Surviving Daunting Regulatory Exams:

Key Takeaways from Compliance Pros Who’ve Been There

Author:

Key Takeaways

- Regulatory exams are becoming more frequent and efficient, with remote and hybrid exams enabling better oversight.

- A strong compliance program should be built over time with tailored policies, timely testing, documentation, and consistent communication.

- Conducting mock exams helps firms identify gaps in their compliance programs and train employees for interviews.

- For a deeper dive, watch our webinar on demand at your convenience.

Regulatory Exams Are Faster, Smarter, and Still Coming

Coinciding with changes in regulatory priorities under new leadership, the SEC’s exam division remains active and committed to its risk-based approach, seeking to annually review approximately 10% of the 16,000 advisors servicing about $145 trillion in AUM. In addition, remote and hybrid exams are most common, enabling more frequent and efficient oversight.

When polled about the last time their firm was examined, 58% of our webinar respondents said they had never been examined or they hadn’t had an exam prior to 2020. If this applies to your firm, too, or your firm had findings in a recent exam, consider this your heads-up: the algorithms regulators use are actively monitoring firms.

Don’t Panic—Plan

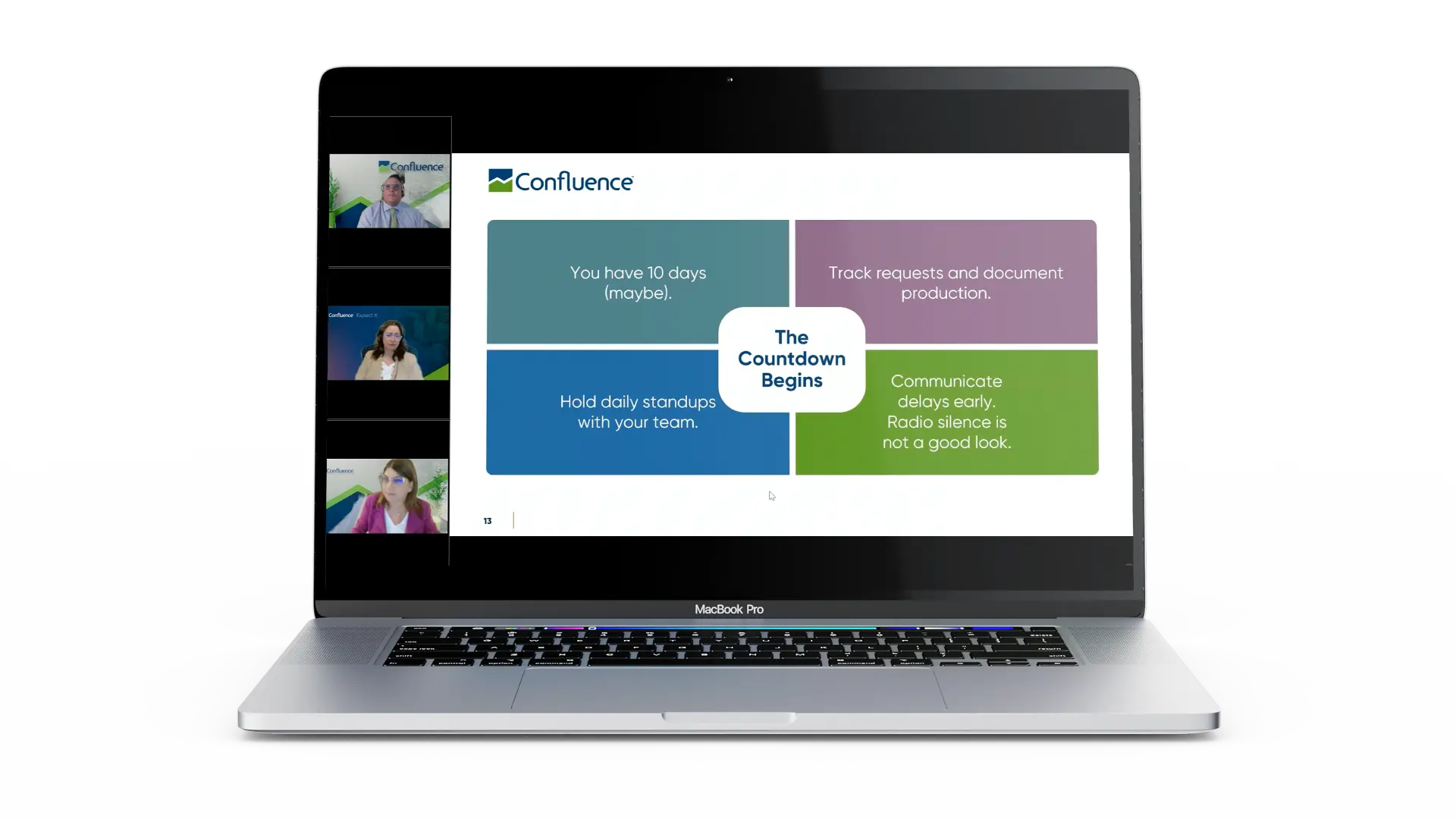

While stress is understandable, a structured response is essential. Notifying management, organizing your team, and starting a document tracker are mandatory. When asked about their biggest concern if selected for an exam in the next year, 43% of webinar respondents said the gaps between policy and practice, followed by fears about the unknown at 40%.

Be ready to clarify requests, assign document owners, and keep meticulous logs. If you make life easier for the examiners, you might make it easier for yourself. The opposite also holds true.

Opening Presentations Are a Strategic Opportunity

The opening day presentation tends to be a formality, but it’s also your chance to control the narrative. Use it to clearly explain your business model, introduce your team, explain your firm’s control environment, and preempt unnecessary lines of regulatory inquiry. Show examiners your firm understands its regulatory obligations and is committed to compliance. Demonstrating a strong tone at the top can be critical to successfully navigating the exam.

Interview Readiness Matters More Than You Think

Interviews with examiners can make or break your exam. Only about 20% of webinar respondents indicated that their teams are well-trained and battle-ready for interviews. The majority fell into the reasonably or mildly confident range, with 30% indicating they need more training and prep.

Get your employees organized and ready—especially those in operations, IT, trading, and portfolio management—to answer questions clearly and concisely. Stick to answering only what is asked, avoid speculation, and do not improvise. Silence is acceptable—rambling can undermine credibility. Also, know when to use your lifelines: your CCO, consultants, or lawyers. And most of all, stay calm. Take notes, require written follow-ups, and calmly ask for clarification.

The Exam Finish Line—and the Aftermath

You may receive verbal feedback or a preliminary readout at the end of the exam. Use this opportunity to clarify findings, present remediation efforts, and strengthen controls where needed to address the root causes of issues.

Don’t expect immediate closure or any guidance. Do anticipate follow-up requests and radio silence. Regardless of what happens next, ensure your responses are timely, thoughtful, and measurable.

Mock Exams Are the Ultimate Dress Rehearsal

Mock exams are increasingly critical for firms seeking to improve readiness. From managing document production to mastering interview techniques, mock exams help firms uncover gaps before they result in formal exam observations or deficiencies. Show a strong compliance commitment from the top of your organization, and build confidence before regulators knock on your door.

Just over 35% of attendees said they felt strongly confident their firm could handle an exam if it came tomorrow, tied with another 35% who said they were cautiously optimistic. Meanwhile, 26% said they were aware but concerned, and only about 3% admitted they were not at all prepared or confident. These numbers underscore the value of mock exams for stress-testing policies and procedures, and for boosting teamwide readiness and morale.

Staying Ready vs. Getting Ready

Regulators aren’t expecting perfection, but they do expect firms to know their obligations, follow sound procedures, and respond promptly to inquiries. Whether you’re newly registered or long overdue for an exam, the best way to prepare is to act like it could happen tomorrow, because the likelihood of an exam is always present.

Discover more

For more information, watch our webinar on demand or contact us to speak in person about your mock exam and compliance readiness needs.

Disclaimer

The content provided by Confluence Technologies, Inc. is for general informational purposes only and does not constitute legal, regulatory, financial, investment, or other professional advice. It should not be relied upon as a substitute for specific advice tailored to particular circumstances. Recipients should seek guidance from appropriately qualified professionals before making any decisions based on this content.

Unless otherwise stated, Confluence Technologies, Inc. (or the relevant group entity) owns the copyright and all related intellectual property rights in this material, including but not limited to database rights, trademarks, registered trademarks, service marks, and logos.

No part of this content may be adapted, modified, reproduced, republished, uploaded, posted, broadcast, or transmitted to third parties for commercial purposes without prior written consent.

About Confluence

Confluence is a global leader in enterprise data and software solutions for regulatory, analytics, and investor communications. Our best-of-breed solutions make it easy and fast to create, share, and operationalize mission-critical reporting and actionable insights essential to the investment management industry. Trusted for over 30 years by the largest asset service providers, asset managers, asset owners, and investment consultants worldwide, our global team of regulatory and analytics experts delivers forward-looking innovations and market-leading solutions, adding efficiency, speed, and accuracy to everything we do. Headquartered in Pittsburgh, PA, with 700+ employees across North America, the United Kingdom, Europe, South Africa, and Australia, Confluence services over 1,000 clients in more than 40 countries.

For more information, visit confluence.com

You may also like: