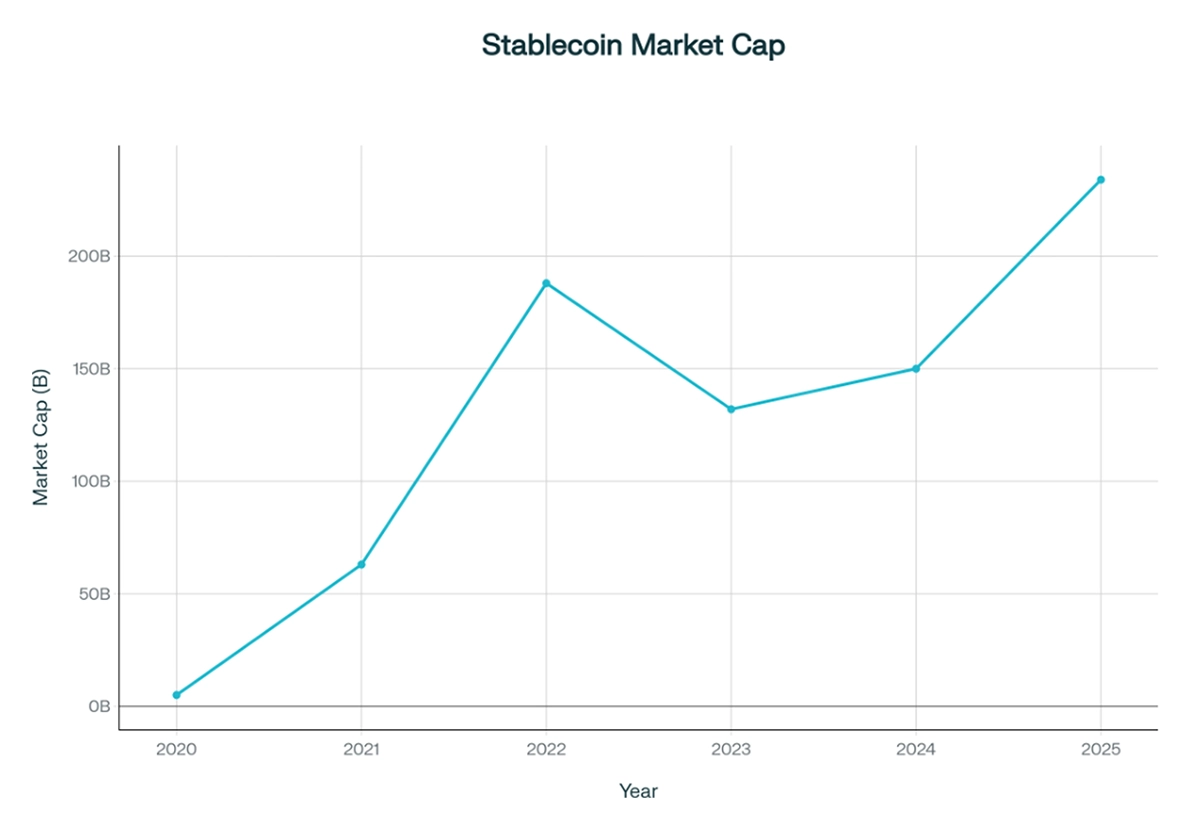

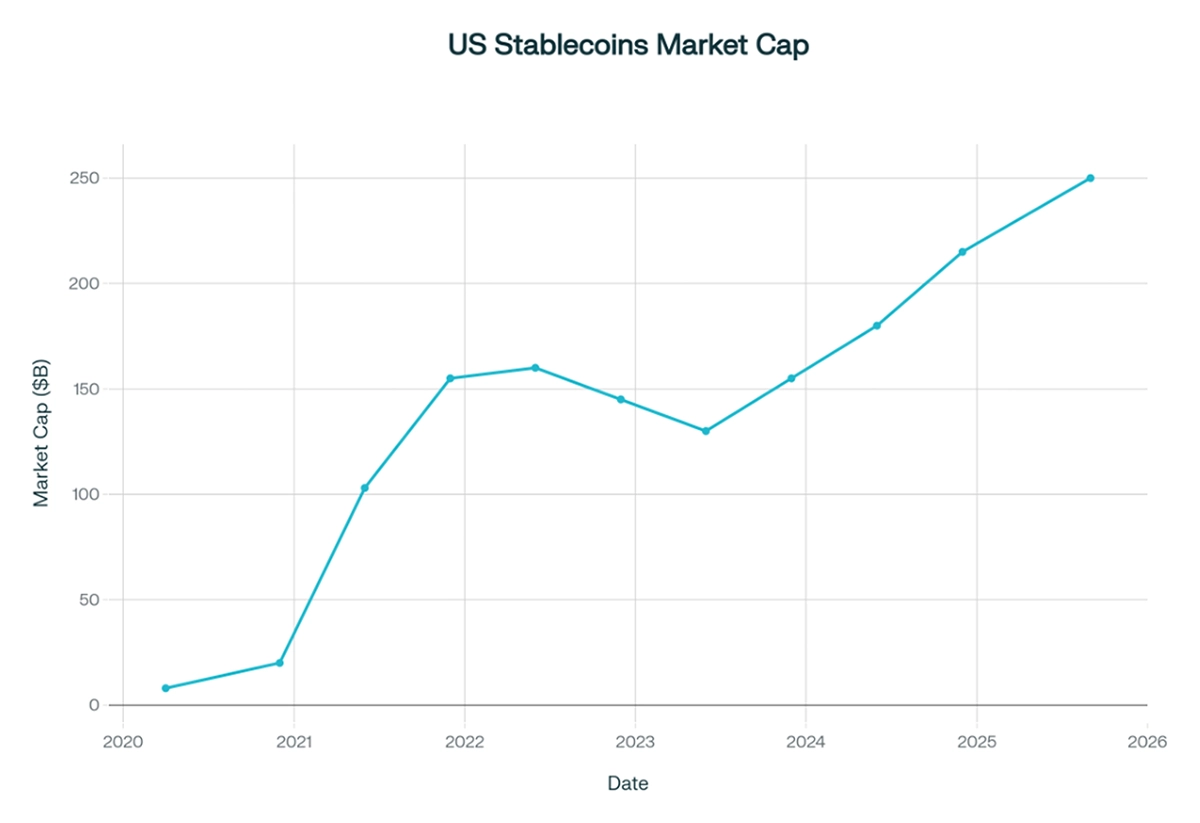

The charts below illustrate that since 2022, the composition of collateral backing stablecoins has shifted significantly. The sharp rise in stablecoin growth during this period is closely tied to the improved performance of short-term U.S. Treasuries, marked by higher yields and enhanced liquidity, which stablecoin issuers rely on as primary reserve assets. Most stablecoins maintain their dollar peg by investing heavily in short-term U.S. Treasury bills, typically with maturities of less than 93 days, valued for their safety, liquidity, and reliable returns. As yields in stablecoins began rising early, these assets became more attractive, enabling issuers to strengthen their collateral base and making these cryptocurrencies more appealing to investors and businesses seeking stability and on-demand dollar access. This dynamic has created a positive feedback loop: higher Treasury yields attract capital into stablecoins for low-risk yield and liquidity, while rising stablecoin demand boosts institutional appetite for short-term Treasury issuance.

Figure 1: Prism, Confluence Technologies

Figure 2: Treasury

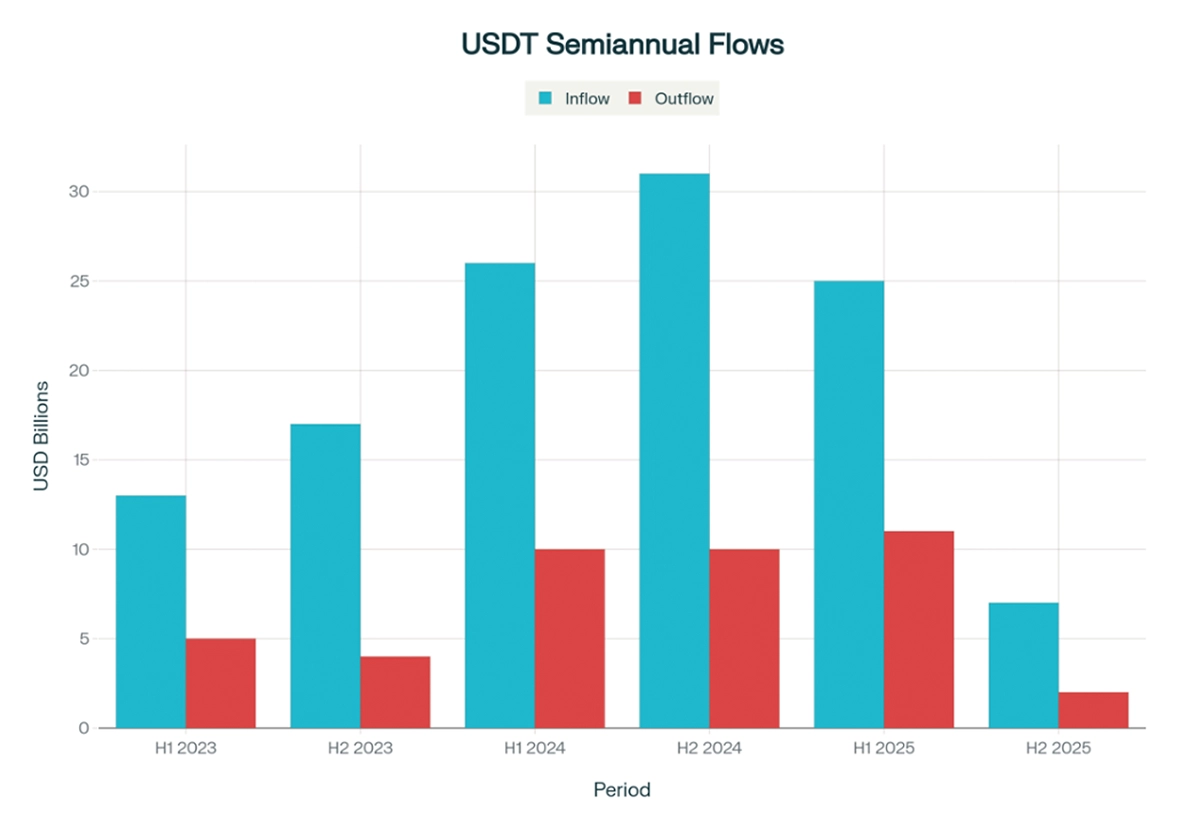

How tether reflects shifts in

U.S. treasury yields

Taking Tether (USDT) as an example – a stablecoin backed by approximately 70% short-term U.S. Treasuries and cash reserves - distinct spikes in inflows were observed in late 2024 and early 2025, each driven by different factors. As illustrated in figure 3 and 4 below, the first half of 2024 surge in inflows was backed by the elevated yields on short-term Treasuries, making USDT more attractive to investors seeking stable, yield-generating digital assets. As stablecoin inflows rose sharply, they began exerting downward pressure on short-term Treasury yields, alongside broader macroeconomic forces. This shift contributed to a subsequent decline in USDT inflows and an increase in outflows following the earlier surge.

