2024: A Year of Uncertainties for Global Markets

As we navigate through 2024, uncertainties loom large on the horizon. High interest rates in major economies influence global economic dynamics, and geopolitical tensions cast shadows over the future. Investors find themselves grappling with the complexities of analyzing financial market trajectories amidst this backdrop of uncertainty.

Bonds

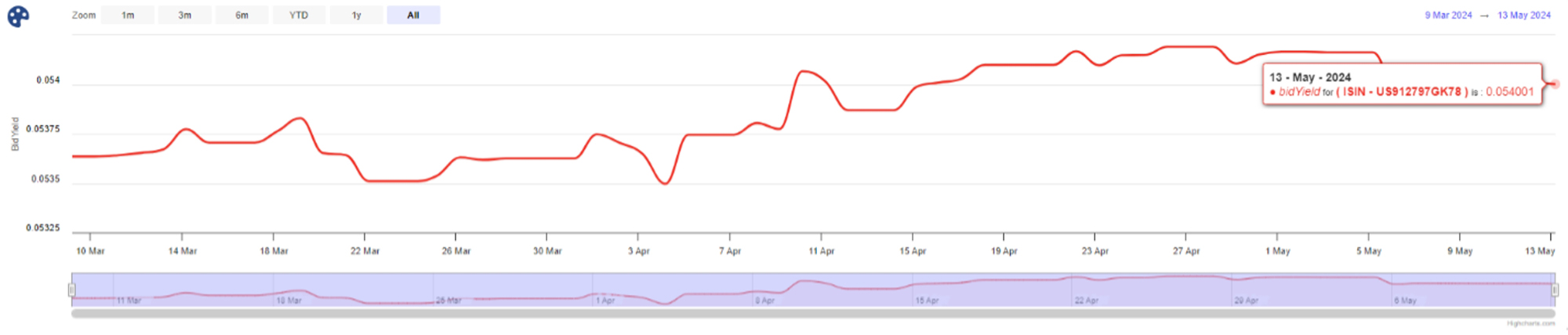

The anticipation of rate cuts by the FEDs has been met with skepticism this year, particularly in light of escalating inflationary pressures. Recent reports from the US Bureau of Labor Statistics indicate that the Consumer Price Index (CPI) comes in at 3.4% YoY, in line with expectations, while the unemployment rate hovers between 3.7% and 3.9%. These factors have contributed to a delay in expected rate cuts, with market confidence in bonds bolstering and yields rising in response.

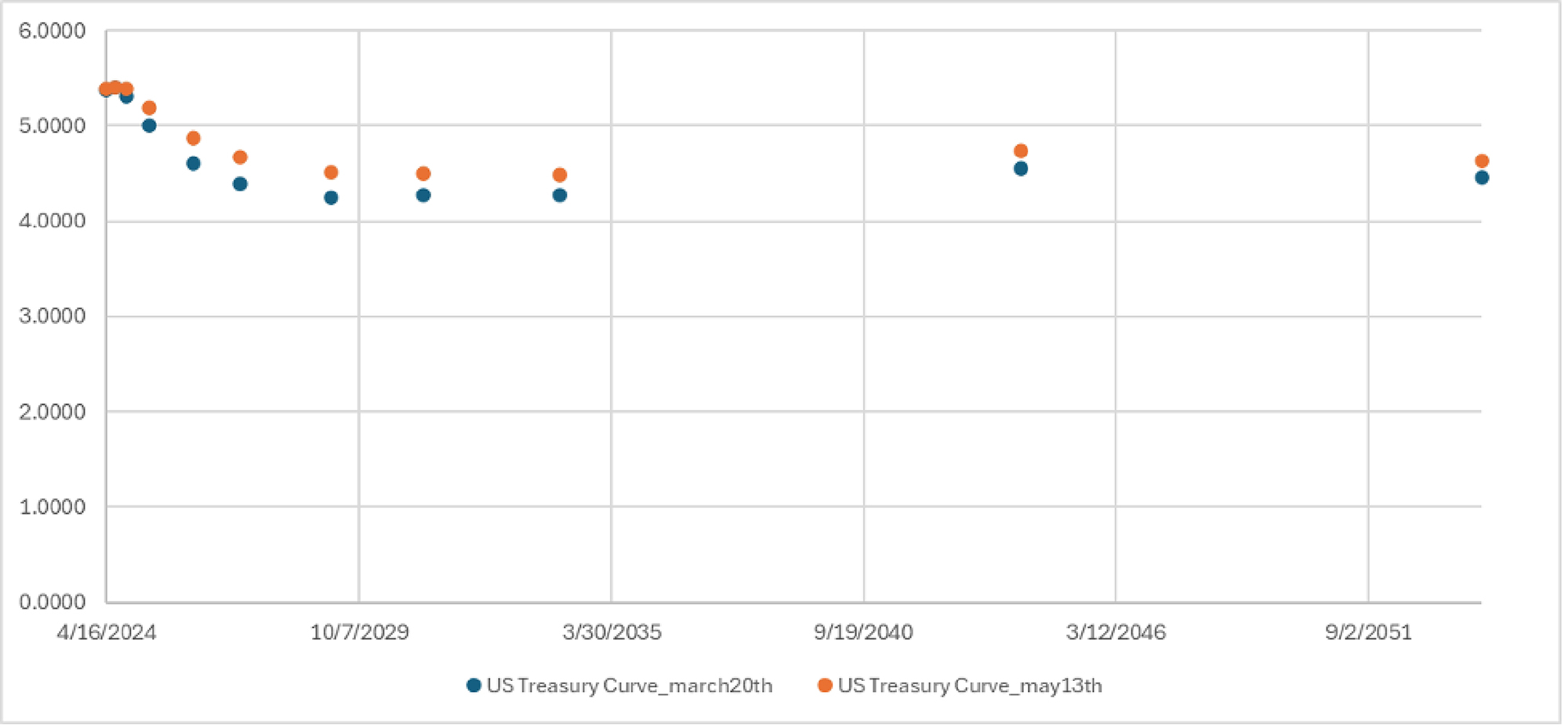

After the last FED announcement, on March 20th, short-term bond yields fell slightly, but since then, the reference rates of the US Treasury Curve have been higher than the previous month.

Figure 1: United States 3 Month Benchmark.

Source: Confluence Internal Data Team.

Figure 2: Comparison of US Treasury Yield Curve, March 20th and May 13th

Source: Confluence Internal Data Team.

