Navigating Market Cycles with a Stability-Focused Portfolio

Background: Investor sentiment is frequently categorized into two opposing regimes: "risk-on", when appetite for volatility and growth dominates, and "risk-off", when markets turn defensive and emphasize capital preservation. While risk-on dynamics are well-studied, less attention is given to how portfolios focused on defensive strategies behave across varying market conditions.

Objective: This use case explores the role and performance of a factor-based portfolio designed to emphasize stability. The aim is to assess how such a portfolio performs relative to broader markets during both risk-on and risk-off periods.

Methodology: The Client Services team constructed a portfolio by selecting companies within the top 1,000 U.S. equities by market capitalization with the highest sector-adjusted scores for earnings growth stability (EGS) and sales growth stability (SGS). Adjustments based on GICS sectors ensured the resulting exposure was sector-neutral, mitigating any bias toward traditionally defensive industries.

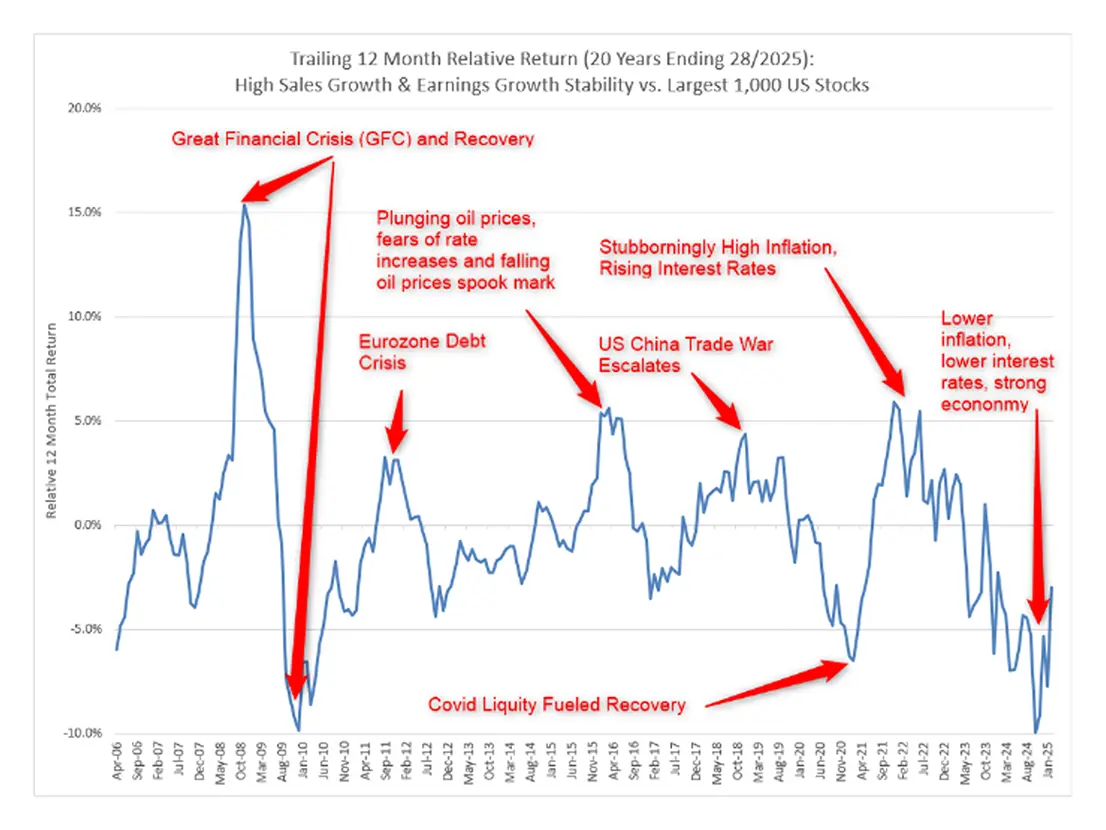

During times of market weakness and uncertainty, like during the Great Financial Crisis (GFC), Eurozone Debt Calamity, and sharp market sell-off in 2022, the High USA SGS and EGS portfolio dramatically outperformed. During risk-on-type environments, including the recoveries post-GFC and COVID crises, and the dramatic bounce-back performance in the US equity region in 2023 and 2024, these strategies tend to underperform in a flight from quality type environment.

