Revolution

Performance & Analytics

Confluence believes software should be simple

Power to Analytics

Revolution is an integrated performance measurement and risk management solution which enables greater productivity and lowers costs. We achieve this by using the latest cloud-based technology, unprecedented scalability and our global industry expertise.

Benefits

Integrated risk and performance

Next generation performance measurement and multi-model risk analytics in one integrated platform. Consolidate, simplify, collaborate.

Enhance your service levels

Designed to reduce the turnaround time for delivering performance and analytics results to stakeholders. Meet increasing demand and data volumes with ease.

Unleash your team’s productivity

Too much time is spent on manual workarounds and data management issues. Enhance your team’s productivity with intelligent workflow and the ultimate in cloud scalability.

Reduce operational risk and lower costs

Remove manual processes and operational risk from your middle office process. Consolidate your analytics platforms and forget about managing software

Features

Next generation performance measurement

Revolution Performance is our performance measurement and data management service within Revolution. With advanced data controls, visual workflow, intelligent functionality and the ultimate in cloud scalability – it is the next generation performance measurement solution.

Advanced attribution analysis

Support for top-down single level and multi-level attribution models to security level with advanced currency overlay. Or, view bottom-up attribution with stock picking decomposition analysis.

Fully integrated market data

Integrated coverage of over 3.2 million global securities, including equities, bonds, mutual funds, FX forwards, futures, options, OTCs and more. Most families of benchmarks also available including MSCI, FTSE, NASDAQ, and Russell.

Multi-asset class analytics

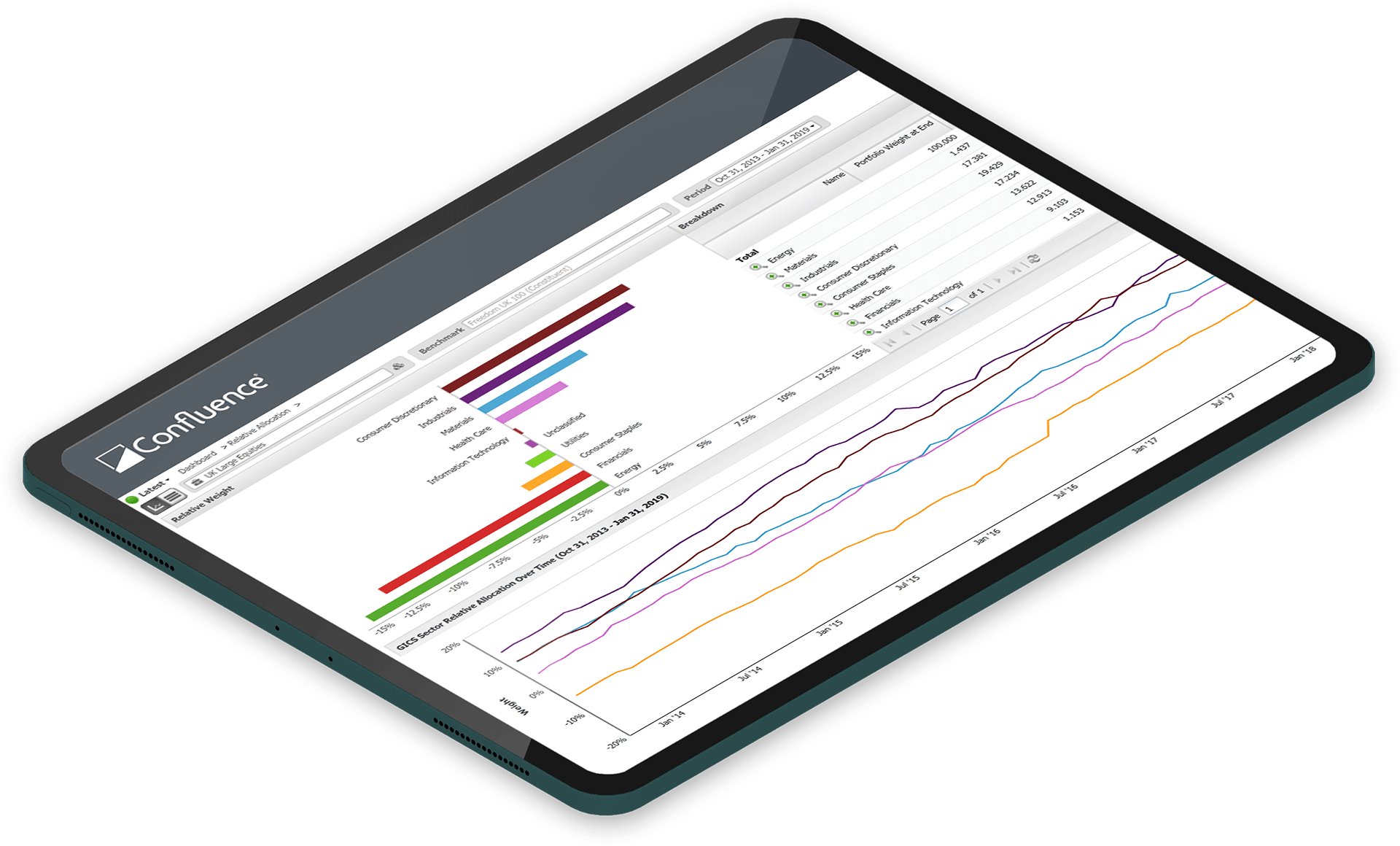

Multi-asset class calculation and analysis of performance, attribution, contribution, risk and compliance in a single cloud-based platform.

Multi-model risk analytics

Full ex-post and ex-ante risk analytics. Covering historical simulation, Monte Carlo, variance and co-variance VaR. Custom factor modeling, stress testing, what-if analysis, correlations and simulations. “The quintessential toolbox for risk management.”

Award-winning risk limits compliance

Award-winning and cost-effective compliance designed for regulated funds. Complete risk limits monitoring covering VaR and commitment approach, netting, hedging and liquidity risk.

Flexible reporting and web API

Board quality reporting. Create PDF or Excel reports with multiple language support. Access our powerful Web API for programmatic data extraction or use Revolution-i for interactive or automated data extraction directly into local file formats, including MS Word or Excel templates.