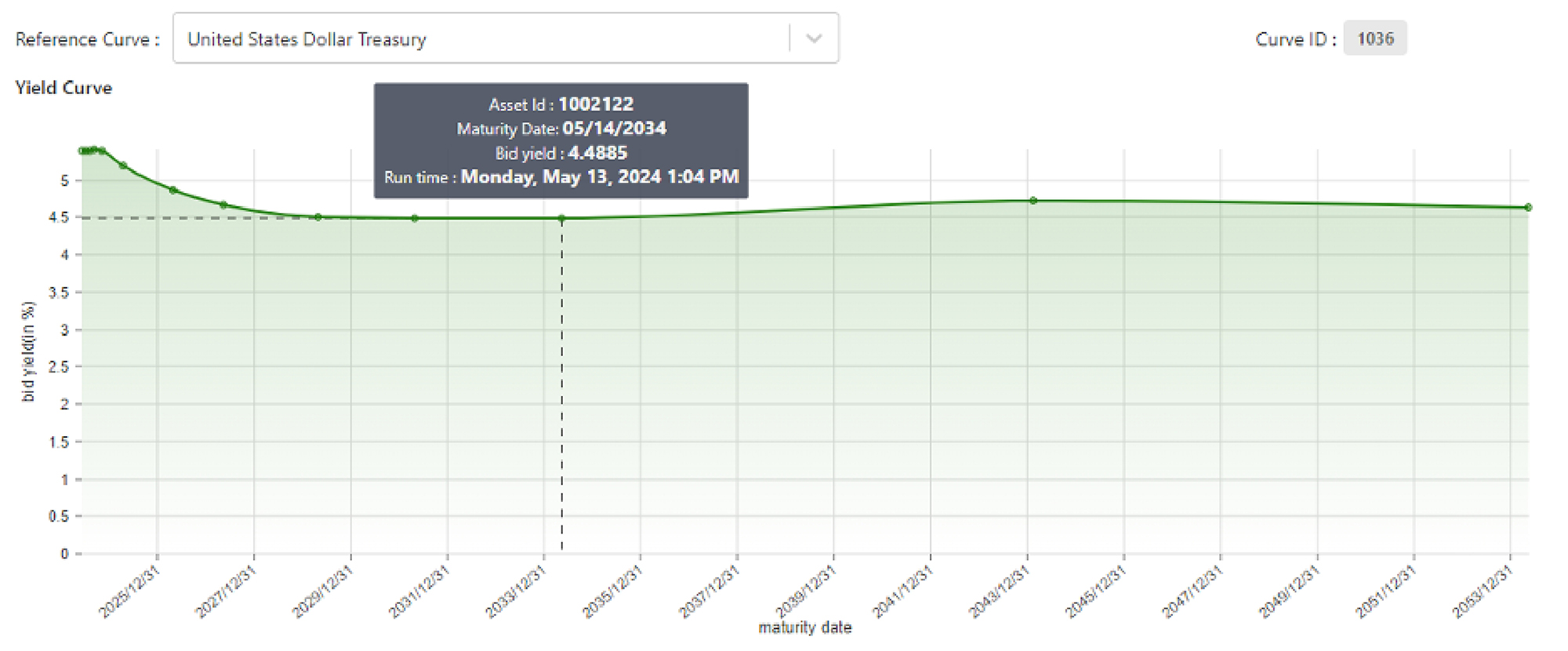

The benchmark 10-year US Treasury rate fell by one basis point, reaching 4.48% as of May 13th.

Figure 3: 10-year US Treasury rate

Source: Confluence Internal Data Team.

The likelihood of rate cuts in the US before September 2024 seems low. If this situation continues, there will be a gap of 14 months or longer between the last rate hike (July 2023) and the first rate cut. According to Bloomberg data, markets anticipate only two cut rates this year, each of Quarter-Point, based on recent growth and employment data.

| Date | Increase | Decrease | Level (%) |

|---|---|---|---|

| March 20, 2024 | 0 | 0 | 5.25 – 5.50 |

| January 31, 2024 | 0 | 0 | 5.25 – 5.50 |

| December 14, 2023 | 0 | 0 | 5.25 – 5.50 |

| July 27, 2023 | 25 | 0 | 5.25 – 5.50 |

| May 4, 2023 | 25 | 0 | 5.00 – 5.25 |

| March 23, 2023 | 25 | 0 | 4.75 - 5.00 |

| February 2, 2023 | 25 | 0 | 4.75 - 5.00 |

Figure 4: Federal Rate Changes.

Outside the US, some Central Banks have begun to cut rates. The first two developed countries to cut rates were The Riskbank, Sweden’s central bank, and The Swiss National Bank, due to a continued economic weakness. The Bank of England is also expected to jump ahead of the FED and make a similar decision. Governor Andrew Bailey expressed confidence that inflation indicators showed signs of being under control and a rate cut could be expected before August.

This week, China is set to commence the sale of government bonds amounting to nearly 1 trillion yuan, as part of its efforts to bolster the economy. The initial offering will consist of 30-year bonds, and the announcement has been positively received by global financial markets.

Precious metals

In contrast to bonds, the prices of precious metals such as gold and silver have seen an upward trajectory. Market participants are increasingly turning to these safe-haven assets amidst the prevailing uncertainties. Analysts are closely studying the price dynamics between gold and silver, with some forecasting that silver’s performance may outshine gold. CNBC states that silver prices are more dependent on the economy because, along with jewelry, it is used in many industrial applications. Silver’s significant role in industrial applications, coupled with its positive correlation with gold, suggests a potential rise in silver prices following gold’s lead.

Cryptocurrency

The highly anticipated Bitcoin halving event in April yielded only marginal price increases, dampening initial expectations. However, with diminishing prospects of rate cuts, investors may increasingly turn to cryptocurrencies as an alternative asset class in the future.

Figure 5: Bitcoin’s Historical Performance

Stocks

Figure 6: S&P 500 Source Google Finance

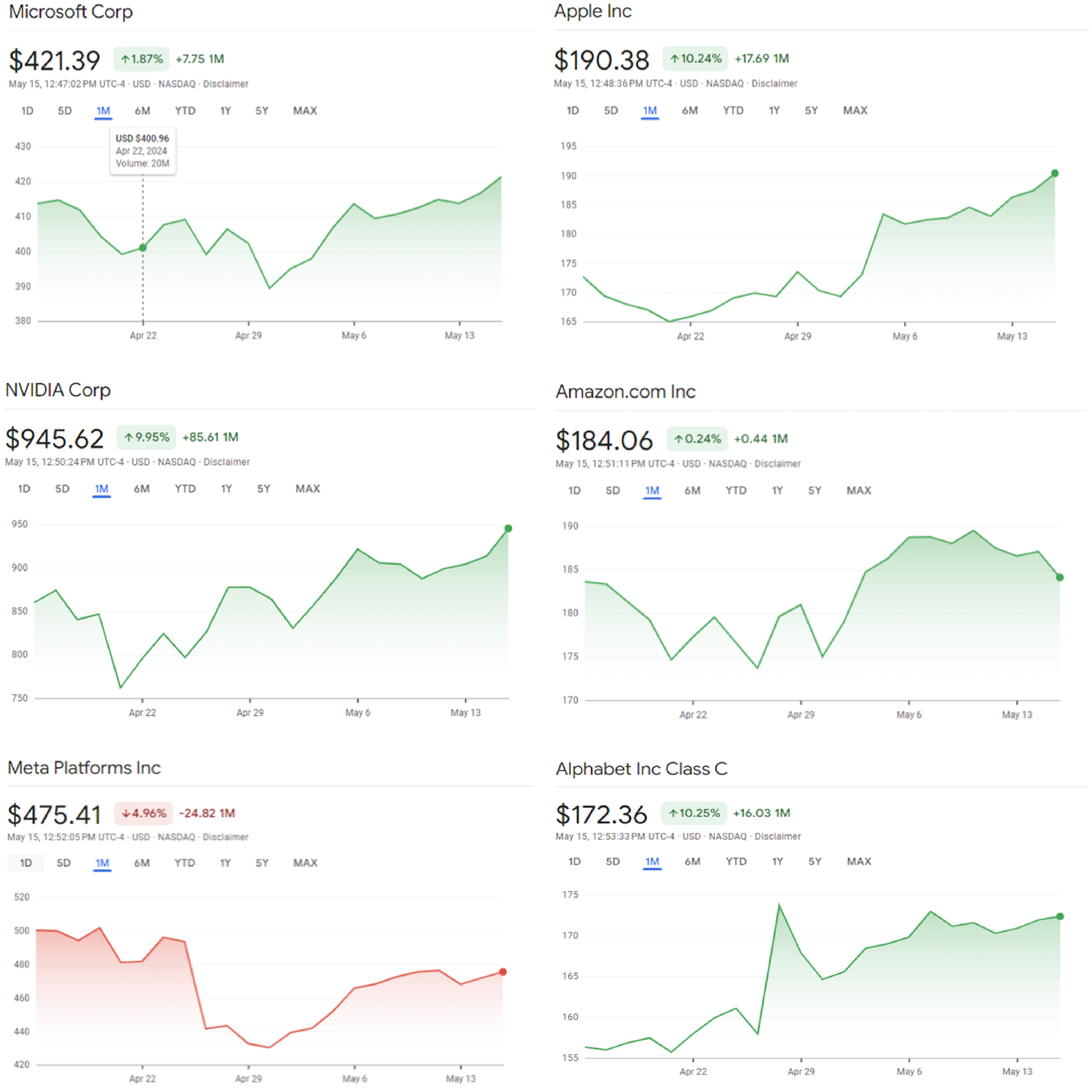

The major holdings in S&P are in the Information technology sector, with 29.7% weight in companies like Microsoft, Apple, Nvidia, Amazon, Meta, Alphabet, and others.

Figure 7: Source Google Finance

The Information Technology (IT) sector, comprising major holdings in the S&P 500, has witnessed a downturn in stock prices over the past month. While pinpointing the exact reasons for this decline is challenging, it is speculated that these stocks may have been overvalued during the pandemic, and corrections are still underway. Heavy investments in Artificial Intelligence (AI) by tech giants have heightened dependency on semiconductor supply chains, exacerbating challenges posed by supply chain disruptions, rising interest rates, and inflation, which have increased expenditures for these firms.

Tech Sector Bonds

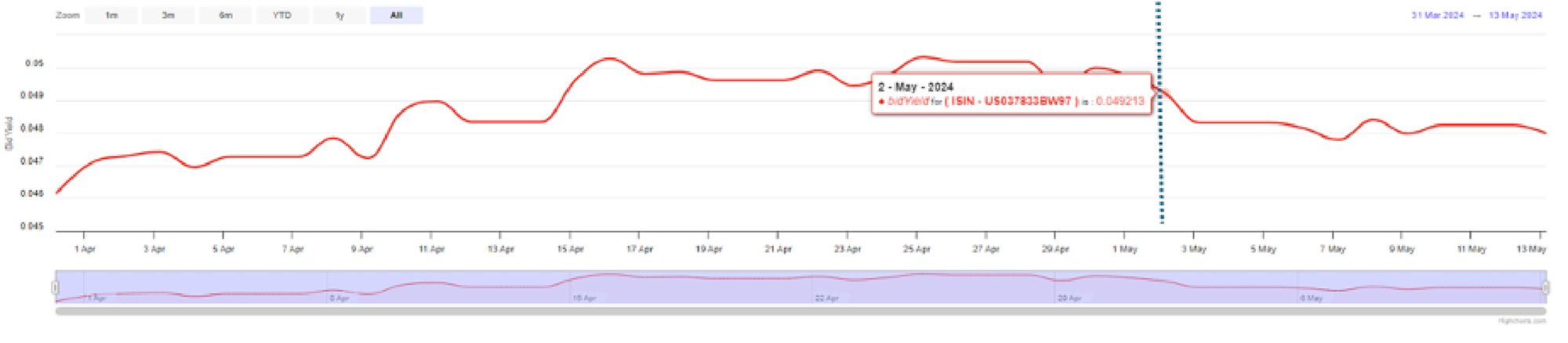

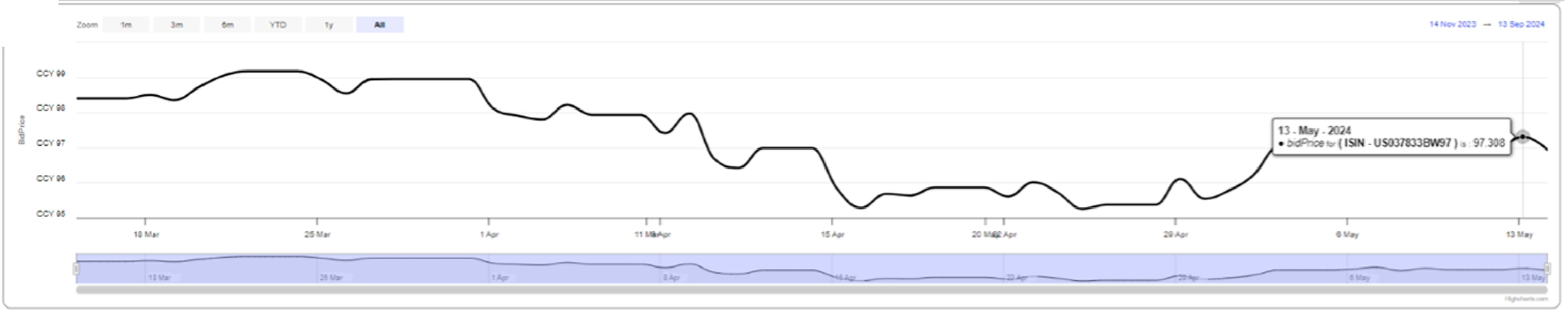

The tech sector’s bond prices have also been affected by rising yields, as seen in Apple’s bond yield increase below.

On Monday, May 2nd, after better-than-expected quarterly results, Apple’s bond yield decreased but is still at higher levels than at the beginning of last month. Apple also announced a $110 billion share buyback, and shares soared over 6% by Friday, May 10th. The company’s value reached 2.86 trillion dollars.

Figure 8: US037833BW97 – Apple’s bond yield

Source: Confluence Internal Data Team

Figure 9: US037833BW9

Source: Confluence Internal Data Team

The upcoming quarterly financial reports from tech companies will provide clearer insights into the sector’s performance. Despite surpassing earnings estimates, Meta’s stock price fell by 17% following its financial results announcement on April 24.

The falling stock price could be attributed to weak revenue guidance. However, Mark Zuckerberg focused on increased infrastructure investments to support the Artificial Intelligence (AI) roadmap.

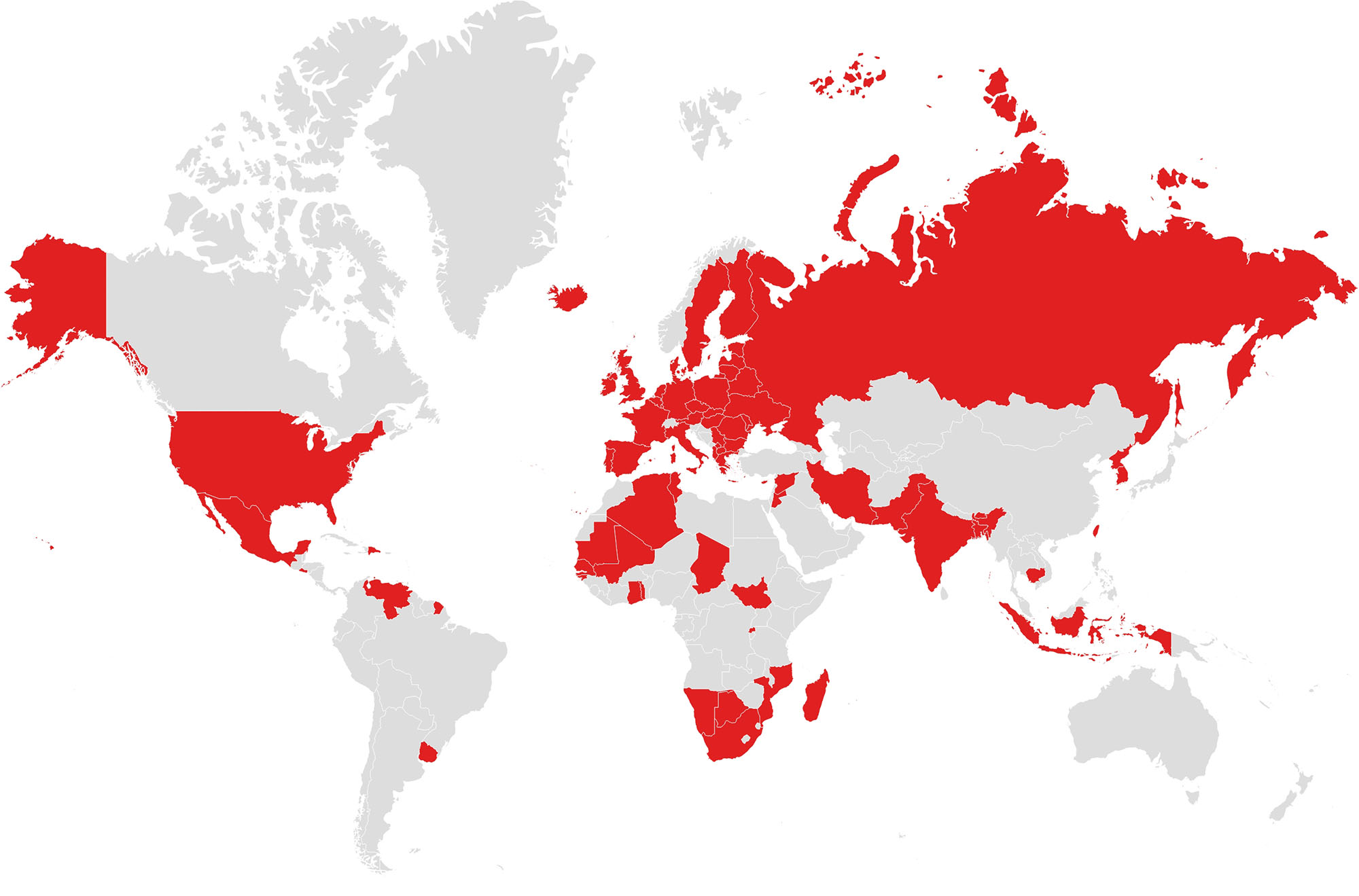

Elections around the world

With elections scheduled in approximately 64 countries, representing half of the world’s population, geopolitical landscapes are poised for transformation.

Figure 10: Source: Time.com

Key nations such as the USA, India, European Union members, Indonesia, Mexico, United Kingdom, and South Africa, among others, will be undergoing electoral processes, potentially reshaping the global economic landscape.

In navigating these political uncertainties, investors are increasingly exploring alternative assets such as commodities and digital assets. While traditional assets like stocks remain under scrutiny due to heightened volatility post-pandemic, bonds continue to serve as a resilient option amidst market fluctuations.

As we navigate the complexities of 2024, adaptability and strategic foresight will be paramount in navigating the ever-evolving financial terrain. Providing accurate valuations and pricing data will be paramount. You can rely on Confluence to provide you with independent valuation on your market data needs.

Appendix Reference Data

World Interest Rates Table

| Country | 10-year bid yield | Benchmark interest rate | Last change |

|---|---|---|---|

| Australia | 4.342% | 4.35% | November 6th, 2023 |

| Brazil | 11.76% | 10.50% | May 8th, 2024 |

| Canada | 3.695% | 5.00% | July 12th, 2024 |

| Switzerland | 0.7616% | 1.50% | March 21st, 2024 |

| China | 2.298% | 3.45% | August 22nd, 2023 |

| Germany | 2.507% | 4.50% | September 14th, 2023 |

| Japan | 0.942% | 0.10% | March 19th, 2024 |

| Mexico | 9.734% | 11.00% | March 21st, 2024 |

| New Zealand | 4.755% | 5.50% | May 24th, 2023 |

| Sweden | 2.332% | 3.75% | May 8th, 2024 |

| Türkiye | 25.8% | 50.00% | March 21st, 2024 |

| United Kingdom | 4.176% | 5.25% | Aug 3rd, 2023 |

| United States | 4.4885% | 5.50% | Jul 26th, 2023 |

| South Africa | 10.465% | 8.25% | May 25th, 2023 |

| Nigeria | 19.458% | 24.75% | March 25th, 2024 |

| Kenya | 17.24% | 13% | Feb 6th, 2024 |

Figure 11: 10-year yield rate March 13th

Source: Refinitiv, Current Interest Rate, Source: Trading Economics

| Duration | Maturity date | US Treasury Curve: Mar 20th |

US Treasury Curve: Mar 22nd |

US Treasury Curve: Apr 23rd |

US Treasury Curve: May 13th |

|---|---|---|---|---|---|

| 1M | 4/16/2024 | 5.3809 | 5.3858 | 5.3945 | 5.3901 |

| 3M | 6/20/2024 | 5.3962 | 5.3826 | 5.4153 | 5.3975 |

| 6M | 9/19/2024 | 5.3130 | 5.3019 | 5.3718 | 5.3839 |

| 1Y | 3/20/2025 | 4.9967 | 4.9783 | 5.1546 | 5.1848 |

| 2Y | 2/28/2026 | 4.6065 | 4.5934 | 4.9353 | 4.8676 |

| 3Y | 3/15/2027 | 4.3965 | 4.3543 | 4.7701 | 4.6692 |

| 5Y | 2/28/2029 | 4.2477 | 4.1857 | 4.6307 | 4.5075 |

| 7Y | 2/28/2031 | 4.2745 | 4.2024 | 4.6245 | 4.498 |

| 10Y | 2/15/2034 | 4.2767 | 4.1981 | 4.6025 | 4.4885 |

| 20Y | 2/15/2044 | 4.5490 | 4.4674 | 4.8468 | 4.7324 |

| 30Y | 2/15/2054 | 4.4571 | 4.3808 | 4.7293 | 4.6318 |

Figure 12: Reference US Treasury Curve Table Data.

Disclaimer

The information contained in this communication is for informational purposes only. Investment Metrics, a Confluence company, is not providing legal, financial, accounting, compliance or other similar services or advice through this communication. Recipients of this communication are responsible for understanding the regulatory and legal requirements applicable to their business.

About Confluence

Confluence is a leading global technology solutions provider committed to helping the investment management industry solve complex data challenges across the front, middle, and back offices. From data-driven portfolio analytics to compliance and regulatory solutions, including investment insights and research, Confluence invests in the latest technology to meet the evolving needs of asset managers, asset owners, asset servicers, and asset allocators to provide best-of-breed solutions that deliver maximum scalability, speed, and flexibility, while reducing risk and increasing efficiency. Headquartered in Pittsburgh, PA, with 750+ employees in 15 offices across the United Kingdom, Europe, North America, South Africa, and Australia, Confluence services over 1000 clients in more than 40 countries. For more information, visit confluence.com

We resolve complex data challenges

As the investment management industry deals with ever-present data challenges along with increasing demands from clients and regulators to provide more detailed data and granular analysis, we help our clients transform their raw data into meaningful insights, providing solutions to complex data challenges.