Figure 3: US Treasury digital Money

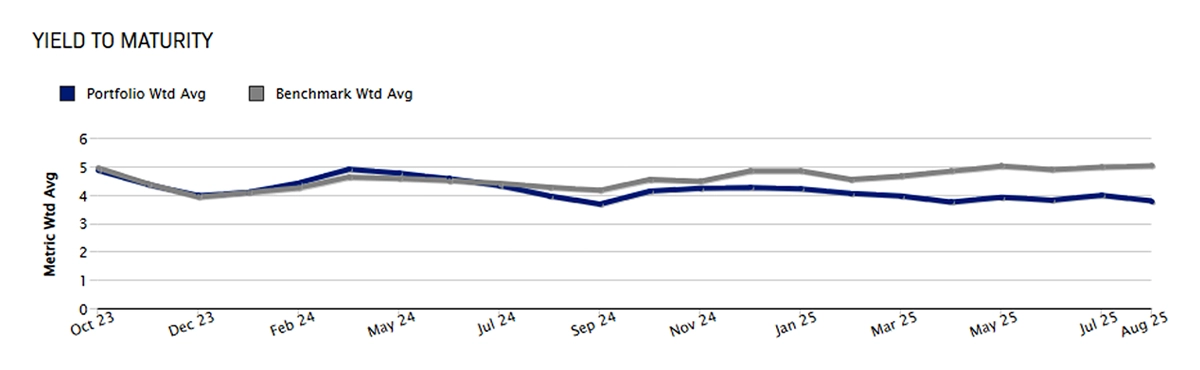

The following charts from Style Analytics Fixed Income present Yield to Maturity trails in the months from 2020 to 2025, reflecting the movements in short term treasury in the months leading up to and following the 2024 spike They highlight the favorable short-term Treasury yields that contributed to the surge and the subsequent decline in yields that coincided with the drop in inflows.

Figure 4: Style Analytics Fixed Income, Confluence Technologies

Portfolio composition: 52%. Short-term treasuries, 13% gold financial product, and 35% cash Benchmark iShares: 25+ Year Treasury STRIPS Bond ETF

When stocks shake: Stablecoins’ role amid equity market turmoil

Stablecoin market cap tends to reflect an inverse relationship with equity market volatility. In periods of heightened stock market turbulence, when highly volatile equities see sharp losses or dramatic swings, investors often look for safer and more liquid places to move their money, turning to stablecoins.

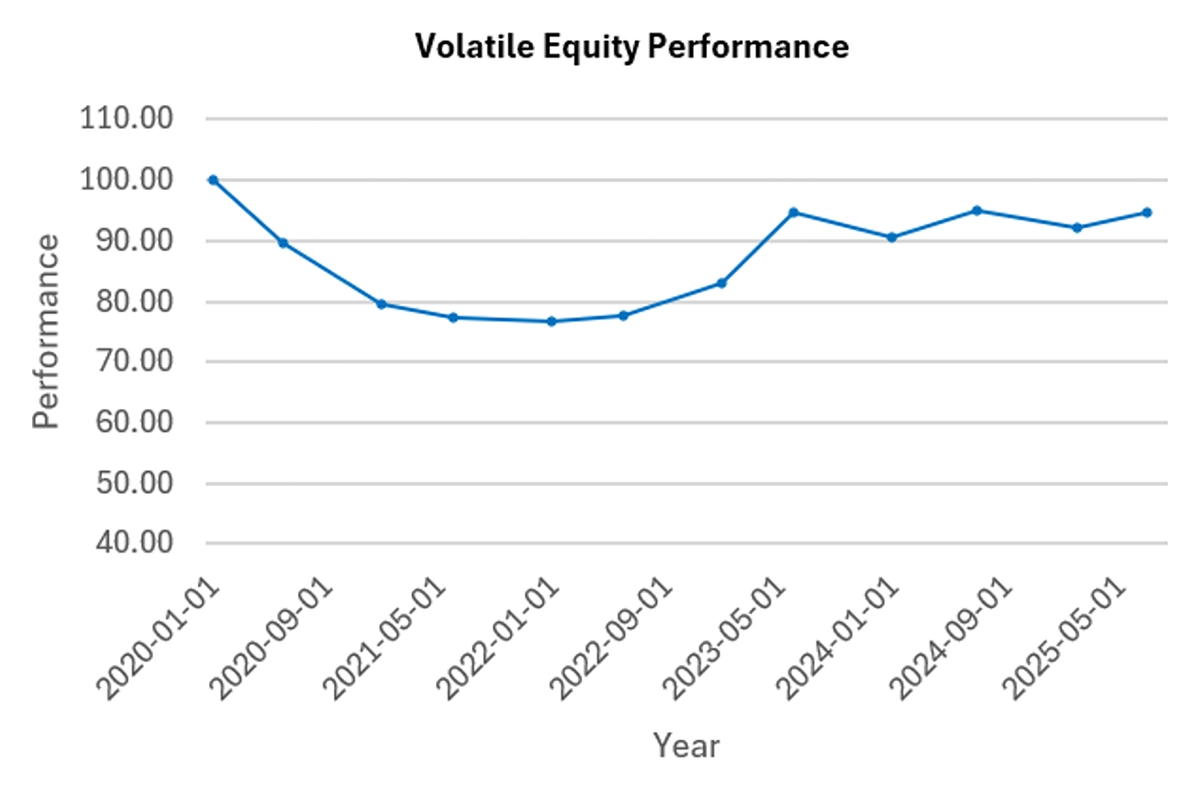

These digital assets, pegged to the U.S. dollar and short-term treasuries, are perceived as stable and accessible alternatives during times of risk aversion. As a result, rising equity market volatility often coincides with increased demand for stablecoins, driving growth in their overall market cap. The charts below illustrate this, comparing the performance of high-volatility stocks (based on the 1-Year Volatility Factor) with stablecoin market cap growth since 2020.

Figure 6: Plan Universe, Confluence Technologies

Volatility equity performance chart is based on the performance of the top 75% stocks with Volatility 1 Year sub-factor, compared to the overall largest 600 companies of USA market.

Conclusion: Stablecoins and the volatility trade-off

Stablecoins have transitioned from niche instruments to essential components of the modern financial ecosystem, offering programmable, highly liquid, and globally accessible dollar-denominated value. Their growth is tightly tied to the structure and yield of short-term US Treasuries, which underpin stablecoin reserves and drive how attractive these tokens are for users seeking safety and dollar exposure. Periods of rising Treasury yields turbocharge stablecoin inflows and revenue for issuers; conversely, falling rates or dollar weakness have led to nuanced shifts in user preferences and inflows. To further strengthen the flight-to-stability dynamic, stablecoins consistently display safe-haven properties during high equity market volatility periods. During investor fear and high volatility, inflows to stablecoins surge as investors seek shelter from risk.

Appendix: How to read the charts

Volatility equity performance chart is based on the performance of the top 75% stocks with Volatility 1 Year sub-factor, compared to the overall largest 600 companies of USA market.

Disclaimer

The content provided by Confluence Technologies, Inc. is for general informational purposes only and does not constitute legal, regulatory, financial, investment, or other professional advice. It should not be relied upon as a substitute for specific advice tailored to particular circumstances. Recipients should seek guidance from appropriately qualified professionals before making any decisions based on this content.

Unless otherwise stated, Confluence Technologies, Inc. (or the relevant group entity) owns the copyright and all related intellectual property rights in this material, including but not limited to database rights, trademarks, registered trademarks, service marks, and logos.

No part of this content may be adapted, modified, reproduced, republished, uploaded, posted, broadcast, or transmitted to third parties for commercial purposes without prior written consent.

About Confluence

Confluence is a global leader in enterprise data and software solutions for regulatory, analytics, and investor communications. Our best-of-breed solutions make it easy and fast to create, share, and operationalize mission-critical reporting and actionable insights essential to the investment management industry. Trusted for over 30 years by the largest asset service providers, asset managers, asset owners, and investment consultants worldwide, our global team of regulatory and analytics experts delivers forward-looking innovations and market-leading solutions, adding efficiency, speed, and accuracy to everything we do. Headquartered in Pittsburgh, PA, with ~700 employees across North America, the United Kingdom, Europe, South Africa, and Australia, Confluence services over 1,000 clients in more than 40 countries.

For more information, visit confluence.com

You may also like: