Q2 2025

Factor Performance Analysis

Volatility maintains leadership

Prepared by:

Market Background

This quarter was marked by heightened market volatility as investors navigated ongoing tariff policy uncertainty and conflict in the Middle East. The April 2 ‘Liberation Day’ tariff announcement—marking a major policy shift—triggered a sharp market selloff. However, renewed investor confidence and a strong earnings season eventually drove a rebound, particularly in mega-cap tech stocks. After lagging in Q1 2025, the ‘Magnificent 7’ delivered strong returns. While U.S. equities and bonds recovered from April’s turbulence, the U.S. dollar continued to weaken, boosting international equities returns for dollar-based investors as foreign currency gains added to performance. All major equity regions posted positive returns for the quarter, with Emerging Markets leading the way.

Oil prices declined to $65 per barrel by the end of June, down from a mid-month high of $73 and from $72 at the end of the previous quarter. Bitcoin jumped 30.7% in Q2, staging a strong rebound from a sluggish first quarter and reaching new all-time highs. After taking a breather in Q4 2024, gold prices resumed their upward trajectory in Q1 2025, repeatedly hitting new all-time highs and surpassing key milestones, including the $3,000 mark. Although prices continued to rise in the second quarter, the pace of gains moderated compared to Q1, with gold ending the quarter at $3,292 per troy ounce.

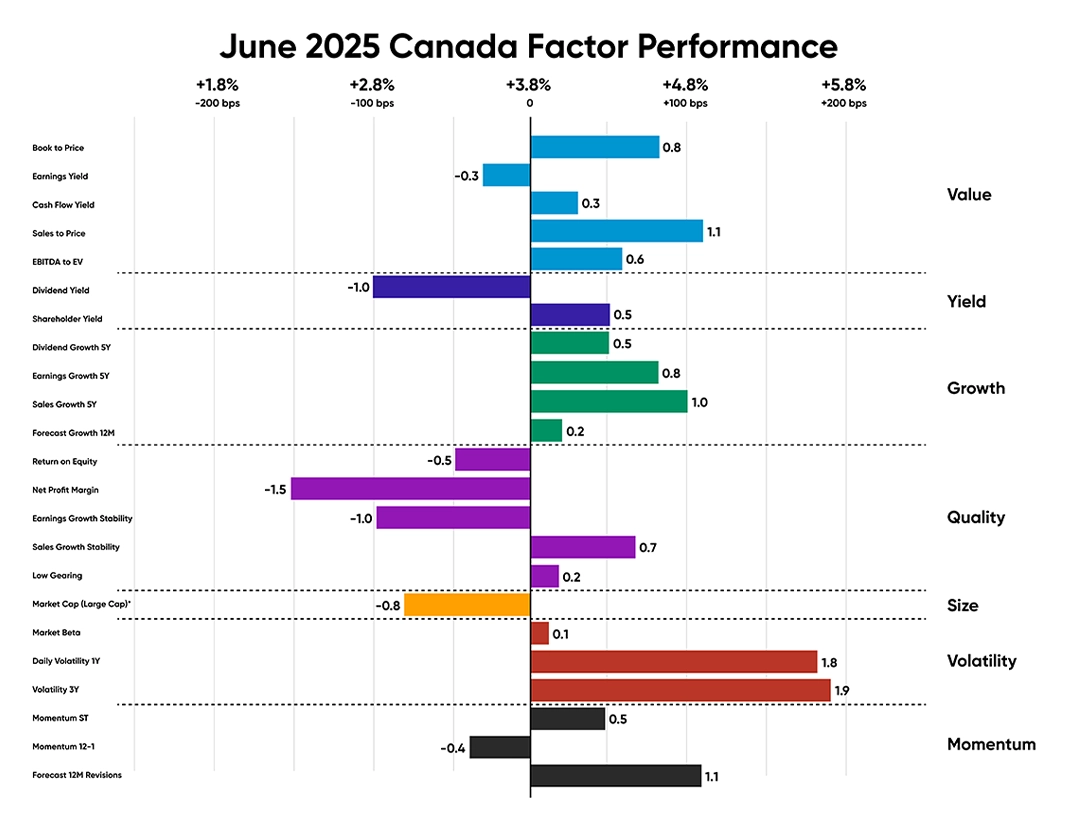

As shown in the image below, there was a notable shift in fund flows, with capital moving into Emerging Markets and Europe, while outflows were observed from the U.S. market. This trend can be attributed to concerns over stretched valuations in U.S. equities—particularly large-cap tech stocks—which have become relatively expensive following years of strong performance. The weakening U.S. dollar also made Emerging Market assets more attractive by enhancing local currency returns. Ongoing tariff-related uncertainty also contributed to a less predictable investment environment, prompting global investors to seek opportunities elsewhere.

Figure 1: June 2025 Mutual Fund Flow data.

Source: Confluence Style Analytics

Factor Summary

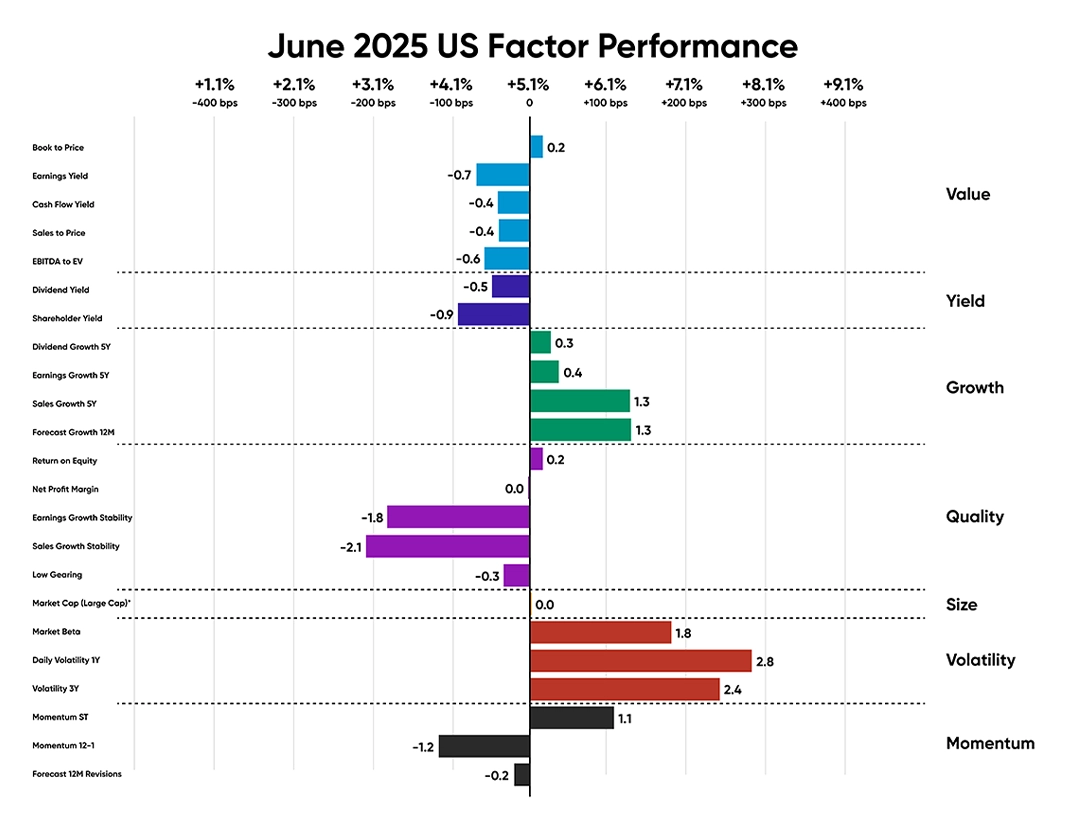

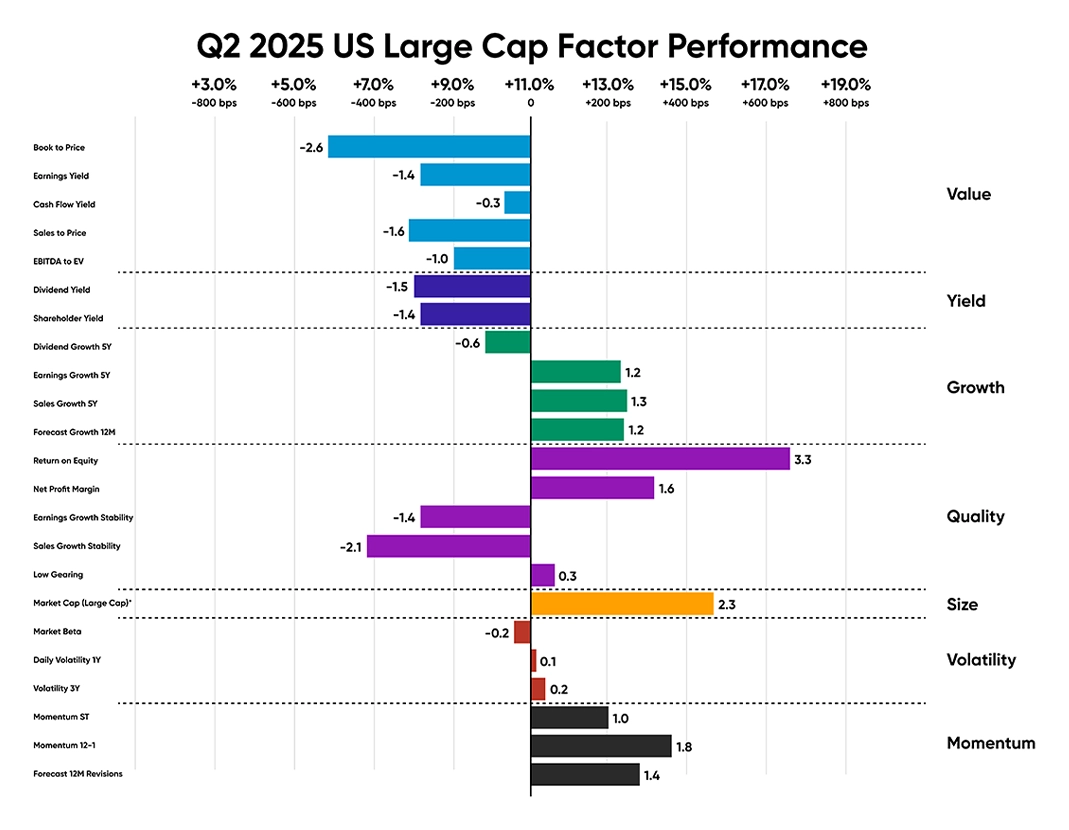

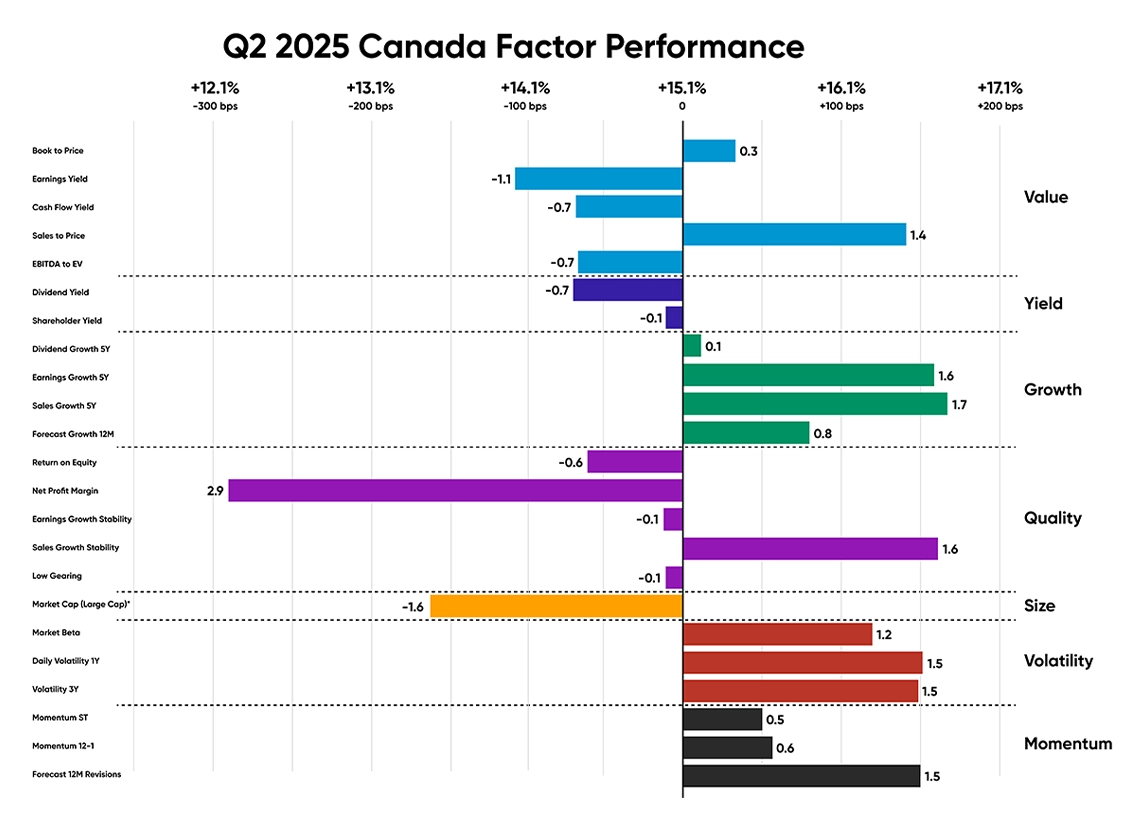

Figures 2a & 2b: Regional relative factor performance (country and sector adjusted) for June ’25 and Q2 ‘25.

Source: Confluence Style Analytics

US Equities

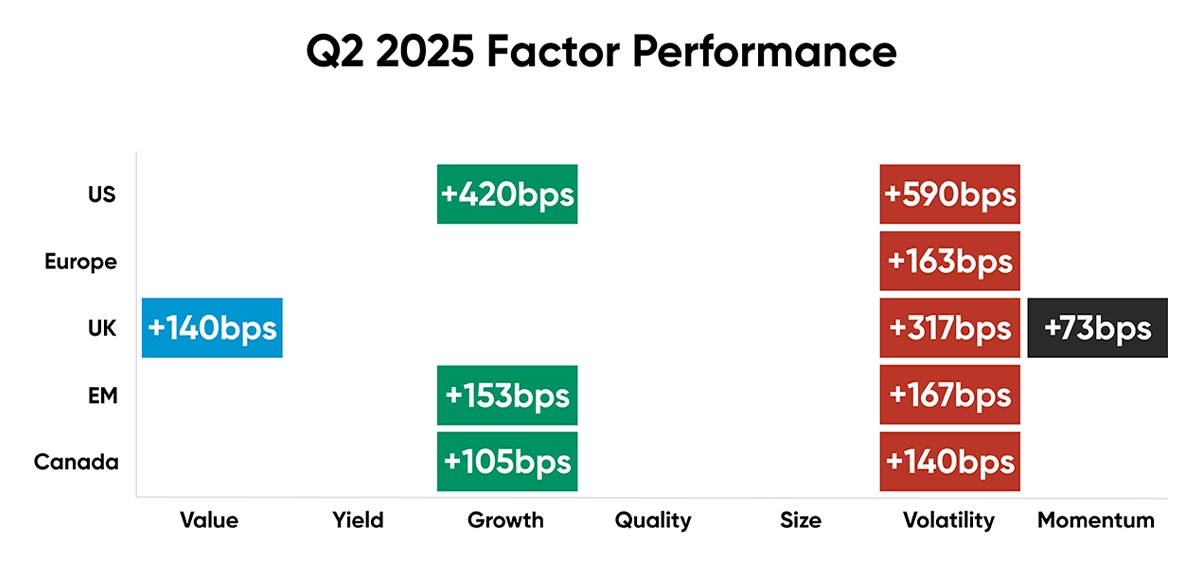

Despite ongoing policy uncertainty and geopolitical instability, equity markets recovered from early April volatility to deliver broadly positive returns by the end of the quarter. The U.S. economy remained stable throughout Q2, with inflation, though easing from last year, still above the Federal Reserve’s 2% target. Following a weak first quarter, U.S. equities rebounded strongly, posting an impressive +11% return and reaching new all-time highs by June. This performance was largely driven by large-cap growth stocks, with the Size, Growth, and Volatility factors outperforming the broader market by 230bps, 420bps, and 590bps, respectively, relative to sector-adjusted benchmarks. The quarter began with a sharp selloff triggered by the U.S. 'Liberation Day' tariff announcement, but sentiment quickly improved as the administration paused further tariff actions and signaled progress in trade negotiations with China and the UK, helping restore investor confidence.

Compared to the previous quarter, the region experienced a near-complete shift in factor trends. Investor sentiment moved away from Value stocks, previously favored, and shifted toward Momentum, which had underperformed in the prior quarter. June continued the previous month’s trend, with a strong tilt toward Volatility and Growth subfactors.

U.S. annual inflation likely accelerated for the second straight month in June 2025, rising to 2.7%, its highest level since February, up from 2.4% in May. Meanwhile, the unemployment rate inched down to 4.1% in June from 4.2% the previous month.

Leading contributors to performance included mega-cap tech names such as NVIDIA Corp (+45%), Meta Platforms (+28%), and Oracle Corp (+59%), all of which exhibited strong return-on-equity characteristics.

Figure 3: June 2025 US Factor Performance (sector adjusted)

Source: Confluence Style Analytics

Figure 4: Q2 2025 US Factor Performance (sector adjusted)

Source: Confluence Style Analytics

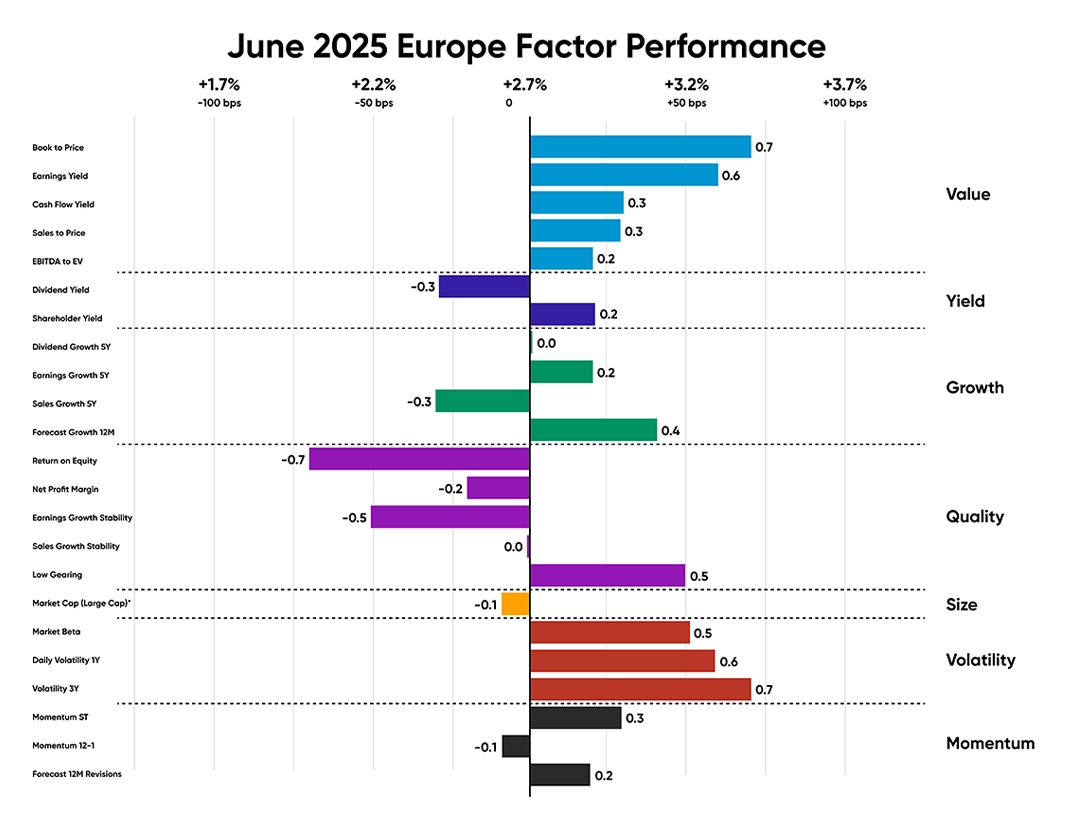

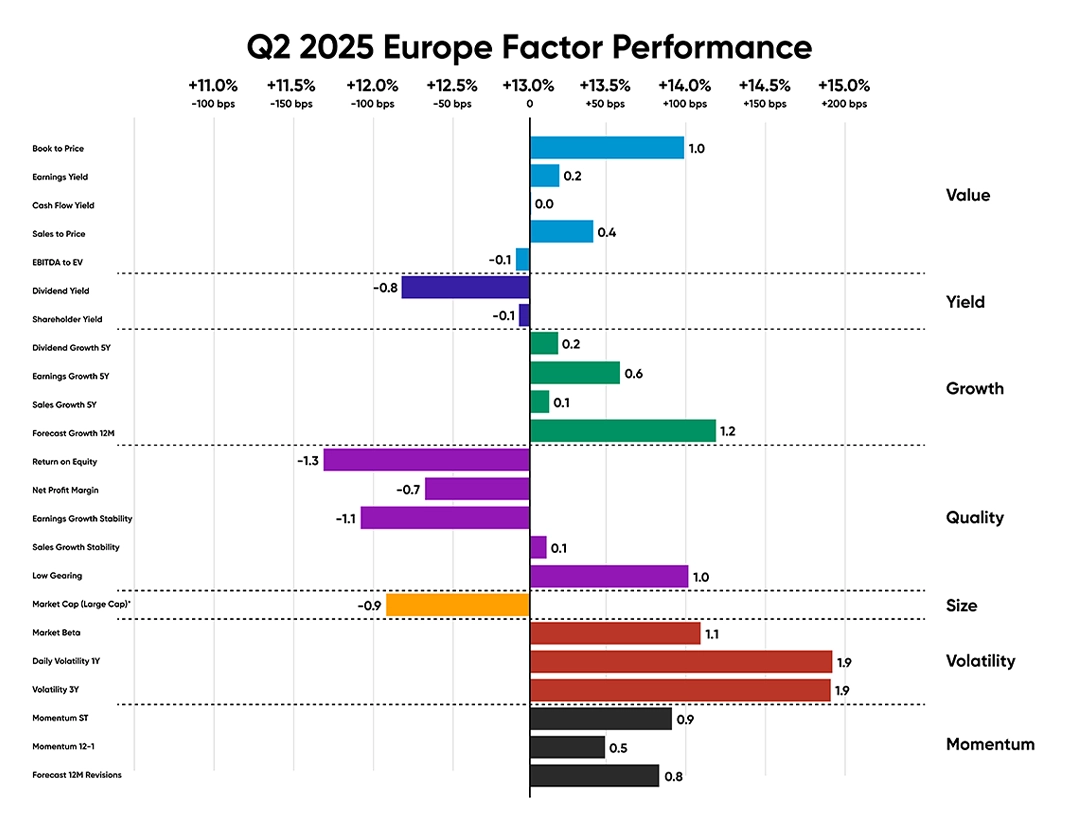

European Equities

European equities saw a strong rebound this quarter, delivering a 13.5% return, up significantly from 6.9% in the previous quarter. Investor sentiment shifted notably, with Volatility and Momentum factors, which had delivered mixed results in the prior quarter, showing strong outperformance this time. In contrast, Value, which had previously led regional performance, posted more mixed returns during the quarter.

The Size factor, which outperformed in May, lagged in the European region in June. The overall decline in European equity performance this month was primarily driven by renewed trade and tariff concerns and rising geopolitical tensions in the Middle East. The industrial sector contributed positively to the region’s performance, with defense stocks receiving a boost from increased defense spending commitments across Europe.

Eurozone consumer price inflation edged up to 2% year-on-year in June 2025, slightly above May’s eight-month low of 1.9% and in line with market expectations. The unemployment rate in the Euro Area rose to 6.3% in May, up from 6.2% in April. Meanwhile, manufacturing production grew by 0.8% year-on-year in April 2025. The European Central Bank (ECB) implemented two 25-basis-point rate cuts during the quarter, signaling a shift toward a more accommodative policy stance and supporting equity markets.

Notable outperformers with daily volatility 1Y include Spanish financials company Banco Santander SA (+25% in Q2), German industrials company Siemens Energy (+87% in Q2), and Rhenmetal Sa (+49% in Q2). The companies with 3Y volatility, which contributed to the region’s performance, include French industrials company Airbus (19% in Q2) and Italian financials company Unicredit SPA (24% in Q2).

Figure 5: June 2025 Europe Factor Performance (sector adjusted)

Source: Confluence Style Analytics

Figure 6: Q2 2025 Europe Factor Performance (country/sector adjusted)

Source: Confluence Style Analytics

UK Equities

Following a strong performance in the previous month, the UK equity market saw a slowdown in June, posting a modest gain of just +0.6%. Despite this dip, the region ended the quarter with a solid overall return of +4.6%.

In May, Value subfactors led the rally, outperforming the region by 130bps. Investor sentiment shifted in June, with Volatility returning mixed performance. For the quarter, Volatility led factor performance, followed by Value, which delivered notable gains in May before moderating in June.

Relative to May, the decline in UK equity performance in June 2025 was primarily driven by softer economic data, persistent geopolitical tensions, and a cautious monetary policy stance. These factors contributed to heightened market volatility and a period of consolidation after May’s strong gains, resulting in muted returns for the month. The quarter had opened with a sharp global selloff sparked by the U.S. 'Liberation Day' tariff announcements, which weighed heavily on risk sentiment and triggered a shift toward more defensive positioning. While markets partially recovered as trade tensions eased, the initial bout of volatility set a cautious tone for UK equities. Additionally, Momentum and Size factors underperformed significantly compared to the previous quarter, further weighing on the region’s relative performance.

In May 2025, the UK's annual inflation rate eased slightly to 3.4%, down from 3.5% in April. Despite the Bank of England implementing a 0.25% rate cut during the month, inflation remained well above the 2% target, limiting the central bank’s ability to pursue more aggressive easing. Meanwhile, the unemployment rate inched up to 4.6%.

Top-performing Emerging Markets equities with high 1-year daily volatility included Industrials company Rolls-Royce Holdings Plc (+38% in Q2), financials company Barclays PLC (+24% in Q2), and Industrials company Ferguson Enterprises Inc (+39% in Q2).

Figure 7: June 2025 UK Factor Performance (sector adjusted)

Source: Confluence Style Analytics

Figure 8: Q2 2025 UK Factor Performance (sector adjusted)

Source: Confluence Style Analytics

Emerging Market Equities

In the second quarter of 2025, emerging markets delivered strong performance, outperforming the U.S. region by approximately 10%. This outperformance was driven by a rebound in investor risk appetite and a shift toward diversification away from the U.S. and other developed markets. Despite ongoing global geopolitical tensions, many emerging markets benefited from solid domestic fundamentals, which underpinned equity resilience.

Emerging markets saw a significant improvement in performance in Q2 2025 compared to the previous quarter, with Volatility and Momentum emerging as key drivers. Notably, Volatility, which had underperformed in the last quarter, played a leading role this time. Its outperformance was driven by a unique blend of market dynamics, geopolitical developments, and shifting investor sentiment. The announcement of sweeping U.S. tariffs in early April triggered sharp reactions and elevated volatility across EM equities. Additionally, the substantial weakening of the U.S. dollar during the quarter boosted returns in local currencies, though it also contributed to increased currency volatility in EM economies.

In June 2025, Taiwan's annual inflation rate eased for the third consecutive month, falling to 1.37% from 1.55% in May. Meanwhile, its unemployment rate declined slightly to 3.34% in May. In India, consumer price inflation dropped to 2.1% in June, while the unemployment rate decreased to 7.9%. Mexico’s annual inflation rate slowed to 4.32% in June from 4.42% in May, aligning closely with market expectations of 4.31%. However, Mexico’s unemployment rate edged up to 2.7% in May 2025, compared to 2.6% a year earlier. In Brazil, annual inflation ticked up slightly to 5.35% in June from 5.32% in May.

Companies that led by daily Volatility 1Y in Emerging Markets this quarter include Chinese financials company China Life Insurance Co Ltd (+11% in Q2); comm services company Netease (+36%in Q2).

Figure 9: June 2025 Emerging Markets Factor Performance (sector adjusted)

Source: Confluence Style Analytics

Figure 10: Q2 2025 Emerging Markets Factor Performance (sector adjusted)

Source: Confluence Style Analytics

Canadian Equities

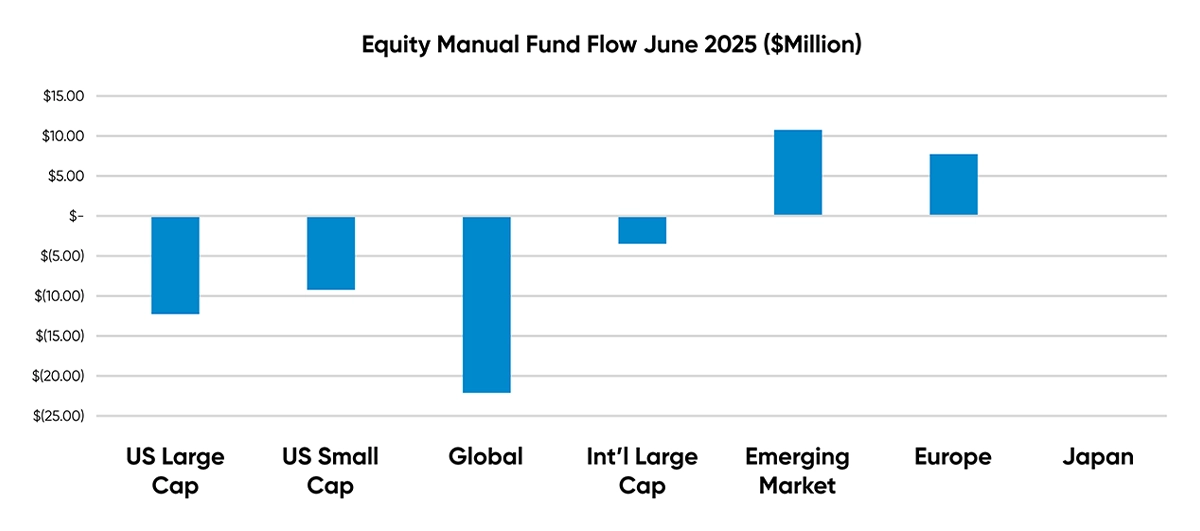

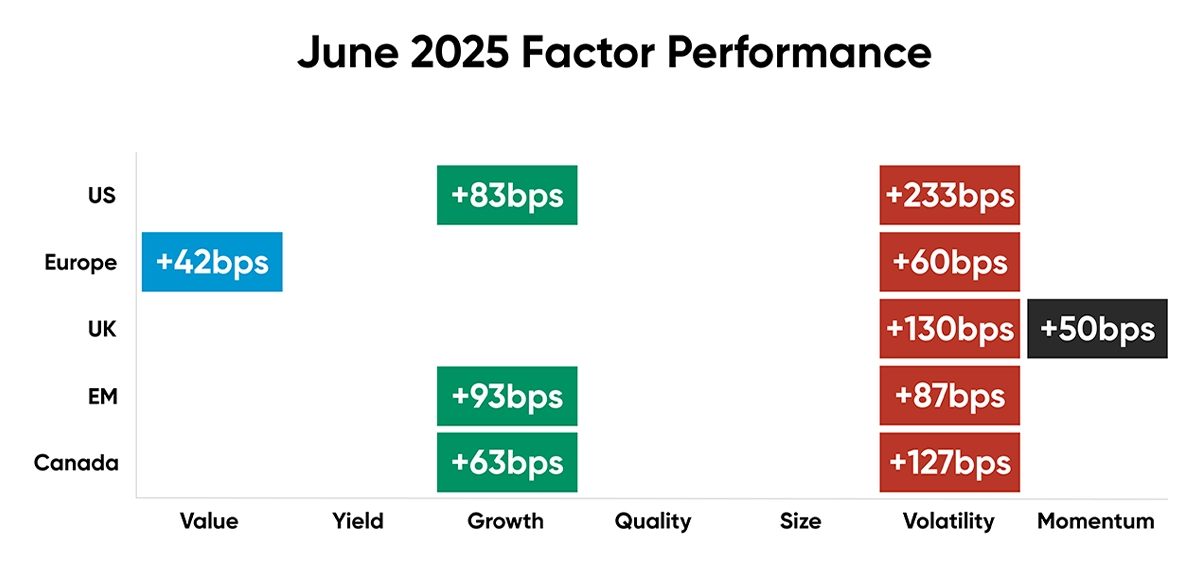

Although U.S. export buyers rushed to make purchases ahead of the tariffs in the first quarter, contributing to Canada's economic growth during that period, regional equity markets delivered negative returns in Q1 2025. However, the second quarter saw a strong rebound with a 15% gain, despite ongoing uncertainty from the trade war. Compared to the previous quarter, volatility-related subfactors were the primary drivers of market performance in Q2. Mirroring last month’s trend, Growth and Volatility subfactors remained key contributors to the market rally with Growth outperforming the market by an average of 64bps in June and Volatility outperforming the market by 127bps. The quarter finished with an outperformance of Volatility, Growth and Momentum subfactors Rising trade tensions, particularly after the Liberation Day prompted investors to shift away from U.S. equities. Canada, with its heavy exposure towards stable sectors like financials, including stocks like Brookfield Corp (18% in Q2), Bank of Montreal (17% in Q2) and volatile tech stocks like Shopify (28% in Q2) drew substantial capital inflows.

Canadian equity markets delivered a more modest return of +3.8% compared to the previous month, with net profit margin and dividend yield subfactors weighing heavily on performance. Canada's annual inflation rate remained unchanged from the previous month at 1.7% in May. The unemployment rate edged down to 6.9% in June 2025, easing from the nearly four-year high of 7% recorded in May.

The outperformance of 3Y volatility subfactor that led the region’s performance this quarter include financials company Bank of Nova Scotia (+18.3% in Q2), National Bank of Canada (25.8% Q2) and Canadian Imperial Bank of Commerce (27% in Q2) and energy company Cameco Corp (80.1% in Q2).

Figure 11: June 2025 Canada Factor Performance (sector adjusted)

Source: Confluence Style Analytics

Figure 12: Q2 2025 Canada Factor Performance (sector adjusted)

Source: Confluence Style Analytics

Style Analytics

Style Analytics Fixed Income is now available globally. To learn more or request a demo, click on the link below.

Appendix: How to read the charts

For example, for the book-to-price factor, we determine the period’s performance of the basket of stocks with the highest book-to-price values relative to the total market. Each factor is analyzed independently, market and fundamental data are adjusted to enable sector-average (within each country) relative data to be used, and the performance measurement isolates the factor’s contribution to return.

Disclaimer

The content provided by Confluence Technologies, Inc. is for general informational purposes only and does not constitute legal, regulatory, financial, investment, or other professional advice. It should not be relied upon as a substitute for specific advice tailored to particular circumstances. Recipients should seek guidance from appropriately qualified professionals before making any decisions based on this content.

Unless otherwise stated, Confluence Technologies, Inc. (or the relevant group entity) owns the copyright and all related intellectual property rights in this material, including but not limited to database rights, trademarks, registered trademarks, service marks, and logos.

No part of this content may be adapted, modified, reproduced, republished, uploaded, posted, broadcast, or transmitted to third parties for commercial purposes without prior written consent.