Figure 1: The Stability Portfolio's relative outperformance during periods of market distress. Source: Confluence Style Analytics

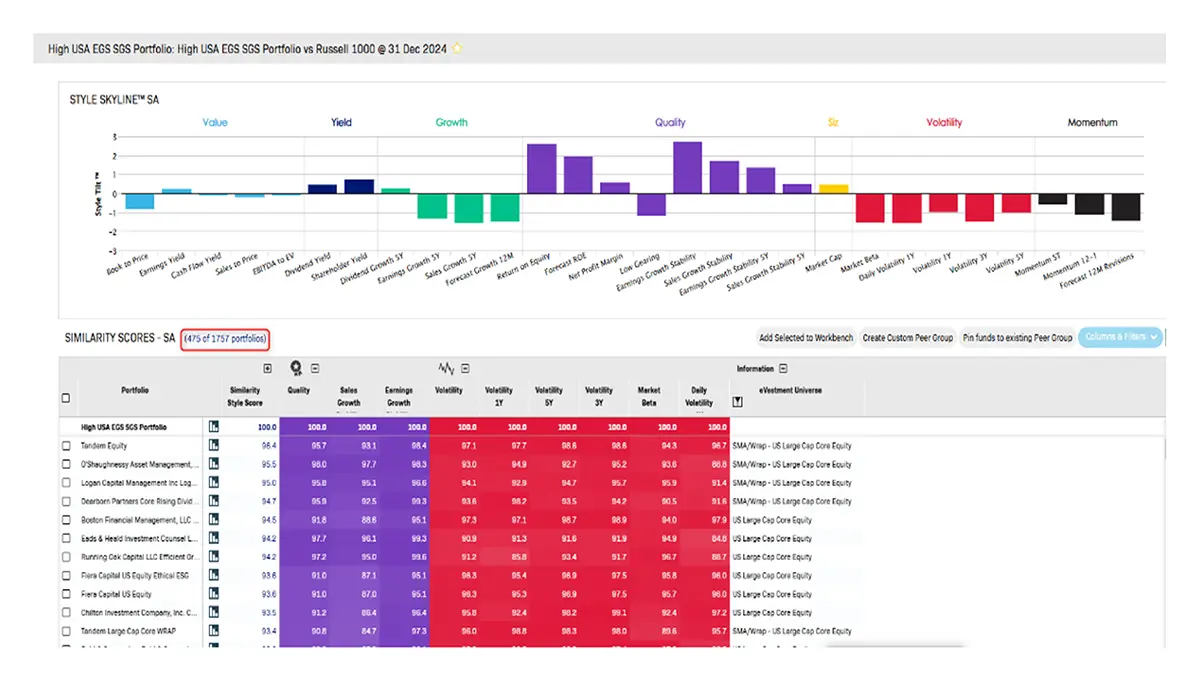

The portfolio’s factor exposures were further analyzed using Confluence Style Analytics. The holdings demonstrated significant alignment with characteristics such as low volatility, high return on equity, and consistent dividend yield. Sector weighting effects were neutralized to isolate true factor-based behavior.

Figure 2 readily shows the defensive nature of this factor portfolio, which is based on the most stable earnings and sales growth companies within this US market.

Figure 2: Portfolio exposures emphasize low volatility and profitability, supporting a defensive posture.

This portfolio had a statistically significant exposure to earnings and sales growth stability using Client Services’ rules of thumb to interpret factor tilts (e.g., scores approaching or exceeding plus or minus 2).

The portfolio also has a high return on equity

Slightly positive exposures to both dividend yield and dividend growth

A very strong and consistent exposure to low volatility.

Findings: The portfolio consistently outperformed during macroeconomic disruption, including the Global Financial Crisis, the Eurozone debt crisis, and the inflation-driven equity sell-off of 2022. Even after stripping out the sector effect, the defensive nature of these types of companies is very apparent. These companies are expected to fare better during economic weakness and market uncertainty. This is usually a preference for companies where dividends (and the specter of higher dividends in the future) are a larger part of one’s total return, focusing on higher profitability and lower stock price volatility.

These periods highlighted the strength of companies with resilient earnings and disciplined balance sheets.

However, the portfolio underperformed in strong bull markets, such as those in 2023 and 2024. Investor preference shifted sharply toward high-growth, high-volatility assets. Style attribution and peer benchmarking using Style Analytics’ Similyzer and Peer Insights modules confirmed this divergence. Comparable portfolios within the U.S. Large Cap Core category exhibited similar underperformance against benchmarks like the Russell 1000.

In Figure 3, it is evident that these portfolios rank highly in each of the seven factor criteria selected (e.g., the top image 1 for stability and the bottom image 2 for low volatility):

Figure 3: Peer portfolios with similar factor exposure show consistent underperformance during risk-on

Figure 4: Factor attribution illustrates how stability exposures were not rewarded in 2024’s bullish market.

Stability

Low Volatility

Rank squarely in the bottom quartile for longer-term performance periods through the end of 2024

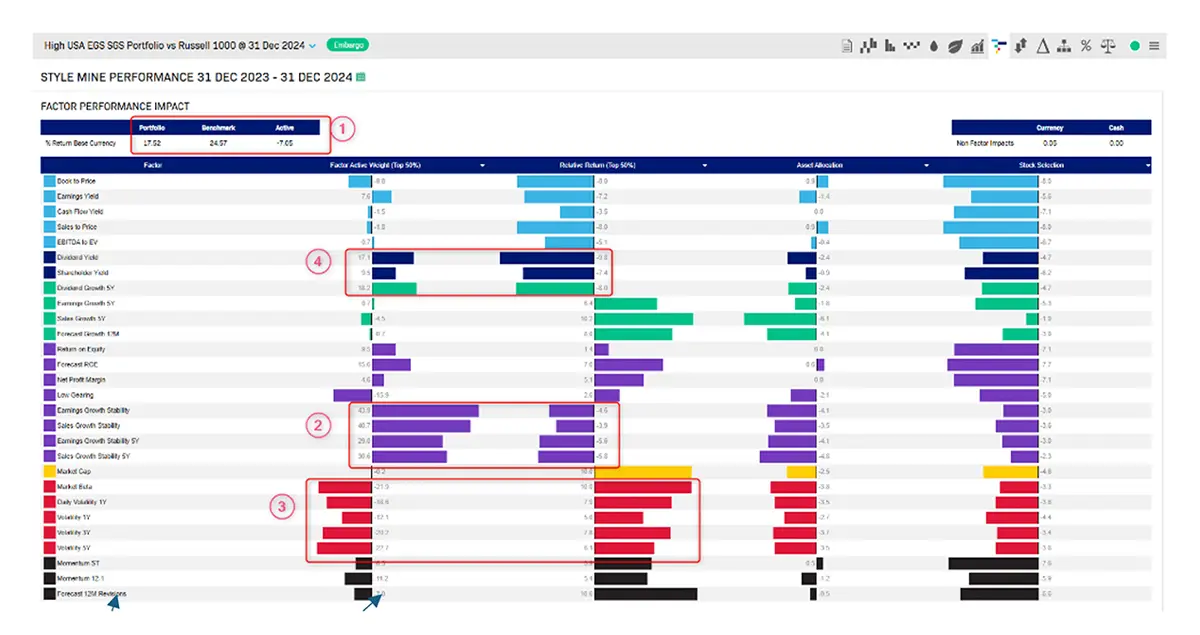

This performance was put into context by looking at the relative performance of these factors during 2024. The Style Analytics’ Style Mine attribution below, shows independent Brinson Fachler attribution analyses across various factors. It shows that the market favored beta, forecasted earnings growth, and momentum factors in a risk-on environment, which ran counter to the stability-focused profile.

Figure 5: The cumulative performance of the stability portfolio vs. benchmark indices across multiple market cycles.

- The first column represents the portfolio’s relative positioning across all the factors chosen for this analysis.

- The second column illustrates what is being rewarded or shunned during this performance window.

- The last two columns represent the allocation and stock selection impacts.

As expected, the portfolio is underexposed to volatility as evidenced by its negative active positions , overweighted in stability factors , and overexposed to high dividend yield (and to companies growing their dividends). Across these groups of factors, what the market (e.g., the Russell 1000) was rewarding was diametrically opposed to how the portfolio was positioned.

Highlighted section in Figure 5 above, the portfolio comfortably underperformed the broader index during 2024. It was positioned conservatively across the various factor groups. Also shown in , the market was rewarding high-volatility stocks while not rewarding companies with strong stability in earnings and sales growth, nor emphasizing high dividend (or high dividend growth) stocks.

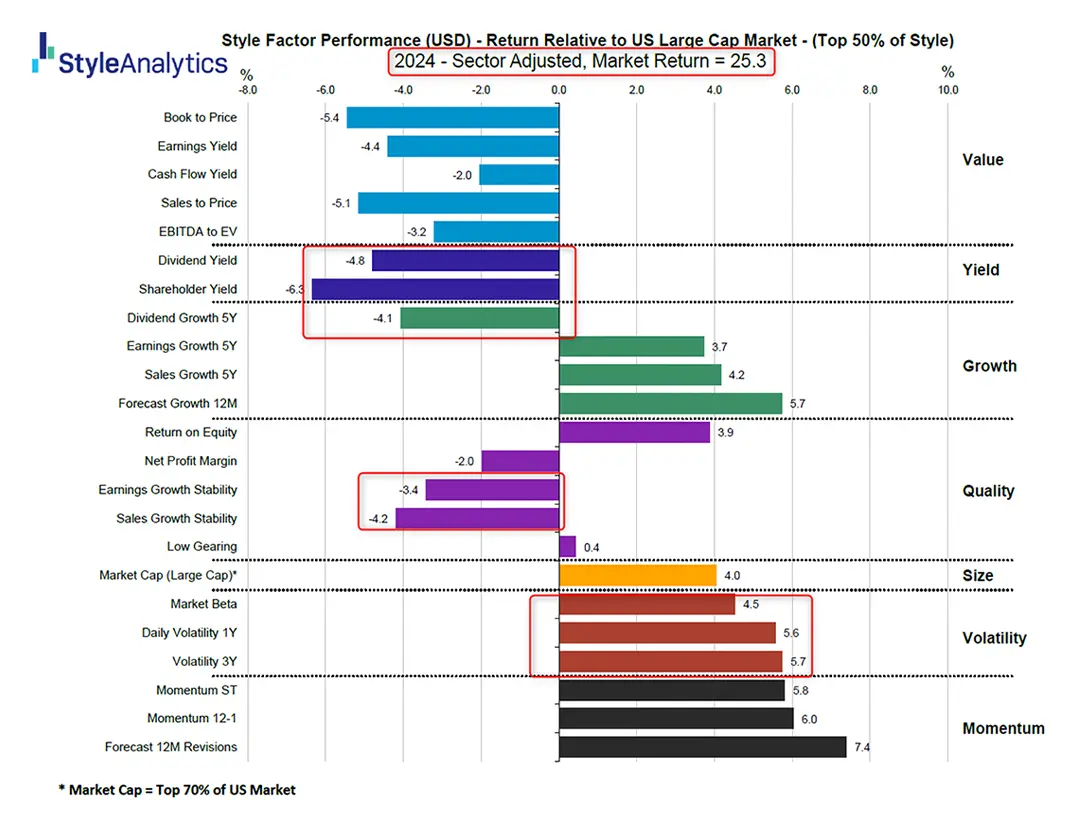

Additional Insight: Figure 6 below shows a different lens using Style Markets Analyzer demonstrating the cumulative performance comparison. It shows a similar dynamic, risk-on type factors handily outperformed their risk-off counterparts, further validating the portfolio's cyclical behavior.

Figure 6: In 2024, risk-on factors like volatility and forecasted growth outperformed risk-off factors such as dividend yield and earnings stability.

Analysis: Markets Analyzer data further demonstrated the cyclical nature of factor performance. In times of monetary tightening, elevated uncertainty, or recession risk, the stability portfolio offered critical downside protection. Conversely, during recovery periods marked by accommodative policy and bullish sentiment, performance lagged due to a structural underweight to speculative and high-growth exposures.

Conclusion: A longer-term view underscores the role of stability-focused allocations in mitigating drawdowns and supporting consistent compounding through volatility. Stability-focused portfolios serve an essential function in a diversified investment strategy. While they may not lead during market rallies, they provide meaningful protection during drawdowns and contribute to long-term consistency. This case study confirms that stability factors, such as low volatility, consistent earnings, and disciplined capital allocation, can materially enhance portfolio resilience when used alongside higher-risk components.

The results validate the value of factor-based analytics in portfolio construction and risk management. Confluence’s data-driven approach enables asset managers to understand and position for shifts in market regimes with precision and clarity.

This case study illustrates the kind of in-depth analysis Confluence Client Services delivers in close collaboration with clients.

See Style Analytics in action

Discover how Style can elevate your investment strategies.

You may also be interested in another article from the Style Analytics team.

Disclaimer

The content provided by Confluence Technologies, Inc. is for general informational purposes only and does not constitute legal, regulatory, financial, investment, or other professional advice. It should not be relied upon as a substitute for specific advice tailored to particular circumstances. Recipients should seek guidance from appropriately qualified professionals before making any decisions based on this content.

Unless otherwise stated, Confluence Technologies, Inc. (or the relevant group entity) owns the copyright and all related intellectual property rights in this material, including but not limited to database rights, trademarks, registered trademarks, service marks, and logos.

No part of this content may be adapted, modified, reproduced, republished, uploaded, posted, broadcast, or transmitted to third parties for commercial purposes without prior written consent.

About Confluence

Confluence is a global leader in enterprise data and software solutions for regulatory, analytics, and investor communications. Our best-of-breed solutions make it easy and fast to create, share, and operationalize mission-critical reporting and actionable insights essential to the investment management industry. Trusted for over 30 years by the largest asset service providers, asset managers, asset owners, and investment consultants worldwide, our global team of regulatory and analytics experts delivers forward-looking innovations and market-leading solutions, adding efficiency, speed, and accuracy to everything we do. Headquartered in Pittsburgh, PA, with 700+ employees across North America, the United Kingdom, Europe, South Africa, and Australia, Confluence services over 1,000 clients in more than 40 countries.

For more information, visit confluence.com

You may also like: